Nuclear Power in Turkey

- Turkey has had plans for establishing nuclear power generation since 1970. Today, plans for nuclear power are a key aspect of the country's aim for economic growth.

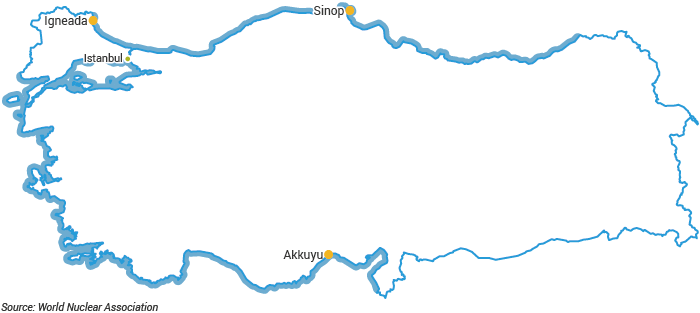

- A four-unit plant is under construction at Akkuyu. It is being financed and built by Russia.

- A Franco-Japanese consortium was expected to build the second nuclear plant, at Sinop.

- China is in line to build the third plant, with US-derived technology.

- A small uranium mining project is planned.

Reactors

Construction

Shutdown

Electricity sector

Total generation (in 2024): 349 TWh

Generation mix: coal 120 TWh (35%); hydro 74.9 TWh (21%); natural gas 67.8 TWh (19%); wind 36.6 TWh (10%); solar 26.3 TWh (8%); geothermal 11.2 TWh (3%); biofuels & waste 9.3 TWh (3%).

Import/export balance: 1.0 TWh net export (2.7 TWh imports, 3.7 TWh exports)

Total consumption: c. 298 TWh

Per capita consumption: c. 3500 kWh in 2024

Source: International Energy Agency and The World Bank. Data for year 2024.

Turkey imports much of its energy – about 75% in 2024. Improving energy efficiency and energy security are high priorities1. About one-third of its gas comes from Russia2, and in February 2016 Gazprom arbitrarily increased the gas price by 10.25% regardless of contracts, and cut supply when Turkish firms declined to pay the extra.

According to the Ministry of Energy and Natural Resources' (EKTB) base scenario, consumption will rise to 376 TWh by 20233. Plans for nuclear power are a key aspect of the country's aim for economic growth, and it aims to cut back its vulnerable reliance on Russian gas for electricity. The state generation company is Elektrik Uretim AS (EUAS).

Plans were to have 30 GWe of coal-fired capacity by 2023, along with 4.8 GWe of nuclear capacity. The country's coal-fired capacity was 20.5 GWe at the end of 2023, and its first nuclear power reactor is now expected to be connected to the grid in 2026. Much of the country’s coal resources are lignite with low calorific value – less than 12.5 MJ/kg – and a substantial amount (Afsin Elbistan) at less than 5 MJ/kg (one-quarter of typical steam coal) with high sulfur content.

Nuclear power industry

Several nuclear power projects have been proposed: in 1970 a feasibility study concerned a 300 MWe plant; in 1973 the electricity authority decided to build a 80 MWe demonstration plant but didn’t; in 1976 the Akkuyu site on the eastern Mediterranean coast near the port of Mersin was licensed for a nuclear plant; and in 1980 an attempt to build several plants failed due to a lack of government financial guarantee.

In 1993 a nuclear plant was included in the country's investment program following a request for preliminary proposals in 1992, but revised tender specifications were not released until December 1996. Bids for a 2000 MWe plant at Akkuyu were received from Westinghouse + Mitsubishi, AECL, and Framatome + Siemens. Following the final bid deadline in October 1997, the government delayed its decision no less than eight times between June 1998 and April 2000, when plans were abandoned due to economic circumstances.

Early in 2006 the province of the port city of Sinop on the Black Sea was chosen to host a commercial nuclear power plant. This has the advantage of cooling water temperatures about 5 degrees C below those at Akkuyu, allowing about 1% greater power output from any thermal unit. A 100 MWe demonstration plant was to be built there first, then 5000 MWe of further plants to come into service from 2012. Some kind of public-private partnership was envisaged for construction and operation.

In August 2006 the government said it planned to have three nuclear power plants total 4500 MWe operating by 2012-15. Discussions had been under way with Atomic Energy of Canada Ltd regarding two 750 MWe CANDU units as an initial investment. These and the PWR type were apparently preferred. The first units of some 5000 MWe total would be built at Akkuyu, since the site was already licensed, but licensing was also proceeding for Sinop.

In November 2007 a new law concerning Construction and Operation of Nuclear Power Plants and Energy Sale (of their electricity) was passed by parliament and subsequently approved by the President. The bill provided for the Turkish Atomic Energy Authority (TAEK) to set the criteria for building and operating the plants. The Turkish Electricity Trade & Contract Corporation (TETAS) would then buy all the power under 15-year contracts. The bill also provided for public institutions to build the plants if other offers are not satisfactory. It also addressed waste management and decommissioning, providing for a National Radioactive Waste Account (URAH) and a Decommissioning Account (ICH) which generators would pay into progressively at 0.15 ¢/kWh. The OECD Paris and Brussels Conventions on third party accident liability would apply.

Immediately subsequent to this law, Criteria for Investors who will Construct and Operate Nuclear Power Plants, and regulations were published.

In May 2008 a civil nuclear cooperation agreement with the USA entered into force, in June 2010 a nuclear cooperation agreement with South Korea was signed, and in April 2012 two such agreements with China were signed.

In November 2013 the IAEA conducted an integrated nuclear infrastructure review (INIR) in Turkey to assess the country’s progress in preparing for the new nuclear power programme. It reported positively but recommended completing a national policy on nuclear energy, strengthening the regulatory body, and developing a national plan for human resource development.

In November 2022 it was announced that the Turkish government had commenced studies into the potential construction of a third nuclear power plant.

In January 2023 Korea Electric Power Corporation (KEPCO) submitted a preliminary proposal to Turkey for the construction of four APR-1400 reactors at an undisclosed site in the northern part of the country.

In September 2023 the Turkish government announced that negotiations with a Chinese company for the construction of a multi-unit nuclear power plant in the eastern Thrace region were expected to be completed in the coming months.

In October 2025 Turkey’s energy minister announced that the country may collaborate with both the USA and South Korea on its second nuclear power plant, following a recent USA-Turkey civil nuclear cooperation agreement.

Power reactors under construction

| Site | Proponent/utility | Type | MWe gross | Start construction | Planned startup |

|---|---|---|---|---|---|

| Akkuyu 1 | Rosatom | VVER-1200/V-509 | 1200 | April 2018 | 2025 |

| Akkuyu 2 | Rosatom | VVER-1200/V-509 | 1200 | April 2020 | 2026 |

| Akkuyu 3 | Rosatom | VVER-1200/V-509 | 1200 | March 2021 | 2027 |

| Akkuyu 4 | Rosatom | VVER-1200/V-509 | 1200 | July 2022 | 2028 |

Power reactors proposed

| Site | Type | MWe gross | Locality | Proponent/utility | Construction start |

|---|---|---|---|---|---|

| Sinop 1-4 | APR-1400? VVER-1200? | c. 5200 | Sinop province | ||

| Igneada 1-4 | HPR1000 x 4 | 4 x 1100 | Kırklareli province |

Akkuyu

The Turkish Electricity Trade & Contract Corporation (TETAS) called for tenders in March 2008, inviting bids for the first nuclear power plant at Akkuyu, near the port of Mersin in Mersin province on the eastern Mediterranean coast. The Turkish Atomic Energy Authority (TAEK) issued specifications, allowing for PWR, BWR or PHWR types of at least 600 MWe and with 40-year service life. Design certification in country of origin was acceptable, allowing TAEK to concentrate on site-specific aspects of the 4800 MWe project. In the event, only one bid was received from 14 interested parties, this being from Atomstroyexport in conjunction with Inter RAO (both from Russia) and Park Teknik (Turkey), for an AES-2006 power plant with four 1200 MWe reactors. After some deliberation, TAEK found that it met technical criteria. (It was later reported that TAEK required foreign vendors to take back used fuel, and none except ASE were prepared to do so.)

Following commercial advice from TETAS, a government decision was expected in April 2009, but in fact only a series of statements resulted, regarding the cost of power over the first 15 years being too high. Then in August 2009 two agreements between TAEK and Rosatom were signed with much fanfare. One was a nuclear cooperation agreement, the other was a standard one on the early notification on a nuclear accident and the exchange of information on nuclear facilities. These progressed the possibility of a Russian nuclear project at Akkuyu, probably with 25% government equity to dampen the likely electricity price rise. The first reactor was expected to come online in 2016, and others in 2017, 2018 and 2019. However, following a ruling by the country's top legal body, TETAS cancelled the Atomstroyexport agreement and said that a new tender would be launched. Instead, the parties proceeded to a direct high-level agreement.

In May 2010 Russian and Turkish heads of state signed an intergovernmental agreement for Rosatom to build, own and operate (BOO) the Akkuyu nuclear power plant of four 1200 MWe AES-2006 units as a $20 billion project. Rosatom, through Atomstroyexport and Inter RAO UES, will finance the project and start off with 100% equity in the Turkish Akkuyu project company set up to build, own, operate and decommission the plant. Longer-term, Rosatom entities intend to retain at least 51% of the company. The Turkish firm Park Teknik and state generation company Elektrik Uretim AS (EUAS) were expected to take up significant shares. In May 2013 Rosatom invited EdF to become an equity partner in the project, but EdF declined. Meanwhile, EUAS transferred the site to the project company.

Earlier, in July 2010 parliament ratified the May agreement for 4800 MWe at Akkuyu, and in November the Russian parliament ratified it. The project company was registered in December 2011 as Akkuyu Nuclear JSC (Akkuyu Nukleer Santral/NGS Elektrik Uretim AS), with full Russian equity.* In October 2013 Rusatom Overseas was made responsible for the main Russian involvement in the project, as majority owner through JSC Rusatom Energy International, and manager. A 49% non-Russian strategic investor was sought, and this was initially taken up in mid-2017 by a consortium of three Turkish companies: Cengiz Holding, Kolin Construction and JSC Kalyon Construction, each to hold 16.33%, subject to approval by the Turkish government and the energy regulator EPDK. The financial details and shareholder agreement were expected to be finalized by the end of 2017, but in February 2018 the energy ministry announced that the three companies had failed to reach commercial agreement with Rosatom and had pulled out of the project.

* By mid-2012 the equity position was Rosenergoatom concern 92.85%, InterRAO UES 3.47%, Atomstroyexport 3.47%, and 0.1% each for Atomenergoremont and Atomtechenergo. In February 2015 Russia's Inter RAO said it would not participate in an authorized capital share issue of JSC Akkuyu Nuclear and would decrease its shares in the company from 1.15% to 0.5%. The equity position then was: Rusatom Overseas (64.96%), Rosenergoatom (30.66%), AtomStroyExport (3.17%), Atomenergoremont (0.03%) and Atomtechenergo (0.03%).

Late in 2012 JSC Akkuyu NPP quoted the cost as $18.7 billion, and in December Russia's President announced that Russia would fully finance the project to more than $20 billion. Turkey's prime minister said that the equity capital of JSC Akkuyu NPP would be increased to $2.4 billion, and the overall investment in the project would total $22 billion. Rusatom will supply the fuel.

TETAS will buy a fixed proportion of the power at a fixed price of 12.35 ¢/kWh for 15 years. The proportion will be 70% of the output of the first two units and 30% of that from units 3&4 over 15 years from commercial operation of each. The remainder of the power will be sold by the project company on the open market. After 15 years, when the plant is expected to be paid off, the project company will pay 20% of the profits to the Turkish government. (These sovereign guarantees are not on offer for the Sinop plant.)

By mid-2012 Rosatom said that the total cost could be $25 billion. In December 2011 the project company had filed applications for construction permits and a power generation licence. In mid-2012 the company had received a site licence, and it let the first major contract for site works in February 2013. Another site licence was received in January 2014. A revised environmental impact assessment (EIS) was re-submitted in July 2014 – the fourth time, and approved at the end of November. A report on site design parameters was then submitted to TAEK. The Energy Market Regulatory Authority (EPDK) granted a 36-month preliminary licence for the project in June 2015, allowing for some preparatory activities and permits pending the production licence. In August 2016 the government said that it would classify the project as a strategic investment, allowing favourable tax treatment.

TAEK approved design parameters for the site in February 2017. In June 2017, EPDK issued a power generation licence for the 4.8 GWe plant for 49 years. In August the IAEA completed a site and external event design (SEED) review of the project, and in October 2017 TAEK granted a limited construction permit for unit 1, allowing the start of excavation and work on non-nuclear parts of the plant. TAEK granted a construction licence for unit 1 at the beginning of April 2018, and the start of construction was announced on 3 April 2018. A construction licence for unit 2 was granted at the end of August 2019, and construction commenced in April 2020. A construction licence for unit 3 was granted in November 2020, and construction commenced in March 2021. A construction licence was granted for unit 4 in October 2021, and construction commenced in July 2022. Atomstroyexport is general contractor for construction, though Turkish companies are expected to undertake 35-40% of the work. The reactors are based on the VVER-1200/V-392M design at Novovoronezh and designated as V-509.

In October 2020 it was reported that Inter Rao had decided to withdraw from the project.

The construction progress slowed significantly in July 2022 when Rosatom replaced the Turkish subcontractor, IC Içtaş, with Russian contractor TSM Enerji. Two months later, Turkey’s President Erdogan and Russia’s President Putin reached an agreement to resume construction, with IC Içtaş recapturing the deal to continue construction activities. The first unit of the plant is planned to start up in 2023.

In February 2023 a 7.8 magnitude earthquake struck near Gaziantep, the biggest earthquake to hit the country in eight decades. The Akkuyu nuclear power plant is being built about 430 kilometres to the west of the epicentre of the quake, where aftershocks of about 3.0 magnitude were experienced. There were no reports of damage to the plant and following safety checks, construction continued.

In September 2022 the reactor pressure vessel for Akkuyu 2 was installed. In April 2023 the first core fuel load for Akkuyu 1 was delivered to the site.

In April 2024 Rosatom said that it would undertake startup and commissioning works during 2024, with the aim of starting up unit 1 in 2025.

In December 2024 Rosatom announced it had installed the turbines for unit 1, and that the unit was now ready to begin cold and hot testing. In October 2025 Rosatom announced the shipment of the final reactor pressure vessel for the plant. The same month, Rosatom delivered the automated process control system for unit 1, comprising 42,000 components.

Sinop

Since February 2008 preparatory work has been under way at Sinop on the Black Sea coast to build a second nuclear plant there, along with a €1.7 billion nuclear technology centre.

In May 2013 the government accepted the proposal from a consortium led by Mitsubishi Heavy Industries (MHI) and Areva (now Framatome), and with involvement of Itochu and Engie, which proposed four Atmea1 reactors with a total capacity of about 4600 MWe.* These would be the first Atmea1 units built. They would be designed for load-following and use the same steam generators as Framatome’s large EPR (but three instead of four). At the time cost was estimated at some $22 billion, though this has since doubled. Acceptance of the proposal was followed by an intergovernmental agreement with Japan for “exclusive negotiating rights to build a nuclear power plant”, and in October 2013 an official agreement at prime ministerial level was signed for the project. This was ratified by parliament in March 2015 and provides for 70% loan financing, 30% equity.

EUAS intended to take a 35% stake in the project company, with the balance shared among Mitsubishi, Itochu and Engie. MHI said it planned to take 15%, and it expected the same for Itochu and 21% for Engie. EUAS then intended to take 49% equity. Engie, which operates seven nuclear reactors in Belgium, was to be the operator. Government sources described it as a build-operate-transfer (BOT) arrangement, whilst Engie described it as build-own-operate (BOO). In April 2018 Itochu withdrew from the project. Engie then pulled out also.

* Earlier negotiations included a March 2010 agreement signed between Korea Electric Power Corporation (Kepco) and EUAS for Kepco to prepare a bid to build the plant at Sinop, with four APR-1400 reactors starting operation from 2019. The bid, in conjunction with local construction group Enka Insaat ve Sanayi, was due in August. Kepco was to take 40% equity in the plant, and would help with financing. However, this proposal foundered due to the Kepco insistence on receiving electricity sales guarantees from the government, rather than from TETAS as at Akkuyu.

Japan then indicated its interest in negotiating to build the 5600 MWe plant, and in December 2010 signed an agreement to prepare a bid for it, with a more definitive agreement expected in March 2011. Toshiba and Tepco were involved with the proposal, using four 1350 MWe ABWR units. However talks were suspended at Japan's request following the Fukushima accident, and Tepco has since opted out. Subsequent reports suggested a possible bid by Mitsubishi Heavy Industries with Kansai, which operates 11 PWRs, and using APWR units. In March 2012 Japan’s Ministry of Foreign Affairs announced that progress continued towards a nuclear cooperation agreement with Japan.

In April 2012 Canada’s Candu Energy signed an agreement with the EUAS to undertake a six-month study on building a 3000 MWe plant at Sinop. In March 2013 the energy minister said that they had withdrawn from the process.

A feasibility study was originally due for completion in mid-2017, and the announced timeline was for construction start in 2017 and operation from 2023. In May 2018 it was announced that the feasibility study was still several months from completion. The operational target date of 2023 has been dropped. In December 2018 it was reported that MHI and partners were negotiating to abandon the project. In January 2020 the energy minister said the government was reviewing its choice of partner due to feasibility studies falling short of his ministry's expectations regarding the construction budget and the schedule for its completion. In September 2020 the Ministry of Environment and Urbanisation approved the final environmental impact assessment report for Sinop. In August 2021 Fugro completed a six-month offshore site characterization project in support of broader feasibility studies for the project.

In January 2023 KEPCO submitted a proposal for the construction of four APR1400 reactors at an undisclosed site in the northern part of the country. This followed reports of discussions in late 2022 between KEPCO and the Turkish government on the development of four APR1400 reactors at Sinop.

In March 2023 EUAS established a nuclear-focused subsidiary known as TUNAS, tasked with 'founding' the Sinop project. TUNAS plans to commence excavations at the site in 2023.

Igneada

There are plans to build further nuclear capacity at another site in the Thrace region of Turkey. TAEK has identified Igneada in Kirklareli province on the Black Sea, 12 km from the Bulgarian border, and this was confirmed in October 2015. Akcakoca between it and Sinop was also considered. Ankara – with low seismic risk – and Tekirdag on the northwest coast of the Sea of Marmara had also been mentioned as possible sites. The energy ministry anticipated announcing the site for the third plant with an invitation for expressions of interest to be issued by the end of 2013. This did not happen and in October 2014 the prime minister said that the project would be substantially indigenous, with construction start about 2019.

In November 2014 EUAS signed an agreement with the State Nuclear Power Technology Corporation (SNPTC) of China and Westinghouse to begin exclusive negotiations to develop and construct a four-unit nuclear power plant in Turkey. No site was specified.

In June 2018 Turkey's Minister for Energy and Natural Resources confirmed that the Thrace region was almost certain to be the site of the country's third nuclear power plant.

In November 2022 it was announced that the Turkish government had commenced studies into the potential construction of a third nuclear power plant located in East Thrace in the northwest of the country.

In June 2023 it was reported that Turkey’s government was in negotiations with Chinese companies regarding the construction of a nuclear power plant in the Kırklareli province of the country.

Fuel cycle

Uranium

Turkey has modest uranium resources. The Temrezli deposit in the central Anatolian region 220 km east of Ankara was discovered by the Department of Energy, Raw Material and Exploration (MTA) in the early 1980s. MTA continued to explore the region for the next 10 years. Regional towns of Yozgat and Sorgun are nearby.

US-based Westwater Resources (formerly Uranium Resources Inc., URI) was planning to develop the Temrezli ISL mine. Australian-based Anatolia Energy* had a 100% interest in 18 exploration licences which included the Temrezli project. Project activities were undertaken by A Dur Madencilik (Adur), a wholly-owned subsidiary. In June 2015 Westwater Resources took over Anatolia Energy.**

* Anatolia Uranium Pty Ltd (AUL) had 65% ownership of the Temrezli project, with parent company Anatolia Energy directly holding 35%. AUL was an incorporated joint venture but ownership was rationalized in 2012-13. In February 2014 Azarga Resources, parent company of Powertech Uranium, increased its holding to a 15% share in Anatolia Energy.

** In June 2015 Anatolia announced a merger with Colorado-based Westwater Resouces (then URI), with uranium projects in Texas. It was technically a takeover, so that the Turkish projects were then under URI (now Westwater Resources).

A preliminary economic assessment of the Temrezli ISL uranium project was published in June 2013 and updated in May 2014, based on NI 43-101 figures. It found that costs would compare favourably with other (US) ISL projects. Measured resources at Temrezli are 2351 tU, indicated resources are 2004 tU, and inferred resources 732 tU, at 0.117%U, 0.092%U, and 0.075%U respectively at the end of 2013. The Ministry of Energy & Natural Resources has awarded a production licence for the project, and a pre-feasibility study was completed in February 2015. With initial capital cost of $41 million, 3800 tU could be recovered over 12 years at $16.89/lb U3O8, giving project payback in less than one year. Subject to finance, a development decision was expected, but in 2016 the project was put on standby pending market improvement.

Westwater Resources commenced a pre-feasibility optimization study of the Temrezli ISL project in 2015, and at the time was pushing forward on permitting-related issues, and preparing to move the Rosita treatment plant from Texas to Temrezli. Low uranium prices have delayed construction.

Westwater Resources' Sefaatli uranium project has significant uranium mineralization discovered in the 1980s, and an intensive drilling programme on the Delier prospect is defining resources. Tulu Tepe is also prospective in that project area, 5 km southwest of Delier. A third prospect is Akcami, 2 km west of Tulu Tepe. The three cover 15 sq km. Sefaatli may be operated as a satellite of Temrezli (35 km away). The company also has a tenement holding in the West Sorgun area.

In June 2018, Westwater Resources received notification from the Turkish government that its mining and exploration licences for the Temrezli and Sefaatli projects had been revoked. The projects were owned by the company’s Turkish subsidiary Adur Madencilik Limited Sirketi, which had held exclusive rights for the exploration and development of uranium there since 2007 and had invested heavily in them. In December 2018 Westwater filed a request for arbitration on the matter.

The Rosatom agreement for Akkuyu provides for setting up a fuel fabrication plant in Turkey.

Waste management

Though originally TAEK required reactor vendors to take back used fuel, the question of whether used fuel for Akkuyu will remain in Turkey or be repatriated to Russia in line with normal practice for Russian plants in non-weapons states had not been settled (by May 2014).

Nuclear power plants operating in Turkey are required to make payments of $0.15 per kWh of generated electricity into a fund for waste management.

Organization

The Ministry of Energy and Natural Resources (MENR or Enerji ve Tabii Kaynaklar Bakanlığı, ETKB) is responsible for meeting energy needs.

The Atomic Energy Commission (AEC) oversees all nuclear activities, submits budgets to the prime minister, and sets the nuclear regulatory authority’s (NDK's) programmes. An advisory council assists the AEC on matters referred to it. The Advisory Committee on Nuclear Safety is involved with licensing matters and gives advice to the NDK, which decides on them.

Turkey Energy, Nuclear and Mining Research Institute (TENMAK) was established in March 2020. This entity consolidates the Turkish Atomic Energy Agency (TAEK), the National Boron Research Institute and the Research Institute of Rare Earths. TAEK was set up under the 2007 law to set the criteria for building and operating nuclear plants, but in July 2018, most of its duties were passed to the NDK (see below).

The main law applicable to the electricity market is the Electricity Market Law which regulates the obligations of all those directly involved in the generation, transmission, distribution, wholesale supply, retail supply, import, and export of electricity in Turkey. The law entered into force in March 2013 to establish a more stable, strong, and transparent electricity market in Turkey. The preceding electricity market law became the Energy Market Regulatory Authority (EMRA or Enerji Piyasası Düzenleme Kurumu, EPDK) law, establishing that body.

The Energy Market Regulatory Authority (EMRA or EPDK) issues licences for generation, transmission, distribution and supply, and implements electricity market legislation.

The state-owned Turkish Electricity Trade & Contract Corporation (TETAS) will buy the nuclear power for distribution. It operates alongside numerous private sector companies.

Electricity transmission is managed by the Turkish Electricity Transmission Company (TEİAŞ), the state-owned grid operator with a legislatively mandated monopoly on the Turkish electricity transmission network.

Turkey is a signatory of the Paris Convention on Third Party Liability, and various amending protocols.

Research & development

A small Triga research reactor has operated at the Istanbul Technical University since 1979. It is regulated by the Turkish Atomic Energy Authority.

Regulation, safety & non-proliferation

Turkey established the Nuclear Regulatory Authority, Nükleer Düzenleme Kurumu (NDK), in July 2018. It assumed many of TAEK's responsibilities, including regulation of nuclear power plants and all related fuel cycle activities. TAEK is now responsible solely for the disposal of nuclear waste.

Non-proliferation

Turkey ratified the NPT in 1979 and has had a safeguards agreement in force with the IAEA since 1981 and the Additional Protocol to its safeguards agreement has been in force since 2001.

Notes & references

1. International Energy Agency country profiles: Turkey [Back]

2. Energy Market Regulatory Authority, Turkish Natural Gas Market Report 2019 [Back]

3. Republic of Turkey Ministry of Energy and Natural Resources – Electricity page [Back]