Nuclear Power in the United Arab Emirates

- The UAE has embarked upon a nuclear power programme in close consultation with the International Atomic Energy Agency, and with huge public support.

- It accepted a $20 billion bid from a South Korean consortium to build four commercial nuclear power reactors, total 5.6 GWe, by 2020 at Barakah.

- Unit 1 of the country's first nuclear power plant was connected to the grid in August 2020, followed by unit 2 in September 2021, unit 3 in October 2022, and unit 4 in March 2024.

Reactors

Construction

Shutdown

Operable nuclear power capacity

Electricity sector

Electricity demand is growing in the UAE and the country relies entirely on electricity to provide its potable water, by desalination. Per capita electricity consumption in the country has increased from about 11,400 kWh in 2000 to about 15,700 kWh in 2022.

United Arab Emirates electricity generation by source (TWh)

Source: EMBER Electricity Data Explorer

About 70% of electricity in the UAE is produced from fossil fuels, down significantly from over 95% prior to the commissioning of the Barakah nuclear power plant.

Nuclear power industry

Reactors operating in the UAE

The United Arab Emirates (UAE) was founded in 1971, comprising seven states including Abu Dhabi and Dubai. Abu Dhabi city is the federal capital of the UAE, and the Abu Dhabi emirate accounts for 86% of the land area of the UAE, and 95% of its oil. Dubai is the UAE's largest city.

Since commencing studies in collaboration with other members of the Gulf Cooperation Council (GCC), the UAE has proceeded with plans to set up on its own an ambitious nuclear power programme.

In December 2006 the six member states of the GCC – Kuwait, Saudi Arabia, Bahrain, the UAE, Qatar and Oman – announced that the Council was commissioning a study on the peaceful uses of nuclear energy. France agreed to work with them on this, and Iran pledged assistance with nuclear technology.

In February 2007 the six states agreed with the International Atomic Energy Agency (IAEA) to cooperate on a feasibility study for a regional nuclear power and desalination programme. Saudi Arabia was leading the investigation. Regional electricity grid integration is progressing.

The six nations are all signatories of the Non-Proliferation Treaty (NPT) and the UAE ratified a safeguards agreement with the IAEA in 2003. In mid-2008 it appointed an ambassador to the IAEA.

Nuclear power programme in the UAE

In April 2008 the UAE independently published a comprehensive policy on nuclear energy. The policy projected escalating electricity capacity requirements from 15.5 GWe in 2008 to over 40 GWe in 2020. Imported coal was dismissed as an option due to environmental and energy security implications. Renewables would be able to supply only 6-7% of the needed power by 2020.

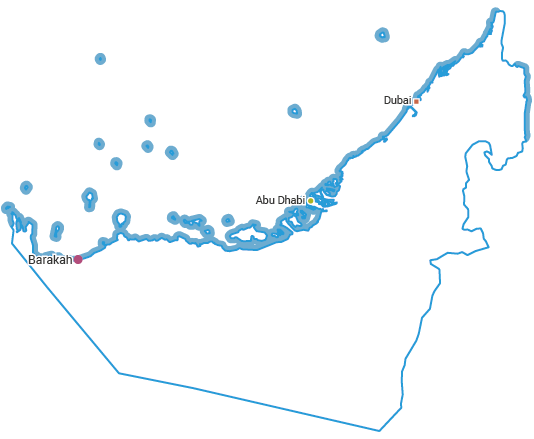

Nuclear power "emerged as a proven, environmentally promising and commercially competitive option which could make a significant base-load contribution to the UAE’s economy and future energy security." This led to creation of a regulatory framework and selection of a site between Abu Dhabi city and Ruwais, at Barakah, 250 km west of Abu Dhabi city. Another possible site mentioned then was Al Fujayrah on the Indian Ocean coast.

Accordingly, and as recommended by the IAEA, the UAE designated its Abu Dhabi Executive Affairs Authority as the Nuclear Energy Program Implementation Organization which in 2009 set up the Emirates Nuclear Energy Corporation (ENEC) as an Abu Dhabi public entity, initially funded with $100 million, to evaluate and implement nuclear power plans within the UAE (or specifically in the Abu Dhabi emirate, which comprises 86% of the land area of the UAE). ENEC became the owner and construction licence holder for the Barakah plant.

The UAE announced that it would "offer joint-venture arrangements to foreign investors for the construction and operation of future nuclear power plants" similar to existing Independent Water and Power Producer structures which are 60% owned by the government and 40% by the JV partner(s). The UAE set up a model of managing its nuclear power programme based on contractor services rather than more slowly establishing indigenous expertise.

The UAE also resolved to forgo domestic enrichment and reprocessing, and "to conclude long-term arrangements... for the secure supply of nuclear fuel, as well as the safe and secure transportation and, if available, the disposal of spent fuel via fuel leasing or other emerging fuel supply arrangements." It thus was able to sign a '123 agreement' with the USA. (See Fuel Cycle section below.)

The UAE invited expressions of interest from nine companies for construction of its first nuclear power plant. ENEC reduced this to a short list of three and sought bids by mid-2009. The three bidders on the short list comprised Areva, with Suez and Total, proposing its EPR, GE Hitachi proposing its ABWR, and the Korean consortium proposing the APR1400 PWR technology. The last group was led by Korea Electric Power Co. (KEPCO), and involves Samsung, Hyundai, and Doosan, as well as Westinghouse, whose System 80+ design (certified in the USA) has been developed into the APR1400. The UAE expressed an intention to standardize on one technology.

ENEC appointed the global full-service programme management, engineering, construction, and operations firm CH2M Hill to manage the UAE's plans for bringing nuclear power to the country.

In December 2009 ENEC announced that it had selected a bid from the KEPCO-led consortium1 for four APR1400 reactors, to be built at one site. The value of the contract for the construction, commissioning, and fuel loads for four units was about $20.4 billion, with a high percentage of the contract being offered under a fixed-price arrangement. The consortium also expects to earn another $20 billion by jointly operating the reactors for 60 years. In March 2010 KEPCO awarded a $5.59 billion construction contract to Hyundai and Samsung for the first plants.

KEPCO claimed later that the reason for its selection in the face of strong competition from France, the USA, and Japan was the APR1400's demonstrable highest capacity factor, lowest construction cost, and shortest construction time.

From 2010 ENEC continued negotiations with the losing bidders, Areva2 and GE Hitachi, regarding cooperation in related nuclear areas.

In October 2016 ENEC and KEPCO signed a joint venture agreement for "long-term partnership and cooperation" in the UAE's nuclear energy programme. The two companies also announced establishment of Barakah One PJSC, an independent subsidiary jointly owned (KEPCO 18%), to be a long-term partnership enhancing the operation of the nuclear power plant and to "represent the commercial and financial interests" of the Barakah project.

Barakah One PJSC also took over management of the $24.4 billion project finances, comprising direct loan agreements of about $19.6 billion and $4.7 billion in equity commitments from ENEC and KEPCO. The direct loan agreements comprise: $2.5 billion from the Export-Import Bank of Korea (KEXIM); $250 million from the National Bank of Abu Dhabi, First Gulf Bank, HSBC, and Standard Chartered; and up to $16.2 billion from the Department of Finance of Abu Dhabi. They cover the overnight cost of the prime contract for construction and commissioning of the Barakah plant, interest during construction, and the cost of initial nuclear fuel. They also include allowances for potential inflationary commodity price increases, such as construction materials, during the construction period.

Earlier in November 2013 the Dubai Electricity & Water Authority said that it had a target of 12% of its electricity supply capacity to be nuclear by 2030, primarily from Abu Dhabi’s Barakah plant, but also possibly from a Dubai plant at some stage. This target is in Dubai’s Integrated Energy Strategy 2030, arising from its Supreme Council of Energy set up in 2009 as an independent legal entity to oversee all matters relating to Dubai's energy sector.

The new UAE Clean Energy Strategy announced in January 2017 involves investment of $163 billion by 2050 to achieve half of its energy being from nuclear power and renewables, 38% gas and 12% coal.

The Dubai Clean Energy Strategy 2050 is less ambitious, aiming for 25% solar, 7% nuclear, 7% coal and 61% gas by 2030. Since 2016 the Dubai Electricity & Water Authority has been building the 2400 MWe Hassyan coal-fired power plant as a project in China’s Belt and Road Initiative, to supply 20% of Dubai’s demand of about 47 TWh/yr and reduce dependence on Qatar’s gas. Cost is about $3.4 billion. The four 600 MWe ultra-supercritical units are due to come online annually from 2020, and the first was grid connected in May 2020. It is the first coal-fired plant in the Gulf Cooperation Council region.

Before the UAE implemented its nuclear power programme from 2008, it was considered that such new programmes would be developed sequentially and slowly. The UAE demonstrated that it is possible to proceed faster by doing a number of things in parallel, by using experienced expatriates initially and transitioning to local expertise over time, and by committing to an experienced reactor and power plant builder with a track record of on-time and on-budget performance.

Barakah power plant

In April 2010 ENEC lodged licence applications and an environmental assessment for its preferred site at Barakah on the coast 53 km west of Ruwais and 300 km west of Abu Dhabi city – a little closer to Qatar than to the capital. The applications were assessed by the Federal Authority of Nuclear Regulation (FANR). This assessment, with environmental management plan, was considered by Abu Dhabi's Environmental Agency and approval was given in July 2012.

The site evaluation process for the four reactors considered ten potential sites and was based on guidance from FANR as well as the US Electric Power Research Institute, the US Nuclear Regulatory Commission, and the IAEA. The Gulf seawater at Barakah is about 35°C, which will give less thermal efficiency than the Shin-Kori 3&4 reference units, where the sea is about 27°C, so larger heat exchangers and condensers are required.

In July 2010 ENEC received two licences from FANR: a site preparation licence for Barakah and a limited construction licence allowing manufacture of major components for four units. A construction environmental permit from the Environmental Agency-Abu Dhabi followed them and groundbreaking took place in March 2011.

Construction licence applications were based on the safety analysis completed for Kepco's Shin-Kori 3&4 in South Korea which are the reference units for the Barakah plant. Differences relate principally to cooling, and 50Hz output instead of 60Hz. The Barakah reactors are 1345 MWe net capacity each (Shin-Kori 3&4 are each rated at 1383 MWe net).

ENEC lodged a 9000-page construction licence application for units 1&2 in December 2010 to undertake full site works and start construction of unit 1 in mid-2012 and unit 2 a year later. The construction licence for units 1&2 was issued by FANR in mid-July 2012. The 18-month review involved more than 60 FANR staff and three international consulting firms, as well as the IAEA, and took in changes resulting from the Fukushima accident. Construction of unit 1 started almost immediately with first concrete, and that for unit 2 started in May 2013.

For units 3&4 ENEC submitted a 10,000-page construction licence application to FANR in March 2013, based on that for units 1&2, and the licences were issued in mid-September 2014. Construction of unit 3 started a week later. Substantial work to prepare for first structural concrete had been authorized for units 3&4 in February 2014. Unit 4 construction started early in September 2015.

Commercial operation of the four units was initially expected in 2017, 2018, 2019 and 2020 respectively.

In March 2015 ENEC submitted its application for an operating licence for units 1&2. The 15,000-page application includes a final safety analysis report, an independent safety verification and design review, details of the organization's physical protection plan, facility safeguards plan, operational quality assurance manual, and emergency plan, as well as a probabilistic risk assessment summary report and a severe accident analysis report. An IAEA Pre-Operational Safety Review Team reported favourably in October 2017, and Nawah Energy Company requested an OSART follow-up in 18 months.

Nawah Energy Company was set up in May 2016 to operate and maintain the four Barakah units, with 82% ENEC equity and 18% KEPCO. Under an $880 million operating support services agreement (OSSA) signed in July 2017 by KHNP and ENEC, KHNP will supply 400 qualified staff to support Nawah Energy until 2030. The KNHP contract includes fuel supply for three cycles of all four units.

Unit 1 was scheduled for fuel loading in August 2017, but in early 2017 its start-up was delayed to 2018. Construction of unit 1 was completed in March 2018, at which point fuel loading was expected in May 2018.

Following an earlier safety evaluation report, Nawah completed a comprehensive operational readiness review (ORR) early in 2018, but FANR made over 400 adverse findings on this which postponed start-up by at least 18 months, to allow Nawah to take corrective actions on a wide range of technical, organizational and management issues. Nawah said in May 2018 that the delay to the start-up of unit 1 "reflects the time required for the plant's nuclear operators to complete the operational readiness activities and to obtain necessary regulatory approvals, all of which are all designed to ensure safe, sustainable nuclear operations." An underlying problem contributing to some of the ORR findings on safety was the need to develop competence in English as a bridging language between Arabic and Korean.

In July 2018 the UAE Department of Energy issued an electricity generating licence for the four units at Barakah.

In February 2020 FANR issued an operating licence for unit 1. Fuel loading commenced shortly afterwards and the unit was connected to the grid in August 2020. It reached 100% power in December 2020, and entered commercial operation in April 2021.

In July 2020, ENEC announced that construction of unit 2 had been completed. An operating licence was issued by FANR in March 2021, and fuel loading took place in March 2021. In August 2021 unit 2 started up and was connected to the grid a month later. It entered commercial operation in March 2022.

In November 2021, ENEC announced that construction of unit 3 had been completed. In June 2022 FANR issued an operating licence for unit 3, and fuel loading commenced. The unit was connected to the grid in October 2022, with commercial operation in February 2023. Unit 4 was connected to the grid in March 2024, and achieved commercial operation in September 2024.

Earlier, in November 2018 it was announced that EDF is to provide services to Nawah Energy Company to support the operation and maintenance of the Barakah plant. The ten-year agreement covers areas including fuel cycle management, operational safety and radiation protection, and environmental monitoring. In June 2019, Nawah Energy Company signed a long-term maintenance services agreement with KHNP, supported by KEPCO Plant Service & Engineering (KEPCO KPS) to support routine and outage maintenance activities. Nawah Energy Company also signed a five-year maintenance agreement with Doosan Heavy Industries & Construction.

An IAEA integrated nuclear infrastructure review (INIR) mission to the UAE reported in January 2011 that the UAE had followed its recommended comprehensive 'milestones' approach for such countries. Areas of good practice identified by the mission included "cooperation, without compromising their independence, between the regulatory bodies and utility, human resource development, a well-structured management system, and a strong safety culture." Also ENEC has joined the World Association of Nuclear Operators (WANO) to benefit from its peer review process at the outset, to ensure high standards of safety.

The US Export-Import Bank approved $2 billion in financing for the Barakah plant in September 2012, for US-sourced components from Westinghouse and services from it and two other firms. Most of it was for coolant pumps and controls.

Barakah 5&6

In August 2023 it was reported that KEPCO, KHNP and ENEC had begun talks regarding two further APR-1400 units at the Barakah site, but this has not yet proceeded.

Fuel cycle

By August 2012 ENEC had awarded six contracts related to the supply of natural uranium concentrates, conversion and enrichment services individually, and the purchase of some enriched uranium product. A spread of suppliers is involved for each stage of the front-end fuel cycle. The company estimates the contracts are worth some $3 billion and will enable the Barakah plant to generate up to 450 billion kilowatt-hours of electricity over a 15-year period.

The contracts involved Canada-based Uranium One, UK-based Rio Tinto, France's Areva, and Russia's Techsnabexport (Tenex) for supply of uranium concentrates. For conversion services, contracts utilize the USA's Converdyn, Tenex, and Areva. Enrichment will be by Europe-based Urenco, Areva, and Tenex. Areva said that its contract involved supply of enriched uranium worth some $500 million, and Tenex claimed to have secured half of the supply. ENEC "expects to return to the market at various times to take advantage of favorable market conditions and to strengthen its security of supply position."

In September 2017, a memorandum of understanding with the UK and Canada was signed with FANR for the cooperation and exchange of information in nuclear regulatory matters.

The enriched uranium will be supplied to Kepco Nuclear Fuels – part of the prime contractor consortium led by Kepco – which is manufacturing the fuel assemblies.

Waste

The UAE is committed to a “dual track” radioactive waste management strategy that involves developing a national storage and disposal programme in parallel with exploring regional cooperation options, which now appear more attractive – notably with the GCC. A further option is fuel take-back, returning it to suppliers. Used fuel will be stored in reactor ponds for up to 20 years, or may be transferred to dry storage after six years. Reprocessing in France or elsewhere internationally is an option, depending on economics. Ownership and responsibility for the used fuel will be transferred to a new state-owned entity after about 20 years.

Sweden’s SKB is studying the prospects of a geological waste repository in UAE, and the Arab Atomic Energy Agency (AAEA), with a widened group of participating Middle East and North Africa (MENA) countries, is discussing regional options along the lines of EU precedents.

Public opinion

A total of 83% of people surveyed by market research company Kantar TNS early in 2017 (N=750) were strongly in favour of nuclear power, compared with 70% in 2013 on the same question. A total of 90% of respondents believed that ENEC was building the plant at Barakah to the highest standards of safety and quality. Other key findings included: 92% believed that the Barakah plant is important for the nation; support for the construction of nuclear plants in the UAE had risen to 79%, up 11% from 2013; the percentage of residents believing it is important for the UAE to have a peaceful nuclear energy programme in order to be able to meet the nation's electricity needs had risen to 69%, up 6%; and the vast majority of UAE residents, 81%, were aware of ENEC, up from 56%.

More recent polling by Savanta, commissioned by Radiant Energy Group, has shown strong net support for nuclear energy. 50% of UAE respondents to the 2024 PACE Index support the use of nuclear energy, whilst just 19% oppose.

Regulation, safety and non-proliferation

In August 2009 the UAE advised the IAEA that it was ready to join the IAEA Convention on Nuclear Safety, and the Joint Convention on the Safety of Spent Fuel Management and on the Safety of Radioactive Waste Management.

In October 2009 the Federal Law Regarding the Peaceful Uses of Nuclear Energy was signed into effect. The law provides for development of a system for licensing and control of nuclear material, as well as establishing the independent Federal Authority of Nuclear Regulation (FANR) to oversee the whole of the UAE's nuclear energy sector, and appointing the regulator's board, headed by a senior US regulator. The law also makes it illegal to develop, construct, or operate uranium enrichment or spent fuel processing facilities within the country's borders.

In September 2015 a renewed five-year agreement with the US Nuclear Regulatory Commission was signed by FANR. The arrangement calls on the two regulators to exchange technical information, cooperate in nuclear safety research and enable FANR staff to train with their NRC counterparts. An agreement with the Korea Atomic Energy Research Institute (KAERI) was signed in 2015, followed by others with France, Canada and the UK. In May 2018 FANR signed a cooperation agreement with China's National Nuclear Safety Administration (NNSA) which included training.

Earlier in 2009, the Emirates Nuclear Energy Corporation (ENEC) was formally established as an investment vehicle. As well as overseeing development of the nuclear program, it will act as a government investment arm by making strategic investments in the nuclear sector, domestically and internationally. This is likely to include taking a significant stake in the successful bidder, though that is not a condition or criterion in the bidding process.

In mid-2010 ENEC set up a Nuclear Safety Review Board to provide a review of the safety and effectiveness of the construction, startup, and operations of the ENEC program, and to contribute to the review of ENEC’s Construction Licenses Application for the proposed Barakah Nuclear Power Plants, submitted to FANR. The Board is made up of five members, from Korea, Japan, and the USA, with significant experience in all areas of civil nuclear power.

Separate from FANR, ENEC has also set up an International Advisory Board (IAB) of experts, headed by Dr Hans Blix.

International agreements

In October 2012 the UAE passed legislation in line with the revised Vienna Convention so that civil liability lies solely and exclusively with the plant operator. It sets a limit of 450 million SDRs, about US$ 694 million, 50% higher than the Vienna Convention minimum, so that the operator needs to insure to this level. The state accepts responsibility as insurer of last resort. In July 2014 the UAE ratified the Convention on Supplementary Compensation of Nuclear Damage (CSC), though it is not yet in force.

The USA signed a bilateral nuclear energy cooperation agreementa with the UAE in January 2009 and South Korea signed one in June 2009. The UK has signed a Memorandum of Understanding on nuclear energy cooperation with UAE. France and Canada have nuclear cooperation agreements with UAE, the latter signed in September 2012, Russia in December 2012, and Argentina signed one in January 2013, then another in April 2014. Japan signed a nuclear cooperation and technical transfer agreement with UAE in May 2013, and another in February 2014. Australia and Canada signed bilateral safeguards agreements with UAE in August and September 2012, and the Australian one came into force in April 2014.

In August 2016 Holtec International and UAE-based Atomic and Automation International announced plans to launch a joint venture "to leverage Holtec's technology assets to aid in the [Gulf Cooperation Council] region's industrialization". The joint venture – named Holtec Arabia – will be based in Dubai and will seek to expand the use of Holtec's heat transfer equipment and systems for the power and process industries. It will also provide storage and transport systems for used nuclear fuel, and promote Holtec's SMR-160 small modular reactor in the region.

In September 2017 ENEC and Kazatomprom signed a nuclear cooperation agreement related to the supply of uranium and fuel fabrication.

The UAE is a signatory of the NPT and it ratified a safeguards agreement with IAEA in 2003. In 2009 it signed the Additional Protocol.

Notes & references

References

a. Agreement for Cooperation Between the Government of the United States of America and the Government of the United Arab Emirates Concerning Peaceful Uses of Nuclear Energy, US Government Printing Office, Washington (2009) [Back]

Notes

1. The consortium involves Hyundai Engineering & Construction, Samsung, Doosan Heavy Industries and Westinghouse, as well as KEPCO subsidiaries: Korea Hydro and Nuclear Power Co. Ltd. (KHNP), which will play a key role as the Engineering, Procurement and Construction (EPC) contractor and as operator; Korea Power Engineering Co. Inc. (KEPCO E&C), which will provide the nuclear power plant design and engineering service; Korea Nuclear Fuel Co. Ltd. (KEPCO NF), which will provide the fuel; and Korea Plant Service and Engineering Co. Ltd. (KEPCO KPS), which will be involved in plant maintenance. [Back]

2. In January 2008 three French companies Areva, Suez and Total had signed a partnership agreement to propose to UAE the construction of two EPR units there. Suez and Total would each invest up to 25% of the project with Abu Dhabi entities providing at least 50%. Suez would be operator, Areva would supply the plant and manage the fuel. Total and Suez were well established in the region and together operated a power and desalination plant for Abu Dhabi, 100 km west of Dubai. The consortium's first EPR could have been operating about 2017. In May 2009 it was reported that EdF had joined this consortium. [Back]

Related information

Emerging Nuclear Energy CountriesDesalination