Australia's Electricity

Australia's Electricity

Appendix to Australia's Uranium paper

- Australia is heavily dependent on coal for electricity, more so than any other developed country. About 60% of electricity production is derived from coal.

- Australia's electricity was low-cost by world standards, but this has changed.

- Natural gas is increasingly used for electricity, especially in South Australia and Western Australia.

- After many years of low investment, there is a major challenge to build more dispatchable generating capacity.

Electricity consumption in Australia has been growing at nearly double the rate of energy use overall. Growth in electricity generation has levelled out over the last decade, driven by price rises, due to network costs, and also in 2017 rooftop PV resulted in 3.1% reduction in grid supply.

Electricity generation accounted for 27.5% of Australia's total primary energy supply in 2016-17, and 19.3% of final energy consumptiona.

Energy in Australia

Much of the energy exported from Australia is used for generating electricity overseas; three times as much thermal black coal is exported as is used in Australia, and all of the uranium production is exported.

Australia also exports a significant amount of energy in mineral products. Exports of aluminium metal* alone embed some 27 TWh of electricity per year, about 11% of the country's total gross production. In 2016 some 34 TWh was used in non-ferrous metals (aluminium smelter production accounts for most of this), almost half of the industry total of 77 TWh.

* at an average of 15 kWh/kg.

Most of the growth in value-adding manufacturing in the past 30 years has come from industries which are energy- and particularly electricity-intensive. The growth has occurred in Australia because of relatively low electricity prices coupled with high reliability of supply and the proximity of natural resources such as bauxite/alumina.

Electricity

The Department of Environment & Energy put the national total gross generation for 2018 as 261.4 TWh, including 120.6 TWh (46%) from black coal and 36.0 TWh from brown coal (14%), 50.2 TWh (19%) from gas turbines, 17.5 TWh (6.7%) from hydro, 16.3 TWh (6.2%) from wind, 9.9 TWh from rooftop solar PV and 2.1 TWh from grid-linked solar PV (total 4.6% solar). Oil/diesel provided 5.3 TWh and biomass 3.5 TWh (September 2019 provisional figures).

International Energy Agency (IEA) data for 2017 shows 258 TWh generated, less 14.2 TWh own use by power plants, hence 243.8 TWh net production. Then 13.9 TWh is lost or used in transmission and 18.8 TWh more in energy sector consumption, leaving 210.7 TWh for final consumption (or about 180 TWh excluding use in aluminium production). Final consumption in 2017 was around 8600 kWh per capita.

At the end of 2017 electricity generating capacity was 66.5 gigawatts (GWe), of which 25.2 GWe was coal-fired, 18.3 GWe gas or multi-fuel, 8.3 GWe hydro (including pumped storage), 1.9 GWe liquid fuels, 0.7 GWe biofuel, 4.8 GWe wind, and 7.4 GWe solar PV (IEA figures). Wind capacity factor averages about 31%, solar PV was 12.5% in 2017.

Most of the generating capacity is associated with the grid-connected National Electricity Market (NEM) in the southeast and east of the country (see below), the second grid being the South West Interconnected System (SWIS) in Western Australia. A smaller grid is in the Pilbara.

In Victoria the main fuel is brown coal (lignite), in NSW and Queensland it is high quality black coal, and in WA it is much lower quality black coal.

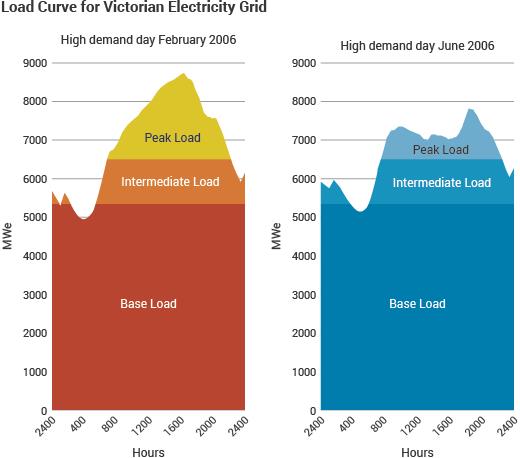

About 61% of Australia's electricity is produced from 42% of the capacity, reflecting the predominance of base-load demand (see Figure below) and the fact that coal provides the main base-load capacity in Australia. Note that electrically, Western Australia is isolated.

National Electricity Market

Eastern Australia's National Electricity Market (NEM) operates the world’s most extensive interconnected power system that runs for more than 5,000 kilometres from North Queensland to Tasmania and central South Australia, and supplies some $10 billion electricity annually to meet the demand of more than 10 million end users. The NEM volume-weighted wholesale price in 2018 ranged from $73/MWh in Queensland to $82/MWh in NSW, $92/MWh in Victoria and $98/MWh in SA. NEM infrastructure comprises both state and privately owned assets, and is managed under the overall direction of the Australian Energy Market Operator (AEMO), which was established by the state and federal governments.

At the end of 2017 the NEM capacity was 54.4 GWe producing about 200 TWh/yr, 77% from coal (some two-thirds of this from black coal), 9% from natural gas, 8% from hydro and 5% from wind. About 50 large dispatchable generators (100-750 MWe each) provide over 85% of the capacity. NEM capacity in January 2019 was 50.6 GWe including 23.0 GWe coal, 3.1 GWe closed cycle gas, 6.7 GWe open cycle gas, 2.1 GWe other gas, 5.0 GWe wind, 8.0 GWe hydro, 1.5 GWe solar (excluding rooftop PV). Of the coal capacity, 2 GWe is announced withdrawal.

Unlike some overseas electricity markets where the transmission system operators activate dispatchable capacity 45 minutes ahead of perceived need, in Australia the NEM has real time balancing with the obligation on renewables up to five minutes before delivery. Prices are therefore capped very much higher, at $14,500/MWh (mid-2018). This has provided an incentive for investment in new balancing plant, with significant flexible capacity being added as a result. In recent years, wholesale prices have spiked to maximum levels when loads were high and intermittent renewable sources were unable to deliver. The situation is exacerbated by retirement of coal-fired plants previously relied upon for much of the dispatchable power. In Australia a gas-fired plant may only run for 900 hours per year (load factor 10%), on 1050 occasions, with 400 of the starts being for five minutes only, but it can be economic.

In mid-2018 AEMO produced an Integrated System Plan (ISP) as the basis of a National Transmission Network Development Plan (NTNDP) for the next 20 years. In this period coal-fired capacity providing 70 TWh/yr is expected to retire. AEMO noted: “In addition to providing critical energy production and dispatchable power, [these] conventional generators have also traditionally been relied on to provide essential grid security services, such as inertia, system strength, and frequency control.” Its 2018 plan includes solar (28 GW), wind (10.5 GW) and storage (17 GW/90 GWh) complemented by 500 MW of flexible gas plant to deliver 90 TWh/yr.

South Australia's electricity

South Australia is small part of the NEM, but poorly connected, with a 460 MWe link to Victoria at Heywood (Vic) in the south and the 220 MWe Murraylink one further north, providing back-up from Victorian brown coal equivalent to about one-quarter of 3100 MWe peak demand. The Heywood interconnector is being upgraded to 650 MWe in both directions, at a cost of $108 million. Modelling by Deloitte Access Economics suggests that by 2019 the interconnectors from Victoria will be at maximum capacity into SA for about 23 hours per day. However AEMO forecasts a decline in supply from Victoria after 2020, due partly to Victoria’s greater reliance on wind, the output of which will fluctuate very much in line with that in SA.

The relatively dry and flat state has had a strong policy of promoting wind and solar capacity, and over 40% of its electricity is from these sources (from 1473 MWe wind, but no solar on grid). Gas accounts for 90% of the dispatchable supply (from 2617 MWe), and the former SA coal-fired plants have been shut down (Northern 546 MWe, Playford B 240 MWe). Another 3200 MWe of wind capacity is committed or proposed. Solar PV is widely used, but virtually all behind the meter.

As well as simply meeting power and supply demand, the challenge of power quality (voltage and frequency control) is increased by the high dependence on wind.

The outcome of this generation situation is that NEM spot prices are sometimes very high, when wind is low. The fossil fuel-fired power stations are uneconomic due to low capacity factors forced by significant priority input of wind generation, coupled with low prices in the wholesale market when (subsidised) wind is abundant. Several have therefore closed down, and a further 770 MWe of gas-fired plant is due to close in 2017. Gas prices are rising due to several factors, which acutely compounds the SA dilemma.

Following winter price spikes in 2015, AEMO commissioned a report by Frontier Economics, which said that the reason was a low level of wind generation at the time. “As has been long predicted, increasing penetration of wind, and its inherent intermittency, appears to be primarily responsible for the (price spike) events. While the events have coincided with relatively high demand conditions in South Australia and some minor restrictions on imports of electricity from Victoria, low wind production levels are the key common feature of every event. The market response at such times has been to offer higher-priced capacity to the market, leading to high prices, just as the National Electricity Market was designed to do under conditions of scarcity.”

The Frontier Economics report says the level of wind and solar penetration in South Australia presents a fascinating natural experiment in the impact of intermittent generation on wholesale prices. “Unfortunately, this test is anything but academic and the people of South Australia are increasingly likely to bear increased electricity costs as wind makes up a greater proportion of South Australian generation,” the report says. “While policymakers may be tempted to act to force thermal and/or wind to behave uneconomically, the likely outcome means South Australian consumers will bear more costs.” (From The Australian, 23/7/16)

In the first part of July 2016 prices averaged over $300/MWh in South Australia, compared with under $80/MWh in the four eastern states. In June, SA prices had averaged $133/MWh. Spikes of over $10,000/MWh have occurred. On 7 July, SA wind farms were producing 190 MWe early in the morning, but by afternoon they were actually drawing energy from the grid, this effect being most acute due to limited back-up supply.

There are proposals for three new interconnectors from SA to NSW, ranging in projected cost $3 to $3.75 billion, but none is proceeding. A further connection from Krongart in SA to Heywood (Vic) is projected at $530 million but is not proceeding.

Australian Energy Technology Assessment (AETA)

The AETA was undertaken by the Bureau of Resources and Energy Economics (BREE) in 2012. It evaluated 40 utility-scale generation technologies, projecting out to 2050, and focusing on estimating the levelised cost of electricity (LCOE), using AEMO’s NTNDP parameters and those from Treasury. The capital costs of various options excluded financing and system costs. AETA assessed two nuclear technologies: large light water reactors and small modular light-water reactors (SMR). Capital costs used were $4210/kW and $7908/kW respectively for first of a kind units, and $3470/kW and $4778/kW for Nth of a kind (while noting that overnight costs in Asia are much lower). These gave almost the lowest cost ranges of any of the 40 technologies over 2020 to 2050, with GW-scale nuclear about $100-110/MWh and $115-125/MWh for SMR over 2020-2050.

This study complemented a CSIRO eFuture model, which shows that incorporating nuclear into the generation mix from 2025 so that it contributed about 55% of supply from 2040 would save $130 billion in greenhouse gas abatement and $18 billion in health cost savings to 2050 compared with the Government’s 2012 Energy White Paper projections, and reduce LCOE from $158 to $125/MWh over 2040-50. The retail price saving is $86/MWh. Looking at capital costs to 2050, the White Paper projects $195-225 billion, the eFuture with nuclear $175-235 billion, including $85-100 billion for nuclear build.

Emissions

Australian coal is mostly very clean by world standards, so electricity is produced without very much sulfur dioxide being emitted (or requiring expensive equipment to avoid its emission).

However, power generation contributes 33% of the country's net carbon dioxide-equivalent emissions (179 out of 543 Mt in 2013-14). The 2008-09 figure calculated from thermal plants in an ESAA benchmarking study is 204 Mt, about 37% of total. In this, black coal plants in NSW emit 920,000 tonnes CO2 per TWh, Victorian brown coal plants emit 1.29 million tonnes CO2 per TWh.

The Cost of Electricity

Much electricity in Australia is now traded so that distribution companies buy at the best price available from hour to hour from competing generators. According to an informed estimate*, Australian retail power prices comprise about 30% wholesale, 50% network charges, and 20% retail costs and margins. (In Europe, about 40% of the retail price is the wholesale cost.)

* Prof John Fletcher, UNSW

The difficulties matching supply with demand can be judged from the fact that Victorian demand ranges from 3900 MWe to 10,000 MWe, and that in NSW from 5800 to 15,000 MWe.

Australian electricity prices were almost the lowest in the world to about 2007, but have risen significantly since then, and international comparisons are exacerbated by the exchange rate. Hence 2011-12 average Australian household prices were above the Japan and EU averages and much higher than that of the USA. By state, WA, Victoria, NSW and SA 2011 prices ranked behind only Denmark and Germany.

In mid-2016 the biggest three retailers (and many smaller retailers) in South Australia, New South Wales and Queensland increased their prices significantly. Following these increases, household electricity prices in New South Wales joined those in South Australia and Victoria in being higher than the average prices paid by households in other high income OECD countries (before taxes).

The earlier low prices created a major problem in attracting investment in new generating plant to cater for retiring old plant and meeting new demand – a 25% increase by 2020 was projected, and in fact a 40% rise occurred by 2011.

Load curve of the Victorian electricity system in two peak days in 2006, showing the relative contributions of base, intermediate and peak-load plant duty. The shape of such a curve will vary markedly according to the kind of demand. Here, the peaks reflect domestic demand related to a normal working day, with air conditioner demand evident on the hot summer day.

Note that base-load demand accounts for the majority of electricity supplied. The base-load here is about 5300 MWe, and while total capacity must allow for nearly double this, most of the difference is normally supplied by large intermediate-load gas-fired plant. The peak loads are typically supplied by hydro and gas turbines. Under the wholesale electricity market, power stations bid into the market and compete for their energy to be despatched. Thus the sources of supply at any particular moment are determined by some balance between plant which (once installed) can be run very cheaply, and that which while costing less to build, uses more expensive fuel. Source: Vencorp.

Transmission

Australia has 27,640 km of transmission lines and cable (220 kV and above – 10,300 km 330 kV and above), mostly state-owned and operated, transporting over 200 TWh of electricity per year. There is no connection between the east of SA and WA.

Because most of Australia's electricity is produced near the main load centres there is less high voltage (500, 330, 275, 220 kV) transmission needed than in some countries. There is nearly as much at 132 kV as at those four higher levels combined. (At 500 kV, transmission losses over 500-1000 km are halved.)

Notes & references

Notes

a. Figures from Australian Energy Statistics, Department of the Environment and Energy of the Australian government. Financial year runs from 1 July to 30 June [Back]

General Sources

OECD International Energy Agency, Electricity Information (annual)

International comparison of Australia’s household electricity prices, CME report on behalf of One Big Switch (July 2016)

Tracking Towards 2020: Encouraging renewable energy in Australia, Australian Government Clean Energy Regulator (2016)

Quarterly Update of Australia's National Greenhouse Gas Inventory

Appendices

Australia's ElectricityAustralia's former uranium mines

Australia's U deposits and Prospective Mines

Australia's Uranium Mines