Nuclear Power in Canada

- About 15% of Canada's electricity comes from nuclear power, with 17 reactors mostly in Ontario providing 12.7 GWe of power capacity.

- Canada has plans to build both new large-scale nuclear capacity and small modular reactors.

- For many years Canada has been a leader in nuclear research and technology, exporting reactor systems developed in Canada as well as a high proportion of the world supply of radioisotopes used in medical diagnosis and cancer therapy.

Reactors

Construction

Shutdown

Operable nuclear power capacity

Electricity sector

Total generation (in 2024): 620 TWh

Generation mix: hydro 343 TWh (55%); natural gas 102 TWh (16%); nuclear 86.1 TWh (14%); wind 46.6 TWh (8%); coal 18.1 TWh (3%); biofuels & waste 10.6 TWh (2%); solar 7.9 TWh (1%); oil 5.0 TWh.

Import/export balance: 12.5 TWh net export (23.3 TWh imports, 35.8 TWh exports)

Total consumption: 532 TWh

Per capita consumption: c. 12,900 kWh in 2024

Source: International Energy Agency, The World Bank. Data for year 2024.

Nuclear power industry

Reactors operable in Canada

There have been several notable developments this century in Canada's nuclear situation: the first based on the 2015 Ontario decision to approve refurbishment (lifetime extension) of the four nuclear units at Darlington and the remaining six units at Bruce (the first two units were already refurbished). This C$26 billion 15-year programme is one of the largest clean energy projects in North America. The first unit at Darlington, unit 2, started its refurbishment outage in October 2016, and was returned to commercial operation in June 2020. The second unit at Darlington, unit 3, was returned to commercial operation in July 2023. The first Bruce unit to undergo refurbishment was unit 6, which started its outage in January 2020 and was restarted in August 2023.

The second development relates to international leadership regarding small modular reactors (SMRs). In 2018 Natural Resources Canada (NRCan) issued its SMR Roadmap, a plan for nuclear technology development based on SMRs. In December 2019 the provinces of New Brunswick and Saskatchewan agreed to collaborate with Ontario in advancing the development and deployment of SMRs to address climate change, regional energy demand, economic development, and research and innovation opportunities.

Along with this, the Canadian Nuclear Safety Commission (CNSC) has a pre-licensing vendor design review process to assess nuclear power plant designs based on the vendor's reactor technology – for about ten small reactors with a wide range of capacities up to 300 MWe. Also, Canadian Nuclear Laboratories (CNL) invited expressions of interest resulting in almost 20 proposals for siting an SMR at a CNL-managed site. CNL had intended to have a new SMR at its Chalk River site by 2026.

In December 2020, NRCan released its SMR action plan, which responds to the 53 recommendations in the SMR Roadmap and lays out the steps for the development, demonstration and deployment of SMRs at home and abroad. The plan envisaged the first units to come online in the late 2020s.

In February 2023 the Canadian government launched the 'Enabling Small Modular Reactors Program', providing C$29.6 million (about $22 million) in support for the development and deployment of SMRs. Under the programme, applicants can request up to C$5 million for R&D projects, with the programme providing up to 75% of the total project costs, or up to 100% for projects led by indigenous applicants.

In November 2023 the government revised the Green Bond Framework – which previously excluded nuclear energy from obtaining financial support – to explicitly permit “the deployment of nuclear energy to generate electricity and/or heat.” The first issue under the amended framework, of C$4 billion ($2.9 billion), was sold in February 2024.

Reactor development

Canada has developed its own line of nuclear power reactors, starting from research in 1944 when an engineering design team was brought together in Montreal, Quebec, to develop a heavy water moderated nuclear reactor. The National Research Experimental Reactor (NRX) began operation in 1947 at Chalk River, Ontario, where today the Chalk River Laboratories are the locus of much of Canada's nuclear research and development. The government established Atomic Energy of Canada Ltd (AECL) as a crown corporation in 1952 with a mandate to research and develop peaceful uses of nuclear energy. The National Research Universal (NRU) reactor was built at Chalk River in 1957. Up to October 2016, NRU produced 40% of the world supply of molybdenum-99, the source of technetium-99 widely used for medical diagnosis, and cobalt-60 for cancer treatment. It was shut down in March 2018, after a remarkable service life.

Candu design

AECL, in cooperation with Canadian industry, began developing the first Candu (Canada deuterium uranium) reactor in the late 1950s. The first commercial Candu reactors began operation in Pickering, Ontario, in 1971. Eighteen of Canada's 19 commercial reactors are located in Ontario (Point Lepreau is in New Brunswick). In 2021, about 58% of Ontario's electricity production came from nuclear power. As well as their use for electricity, Candu power reactors produce almost all the world's supply of the cobalt-60 radioisotope for medical and sterilization use.

Today, there are 27 Candu power reactors in seven countries, as well as 17 'Candu derivative' reactors in India. Export sales of 12 Candu units have been made to South Korea (4), Romania (2), India (2), Pakistan (1), Argentina (1) and China (2), along with the engineering expertise to build and operate them.

Candu reactors use heavy water (deuterium oxide) as a moderator and coolant, and are fuelled using natural uranium (as opposed to enriched uranium). The advantages of the Candu reactor are savings in fuel cost, because the uranium does not have to go through the enrichment process, and reduced reactor downtime from refuelling and maintenance. These savings are partially offset by the cost of producing heavy water. A small (22 MWe) Candu prototype went into operation in 1962 at Rolphton, Ontario, 30 km upstream from the Chalk River facilities. A larger prototype – 200 MWe – began generating power at Douglas Point, Ontario, in 1967. It was the design basis of the first Indian PHWR power reactors, Rawatbhata 1&2.

The technology and design of Candu reactors have evolved through several generations, with the newest reactors the Enhanced Candu 6 (EC6, based on Qinshan in China). The next-generation Advanced Candu Reactor (ACR-1000) was not fully developed.

The number of steam generators (SG) per Candu reactor is different for different designs. The Bruce station units have eight SGs each, of a unique design, not used anywhere else. Candu-6 plants (e.g. Point Lepreau) all have four SGs per unit, as do the larger Darlington units. The old Pickering reactors have 12 small SGs per unit.

In mid-2011 AECL sold its reactor division to SNC-Lavalin's Candu Energy subsidiary for C$ 15 million, with the Canadian government retaining intellectual property rights for the Candu reactors, in the hope of future royalties from new build and life extension projects "while reducing taxpayers' exposure to nuclear commercial risks." Candu Energy could pursue new business opportunities in connection with existing Candu reactors worldwide and new build opportunities with EC6 models. The government would contribute $75 million towards completing the EC6 development programme. Candu Energy would complete the refurbishment projects at Bruce, Point Lepreau, and Wolsong through subcontract service agreements with the Canadian government. About 1200 employees transferred to Candu Energy.

By 2016 Candu Energy was focusing on adapting its designs to run on recycled uranium from light water reactors and thus to complement operators of those rather than compete with PWR and BWR designs. One manifestation of this is the 2012 and 2016 agreements with China National Nuclear Corporation and others to finalize the design and then build Advanced Fuel CANDU Reactors (AFCR).

In late 2023, AtkinsRéalis (formerly SNC-Lavalin) announced its new Candu Monark design, with several passive safety features. The 1000 MWe design is a heavy water cooled and moderated Candu reactor core of 480 channels, with a two-loop 'figure of eight' heat transport system, similar to the design used for the Darlington plant. The fuel is natural uranium in 37-element bundles (37M).

Reactor refurbishment

To meet current and future electricity needs, provincial governments and power companies have made the decision to extend the operating lifetime of a number of reactors by refurbishing them. Refurbishing Candu units consists of such steps as replacing fuel channels and steam generators and upgrading ancillary systems to current standards.

From 1995-98, the four Bruce A units and the four Pickering A units were laid up by the former Ontario Hydro. This followed a review commissioned by Ontario Power Generation which was critical of the company's management and recommended a phased approach to improvement which involved the closure of seven reactors (one was already shut down) pending refurbishment and a focus on the other 12 then operating (Bruce B, Pickering B and Darlington).

The Pickering A – Bruce A saga is a cautionary tale (and classic industry case study) regarding what is now called knowledge management (KM). By the mid-1990s there was a divergence between drawings and modifications which had progressively been made, and also the company had not shared operating experience with the designer. Maintenance standards fell and costs rose. A detailed audit 1997-98 showed that the design basis was not being maintained and that 4000 additional staff would be required to correct the situation at all Ontario Hydro plants, so the two A plants (8 units) were shut down so that staff could focus on the 12 units not needing so much attention. From 2003, six of the eight A units were returned to service with design basis corrected, having been shut down for several years – a significant loss of asset base for the owners. Two units at Pickering (2&3) were considered uneconomic to refurbish so were not restarted.a

Full refurbishment of the later model Candu 6 units such as Point Lepreau includes replacement of all calandria tubes, steam generators and instrument and control systems. (This first project went over time and budget, but the second, at Wolsong 1 in Korea, benefited from the experience.)

There are currently major refurbishment programmes ongoing at both the Darlington and Bruce sites, extending the operating lifetimes of the reactors by 30 years (see below).

Pickering

The Pickering site comprises four operable Candu 500 reactors, Pickering units 5-8, collectively known as Pickering B.

Pickering A comprised four reactors, all of which were laid up in 1997. Pickering A1 and A4 were both refurbished to extend their life expectancy. Unit 4 was restarted in September 2003 and unit 1 in September 2005. The Pickering 1 refurbishment in 2004-05 cost its operator Ontario Power Generation (OPG) over US$1600/kWe, more than double the original estimate, which led the government to retire units 2&3 rather than refurbish them.

In February 2010, OPG decided against full refurbishment, but would spend C$ 200 million on a fuel channel life management project to keep them going for another ten years. CNSC renewed the single operating licence of all six operable reactors for five years in August 2013, subject to a whole-site probabilistic safety assessment focused on the B units 5-8. The design limit for these units is normally 210,000 equivalent full-power hours. In August 2014 CNSC extended the limit for unit 6 to 247,000 hours – by four years to about 2019. This became the first Canadian reactor to clear the 210,000 hour limit.

In January 2024 the government approved OPG’s proposal to refurbish units 5-8 of the Pickering plant. The C$2 billion ($1.5 billion) 'project initiation phase', which included engineering and design work as well as securing long-lead components, lasted until the end of 2024. The refurbishment project is expected to be completed by the mid-2030s. OPG has received permission from the CNSC to operate units 5-8 to end-2026, after which they will be taken out of service for refurbishment.

Pickering 1 was retired in September 2024 followed by unit 4 in December.

Bruce

Bruce Power was formed in 2001 as a Canadian company and it leases the Bruce site from Ontario Power Generation. It is the licensee for the plant. Over 90% of Bruce employees hold equity in the company.

The site comprises eight operable Candu reactors divided equally between two plants. Plant A includes two Candu-791 reactors and two Candu-750 reactors, whilst plant B has four Candu-750s.

Bruce A

Units 3 and 4 of Bruce A had been laid up early in 1998, and were returned to service in January 2004 and October 2003, respectively as an early priority of Bruce Power.

Facing an impending power shortage, the provincial government's Ontario Power Authority in October 2005 agreed with Bruce Power to refurbish its oldest Bruce A reactors. Unit 2 had been laid up in 1995 due to a maintenance accident in which lead contaminated the core. Unit 1 was laid up along with the four Pickering A units at the end of 1997, to allow operational focus on newer plants. Their operational lifetimes were extended by 25 years. Refurbishment of units 1&2 followed units 3&4 being returned to service by 2004 and was completed in 2012.

About eight years after returning to service, unit 3 had a C$300 million upgrade over November 2011 to May 2012 to extend its operating lifetime by ten years, and unit 4 had a similar life-extending upgrade in 2012. Replacement of low-pressure turbines was completed following the reactor refurbishments, at a cost of over $200 million per unit.

UK-based AMEC managed Bruce A work. The whole project was expected to cost C$5.25 billion, with C$2.75 billion for units 1&2, C$1.15 billion for unit 3 and $1.35 billion for unit 4. Early in 2008, with C$2 billion spent, it was announced that the cost of unit 1&2 refurbishment would be about C$3 billion, which late in 2010 was increased to C$4.8 billion. The installation of new calandria tubes was completed in November 2010. In July 2012 unit 1 was authorized to restart, and it was grid-connected in September. Unit 2 started up in March 2012 and came back on line in October, after sorting out a generator problem. They returned to commercial operation by October and November 2012 respectively.

The Bruce site in Ontario features eight Candu reactors, four at Bruce B (foreground) and four at Bruce A

As part of the 2005 agreement, Bruce Power is paid for all electricity from Bruce A on the basis of a 6.3 cents/kWh reference price capped for 25 years. The price is adjusted in line with the consumer price index. The difference between the actual capital expenditure and $4.25 billion (apart from unit 4 refurbishment) is shared between the government and the investors. One of the partners in Bruce Power at the time, Cameco (31.6%), said before commencement that while it strongly applauded the project it did not meet Cameco's investment criteria, so it received a $200 million payout of its interest in Bruce A. The other partners set up Bruce A Limited Partnership (BALP) to sublease Bruce A from Bruce Power and to pay for the project.

Bruce B

Decisions on the four Bruce B reactors were pending, though in July 2009 Bruce Power announced that it would focus on refurbishing these rather than building new plants at Bruce, the expected cost being about half that of new plants. Early in 2010 the company completed work to uprate the four units from 90% to 93% of original design capacity by modifying the fuel loading. From 2001 to 2015, Bruce Power spent about C$10 billion on the whole plant. Bruce Power has contracted with BWXT Canada to design and manufacture 32 replacement steam generators for the Bruce B plant, for C$ 400-500 million.

Effective at the end of December 2013, Cameco sold its 31.6% interest in Bruce Power LP (effectively Bruce B) to Borealis Infrastructure, one of its partners, for C$ 450 million. Borealis is a division of the Ontario Municipal Employees Retirement System (OMERS), doubling its share to 63.2%. TransCanada Corporation, the Power Workers' Union and the Society of Energy Professionals are other equity holders, and TransCanada is acquiring some of OMERS’ holding so that each have 48.5%.

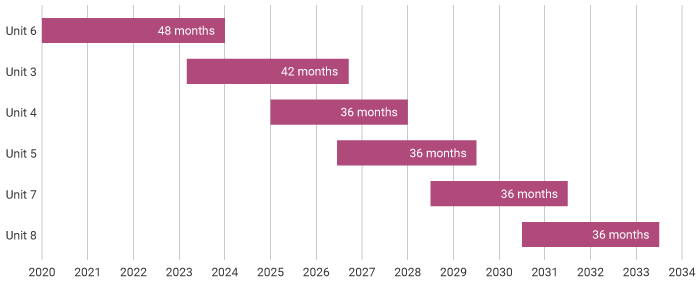

Refurbishment

Following the Ontario 2013 Long-Term Energy Plan, in December 2015 Bruce Power and the Independent Electricity System Operator (IESO)* agreed on long-term sales of 6300 MWe from Bruce, enabling a further major refurbishment programme to extend the operating lifetimes of units 3-8 by up to 35 years. From 2016 Bruce Power will receive C$65.73/MWh for all output, adjusted according to consumer price index. The six reactor refurbishments were expected to cost C$13 billion (in 2014 C$) from 2020 to 2033 and include steam generator and calandria tube replacement. In addition, C$5 billion would be spent on other lifetime extension or ‘asset management’ work from 2016 to 2053, $2.3 billion of these sums before 2020.

* incorporating Ontario Power Authority

Bruce refurbishment schedule

Bruce Power will continue to provide approximately one-third of its output (2400 MW) as flexible generation, allowing the province to permanently balance system needs in its post-coal environment. This is a feature that only the Bruce Power units can provide, and has been used frequently by the IESO since 2009.

In March 2023 Bruce Power began the refurbishment of unit 3. In May 2023 the first refurbished Bruce unit – unit 6 – completed fuel loading, and it was connected to the grid in September 2023.

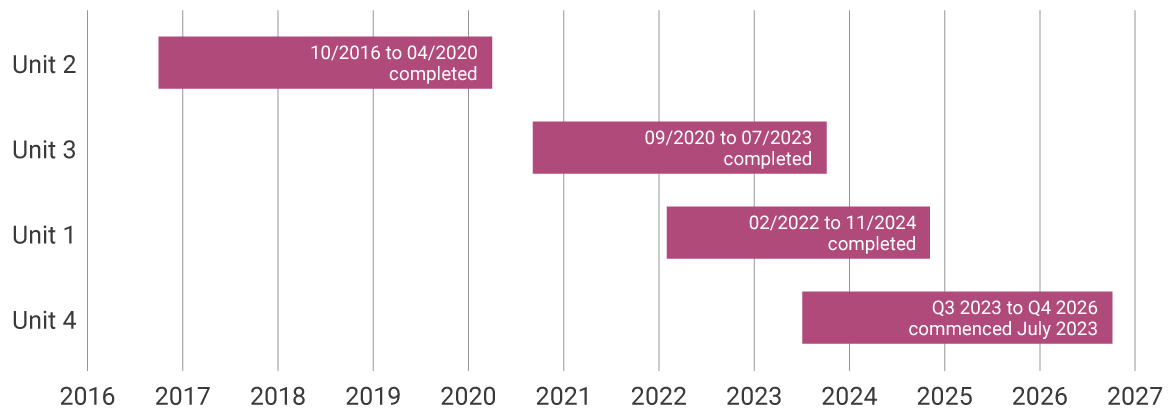

Darlington

The Darlington site comprises four CANDU-850 reactors. These are Canada's newest Candu reactors. Following detailed studies, OPG decided on full refurbishment starting in 2016 and consequent 30-year lifetime extension. The work involves replacing fuel channels and upgrading ancillary systems to current standards as well as overhauling the turbine generators. In November 2015 OPG announced approval of a C$12.8 billion refurbishment project to 2026, about half the cost of replacing them, and 9% less than originally projected. The Ontario government approved the project in January 2016.

OPG plans to shut the reactors sequentially for approximately 3.5 years each so that no more than two are out of action at the same time. OPG awarded a C$ 600 million contract to a joint venture of SNC-Lavalin Nuclear (now AtkinsRéalis) and Aecon Construction for the project's planning phase, and in January 2016, a C$2.75 billion contract to them for re-tubing. CNSC gave environmental approval for the refurbishment, which will enable the units to continue operating for a further 25-30 years. In September 2025 CNSC approved a 20-year licence extension for the plant. The price of power from the refurbished plant is expected to be between 7 and 8 ¢/kWh.

Darlington refurbishment schedule (revised in 2020)

In June 2018 OPG announced that work had begun to reassemble the reactor of unit 2, and in November 2019 fuel loading began. In April 2020 the unit had reached criticality, and it returned to commercial operation in June 2020. The unit was shut down in October 2016, before being isolated from the station, defuelled and the reactor components were removed. The last of its 480 calandria tubes was removed in May 2018.

In March 2020 OPG said that it would delay the planned start of unit 3's refurbishment, originally scheduled for May 2020, as part of its plans to ensure supply of electricity during the Covid-19 crisis. Work began in September 2020. Removal of the 6240 fuel bundles to storage was completed by the end of November 2020. Refurbishment work was completed in early June 2020, and it was returned to commercial operation in July, 169 days ahead of schedule.

Work on unit 1 began in February 2022 and the unit was reconnected to the grid in November 2024, ahead of schedule.

Refurbishment of unit 4 was commenced in July 2023, with refurbishment of all four units expected to be completed by 2026.

Point Lepreau 1

The Point Lepreau site has a single reactor. In mid-2005, the decision was made to refurbish New Brunswick Power's 635 MWe Point Lepreau reactor, which provides one-quarter of the province's power. It was the first Candu 6 type in commercial operation and was the first Candu-6 reactor to undergo full refurbishment, including replacement of all calandria tubes as well as steam generators. Work began in April 2008 and was originally expected to be completed in September 2009 at a cost of C$1.4 billion including replacement power. However, the project ran some C$2 billion over budget and three times over schedule (54 instead of 18 months). In 2010 AECL decided to remove and reinstall all 380 calandria tubes in the reactor core because of problems with the seals obtained for initial installation during the project.

The CNSC authorized fuel loading in March 2012, restart in July, and grid connection in October 2012, but it continued to operate at low capacity for some time. The provincial government sought to recover the overrun cost from the federal government. Two new low-pressure turbine rotors that were damaged in transit in 2008 were replaced in 2016. CNSC renewed the reactor’s operating licence in 2022 for a period of 10 years.

There was a proposal to sell the unit for C$1.4 billion to Hydro-Québec, to be finalized after the reactor was back online, but this was cancelled in March 2010b.

Gentilly 2

Hydro-Québec decided in August 2008 to similarly refurbish the 638 MWe Gentilly 2, but in September 2012, the new provincial government decided to close the plant at the end of the year instead of refurbishing it.

Most Québec electricity is hydro, supplied from the north of the province. Gentilly, close to the load centre, had particular importance for grid stability and it also provided energy security regardless of seasonal rainfall. The C$1.9 billion investment would have included construction of a radioactive waste management facility.

New reactor plans and proposals

There have been proposals to build several nuclear reactors.

Planned and proposed Canadian nuclear power reactors

| Utility | Site | MWe gross | Reactor | Operation |

| NB Power | Point Lepreau | 1x100 | ARC-100 | 2029 |

|---|---|---|---|---|

| OPG | Darlington | 1x300 | BWRX-300 | 2030 |

| Total planned: 2 units, 400 MWe | ||||

| Bruce | Bruce C | 6x800 | CANDU | |

| OPG | Darlington | 3x300 | BWRX-300 | |

| Total proposed: 9 units, 5700 MWe | ||||

| New Brunswick Power | Point Lepreau, New Brunswick | 1x1100 | Atmea1 or Kerena | plans lapsed |

| Bruce Power Alberta | Peace River, Alberta | 3200-4400 | AP1000, EPR | plans lapsed |

Ontario

In June 2006 the Ontario government implemented a 20-year energy plan, which envisaged maintaining existing nuclear generation capacity at 14,000 MWe. Earlier, in 2003, the province had committed to phasing out coal-fired electricity entirely.

The updated energy plan of 2010 proposed 12,000 MWe of nuclear capacity – out of a total installed capacity of around 41,000 MWe – by 2030. This projected $33 billion capital expenditure on new and refurbished nuclear capacity to 2030, the latter involving refurbishment of ten older reactors (four at Darlington, six at Bruce).

In 2022 Ontario’s Independent Electricity System Operator (IESO) issued a report forecasting the province could need more than double its current electricity generation capacity (42,000 MWe) by 2050. The report recommended Ontario begin planning, siting and environmental assessment work for long-lead assets, including nuclear power.

In December 2024 the Ontario government began work to determine community support for new energy generation, including nuclear, at three sites in the southern part of the province: Lambton, Nanticoke, and Wesleyville. In January 2025 the government asked OPG to explore opportunities at a site in Port Hope, Wesleyville, after the local municipality and indigenous communities expressed their support.

Bruce

In August 2006 Bruce Power applied for a licence to prepare its 9.3 km2 Bruce site for construction of up to four new reactors as Bruce C. The CNSC accepted the company's project description for 4000 MWe in January 2007.

Bruce Power submitted an environmental impact statement in September 2008, showing that up to four new reactors at Bruce C would have no significant environmental effect. The new units were envisaged as coming online from 2015. Six different reactor types were under consideration. However, in July 2009, the company announced that it would withdraw its site licence application and suspend its environmental assessment for Bruce C, and focus on refurbishment of Bruce A and B (a major task – see above).

In 2023 the province’s government announced it was starting pre-development work to build up to 4800 MWe of new large-scale nuclear capacity at Bruce Power’s existing site. In 2024 Bruce Power embarked on a new multi-year feasibility study regarding Bruce C. This was supported by C$50 million in federal funds due to its potential to meet 25% of the growth in electricity demand predicted by the 2022 IESO report.

In October 2008 Bruce Power announced it would conduct an environmental assessment for two new nuclear units in the Haldimand-Norfolk region of southern Ontario. The region was home to OPG's 4096 MWe Nanticoke Generating Station, the largest coal-fired power plant in North America. After Nanticoke closed in 2014, Ontario’s electricity supply came almost entirely from hydro and nuclear.

Although both the Haldimand and Norfolk councils supported the proposal, as well as 80% of residents, according to an Ipsos-Reid poll, the Ontario government did not support it. In July 2009, Bruce Power withdrew its site licence application and suspended its environmental assessment.1

Darlington

In September 2006 Ontario Power Generation (OPG) applied for a licence to prepare its Darlington site for construction of up to four new nuclear power units.

In March 2008 Ontario's Minister of Energy invited companies to submit proposals to build two new nuclear reactors at Darlington or Bruce, or both. In June 2008, the Ontario government selected Darlington as the site for the two new nuclear reactors, to be operated by OPG and to come online in 2018c. Three submissions were received by the February 2009 deadline – from Areva (US EPR), Westinghouse (AP1000) and AECL (ACR-1000). However, in June 2009, the provincial government announced that the procurement process was being stalled pending resolution of the future of AECLd. This brought the Canadian EC6 reactor into contention as the most likely design for Darlington 5&6.

In June 2012 OPG signed agreements with Westinghouse and SNC-Lavalin/Candu Energy to prepare detailed construction plans, schedules and cost estimates for two potential nuclear reactors – EC6 and AP1000 types respectively – at Darlington. These were received in June 2013, but further decisions were put on hold when the Ontario government deferred plans for construction in November 2013. OPG paid the two companies up to C$ 26 million for the estimates.

A licence to prepare the site was issued by the CNSC in August 2012. This was revoked by a federal court in May 2014 due to concerns about nuclear waste, hazardous emissions and accidents, but the CNSC appealed the decision on the grounds that these are matters for the construction and operating licences. To keep the construction option open, OPG and the government agreed to maintain the site licence.

In June 2016 the Energy Statute Law Amendment Act 2015 was passed, requiring a new long-term energy plan to be developed. It was published in 20172 and confirmed that the two new units at Darlington were deferred indefinitely. The report reaffirmed the commitment and rationale for refurbishing ten of the province's nuclear reactors: "The most cost-effective option for producing the baseload generation the province needs while releasing no greenhouse gas emissions is to refurbish Ontario’s nuclear generating stations." The report stated that the refurbishment and continued operation of Darlington alone would contribute C$90 billion to Ontario's GDP and increase employment by an average of 14,200 jobs annually.

Darlington SMRs

OPG had been considering the deployment of small modular reactors (SMRs) in remote areas and at its Darlington site. Having provided support to developers for several years, OPG in October 2020 announced that it would work with three developers to advance engineering and design work: GE Hitachi, Terrestrial Energy and X-energy. In December 2021 OPG announced it had selected GE Hitachi's BWRX-300 SMR for deployment at Darlington.

Site preparation activities at Darlington commenced in September 2022. In the following month, OPG submitted a construction licence application for a BWRX-300 unit, which was granted by the CNSC in April 2025.

Earlier, in January 2023 OPG, GE Hitachi, SNC-Lavalin (now AtkinsRéalis) and Aecon announced a six-year alliance to develop, engineer and construct a BWRX-300 at OPG's Darlington New Nuclear Project. At that time, completion of construction of the unit was expected by late 2028 with first power in 2029.

In July 2023 the Ontario government announced it would commence planning and licensing activities with OPG for three additional units at the site. OPG expects the first BWRX-300 to commence operation in 2030.

In May 2025 the provincial government of Ontario announced approval for OPG to begin building the first 300 MWe GE Hitachi BWRX-300 at the Darlington site. The same day, Aecon Kiewit Nuclear Partners, a joint venture between Aecon and Kiewit Nuclear Canada, secured a construction contract from OPG.

New Brunswick

In 2007, the New Brunswick provincial government requested a feasibility study on building a second reactor at the Point Lepreau site. The 2008 study was conducted by the Team Candu consortium* of AECL, GE Canada, Hitachi Canada, Babcock & Wilcox Canada and SNC-Lavalin Nuclear. In mid-2010, Areva signed a letter of intent with the government regarding it financing and building a merchant plant using Atmea (1100 MWe PWR) or Kerena (formerly the SWR-1000, a 1250 MWe BWR) technology. While government-owned NB Power would be licensee and operator, the plant would most likely be privately owned and financed rather than publicly financed from government debt. About half of the output would likely go to northeastern USA. There is over 1300 MW interconnection to New England, and in 2007 it imported 12 TWh from New Brunswick. However, the proposal has not proceeded.

Proposals have also been made for a third reactor in New Brunswick, mainly for the purpose of exporting power to New England.

In July 2023 NB Power and ARC Clean Technology Canada submitted an environmental impact assessment registration document and an application for a site preparation licence for an advanced SMR at the Point Lepreau site. In 2020 ARC, NB Power and Moltex Energy agreed to set up an SMR ‘vendor cluster’ in the province.

*Team Candu was set up in 2006 to offer fixed price plants on a turnkey basis, and originally the 1085 MWe ACR-1000 was the intended technology, which would have been the first ACR-1000 plant in Canada.

Alberta

Much of the interest in building nuclear reactors in Alberta centers on the extraction of oil from the province's extensive oil sands (tar sands) deposits. The current extraction process relies on energy from natural gas, which is costly and poses the additional problem of carbon emissions. In 2018 oil sands extraction accounted for 30% of the natural gas used in Canada. However, due to the Covid-19 pandemic and other market dynamics, natural gas consumption from oil sands decreased by 22% between January and June 2020. Nuclear power is considered an economically attractive, low emissions alternative for producing the steam and electricity the oil extraction process requires. Small modular reactors now being promoted in Canada introduce the possibility of moving the nuclear heat source every year or two.

In 2021 the largest oil sands producers formed an alliance to consider ways to achieve net zero greenhouse gas emissions by 2050, primarily by carbon capture and storage but with small modular reactors (SMRs) playing a role. In 2020 the province had joined Ontario, New Brunswick and Saskatchewan to promote SMRs.

Peace Region Nuclear Power Plant Project

In 2005, Energy Alberta was established to build a nuclear power plant in northern Alberta. In August 2007, Energy Alberta filed an application for a site preparation licence for one or two twin-unit ACR-1000 plants at a site in Peace River3. Soon after, the company agreed to be acquired by Bruce Power, which in March 2008 filed a new application for a licence to prepare for up to 4000 MWe at the same site, Lac Cardinal.4 The main discussion centred upon building twin ACR-1000 reactors primarily for electricity rather than steam production. Most of the power would be supplied to the grid, but off-peak it could be used for hydrogen production (for oil refining).

In late 2008, Bruce Power identified a second site, Whitemud, and decided to withdraw the licence to prepare site application for Lac Cardinal while the company determined which of the two sites was the most viable5. Both sites are located about 30 km from the town of Peace River, 500 km northwest of Edmonton. In March 2009, Bruce Power announced that the Whitemud site had been selected and that an environmental assessment was expected to be launched in 20106. The project, known as the Peace Region Nuclear Power Plant Project, would involve the construction of up to four reactors to provide between 3200 and 4400 MWe of capacity. The designs under consideration in 2009 were the EPR (two units), AP1000 (four units), and the ACR-1000 (two twin units).

Alberta's nuclear consultation process in 2009 confirmed that nuclear technology could play a role in the province's future energy mix – the government said nuclear power will be given the same consideration as all other energy options. In response, in late 2009, Bruce Power stated: "Any decision to proceed further will require us to take another look at the commercial case given the changing market conditions we have seen over the last 18 months."7 In December 2011 it shelved the project, ending a positive four-year engagement with the local people.

TransAlta

X-energy announced in September 2025 completion of a feasibility study into the deployment of its Xe-100 reactor at a repurposed TransAlta coal site in Alberta. The study was conducted with TransAlta, Hatch, PCL, and Kinectrics, and funded by the government of Alberta.

Saskatchewan

At the end of November 2008, a joint feasibility study by Bruce Power and SaskPower concluded that nuclear power could contribute at least 1,000 MWe capacity to Saskatchewan’s generation mix by 2020. The study identified a region spanning from Lloydminster, including the Battlefords and Prince Albert – generally referred to as the 'Prince Albert economic sub-region' – as the most viable host for a nuclear facility. The study also noted that growth in electricity demand in northeastern Alberta could provide a possible export market for Saskatchewan.8 SaskPower currently operates about 5000 MWe of capacity, two-thirds of it fossil fuel-fired. The company has previously investigated the prospect of nuclear power and in 2007 suggested that a 360-750 MWe reactor size would be feasible if Alberta is included, or larger if it also included Manitoba.

In August 2023 the government approved up to C$74 million in federal funding for SMR development in Saskatchewan, led by utility SaskPower. SaskPower has selected the GE Hitachi BWRX-300 SMR for potential deployment in the province in the mid-2030s. A decision on whether to proceed with construction is expected in 2029.

Uranium Development Partnership report

In March 2009, the major Uranium Development Partnership report from a widely representative government-appointed panel recommended that Saskatchewan should move towards building nuclear power capacity.9 The report recommended maintaining a focus on uranium mining and exploration, since the province provides all of Canada's current uranium production. It specifically discouraged value adding in conversion and fuel fabrication, but said that up to 3000 MWe of nuclear power capacity would be appropriate for the province, with major net economic benefit. Overall, the panel said that its recommendations could increase the province's GDP by an estimated C$50 billion and create 6500 construction jobs and 5500 long-term jobs. It also suggested working with Alberta to consider "a common power-generation solution for the two provinces by pooling their power needs." Subsidiary recommendations included building a research reactor and pursuing medical isotope production in partnership with the federal government and getting involved with laser enrichment technology (Saskatoon-based Cameco has a 49% interest in GLE, the main developer).

A public consultation on the report then resulted the government supporting most of the recommendations but saying that it would not support Bruce Power's proposal or any immediate "addition of 1000 MWe as proposed from a single nuclear reactor", but SaskPower should keep the option open for the long term.10 However, the Energy and Resources Minister noted that "the large scale of the proposed nuclear power investment requires a regional approach involving, ideally, all three prairie-provinces for successful implementation," which is in line with the UDP recommendation.

Small modular reactors

In March 2017 a $1.1 million university-based multidisciplinary research project to assess the feasibility of small modular reactors (SMRs) was launched. The project aims to provide a comprehensive approach for adopting nuclear energy and siting nuclear power plants, using Saskatchewan as the case study.

In December 2019 Saskatchewan and New Brunswick agreed to work with Ontario in promoting SMRs to "unlock economic potential across Canada, including rural and remote regions" in line with the national SMR Roadmap. In August 2020 Alberta joined this alliance.

New large reactor designs

Since its inception in the late 1950s, the Candu reactor design has gone through several generations of evolution to improve fuel efficiency and flexibility, meet more stringent safety requirements and reduce costs and construction time.

Innovation has continued on the current Candu 6 design. Although it was later shelved, features from the Candu 9 design (about 900 MWe) have been incorporated into recent Candu 6 reactors. The Candu 9 design had flexible fuel requirements ranging from natural uranium through slightly-enriched uranium, recovered uranium from reprocessing spent PWR fuel, mixed uranium and plutonium oxide (MOX) fuel, direct use of spent PWR fuel, to thorium. The innovations in Candu 9, along with experience in building recent Korean and Chinese units, has gone into the Enhanced Candu-6 (EC6) – built as twin units – with a capacity increase to 750 MWe and flexible fuel options, plus estimated 4.5-year construction and 60-year plant lifetime (with mid-life pressure tube replacement). It is presented as a third-generation design.

Enhanced Candu-6

EC6 has completed CNSC pre-licensing review. Initial design approval was granted in March 2010. The second phase of certification, intended to identify in greater detail any potential barriers to licensing the design, ran to 2012, and the third and final phase of the pre-project design review was completed in June 2013. This to a large extent clears the way for it to be built in Canada should a construction licence application be submitted, and will help its acceptance internationally, notably in Argentina, Romania and China.

The EC6 has been proposed by Candu Energy as a means of burning surplus plutonium in the UK. Up to four EC6 reactors could burn MOX fuel with about 2% plutonium (CANMOX).

Advanced Candu Reactor

The Advanced Candu Reactor (ACR) represents a further evolution in design. While retaining the low-pressure heavy water moderator, it incorporates some features of the pressurized water reactor. Adopting light water cooling and a more compact core reduces capital cost. It would run on slightly enriched uranium (about 1.5% U-235) with high burn-up, extending the fuel life by about three times and reducing high-level waste volumes accordingly. Attention became focused on the 1200 MWe ACR-1000. The modular construction means that major components can be built in US shipyards, using a high degree of standardization of components. The ACR was designed to be built in pairs, with construction time estimated at 44 months for the first unit and 36 months for the fifth and subsequent units. CNSC gave pre-project design approval to the ACR-1000 in 2010, saying that it met the overall regulatory requirements and the expectations for new nuclear power plants in Canada and that there were no fundamental barriers to licensing it. However, the design has been shelved.

Candu-X

Beyond the ACR designs, AECL was also developing the Candu-X, a supercritical reactor that is a step forward from the ACR. It was expected to be available about 2020 but has been shelved.

Advanced Fuel Candu Reactor

Taking development in a slightly different direction, a 2012 agreement between Candu Energy, China National Nuclear Corporation (CNNC) and two other Chinese companies was to develop a detailed conceptual design of the Advanced Fuel CANDU Reactor (AFCR) based on the EC6 which would run entirely on fuel made from recycled uranium blended with depleted uranium – natural uranium equivalent (NUE). One 700 MWe AFCR could be fully fuelled by the recycled uranium from four 1000 MWe PWRs’ used fuel. Hence deployment of AFCRs in China would greatly reduce the task of managing used fuel and disposing of high-level wastes, and significantly reduce China’s fresh uranium requirements. In 2016 a new agreement among Candu Energy’s parent company SNC-Lavalin, CNNC and the major engineering company Shanghai Electric Group (SEC) was signed to set up a joint venture in mid-2017 to develop, market and build the AFCR, with NUE fuel. CNNC will have a majority share in the JV. Two design centres are envisaged, in China and Canada, to complete the AFCR technology with a view to construction of two AFCR units in China. In December 2019 SNC-Lavalin was awarded a contract by China National Nuclear Power Co Ltd (CNNP) for pre-project work on its advanced heavy water reactor programme.

AP100 and Atmea1

The CNSC completed the second phase of preliminary design review of the Westinghouse AP1000 in 2013, but a review of Areva's EPR was cancelled by the vendor after its bid for Darlington was rejected in mid-2009. In February 2011 Areva and Mitsubishi Heavy Industries applied to the CNSC for pre-licensing design review of their Atmea1 reactor, and the first phase was completed in 2013. The Atmea1 has design certification in France and equivalent status in Argentina.

Licensing of new designs

A significant number of vendors have submitted their designs to the CNSC for pre-licensing review. In May 2021 Ultra Safe Nuclear’s MMR became the first SMR to start formal licence review with the CNSC as part of the Global First Power Micro Modular Reactor Project.

| Vendor | Design (coolant) |

Capacity (MWe) | Phase applied for | Review start | Status | Outlet temp °C |

|---|---|---|---|---|---|---|

| Terrestrial Energy | IMSR Integral Molten Salt Reactor (molten salt) |

200 | Phase 1 | April 2016 | Complete | 620 |

| Phase 2 | Dec 2018 | Complete | ||||

| Ultra Safe Nuclear Corporation | MMR-5 and MMR-10 (high-temperature gas) |

5-10 | Phase 1 | Dec 2016 | Complete | 630 |

| Phase 2 | June 2021 | On hold | ||||

| LeadCold Nuclear | SEALER (molten lead fast reactor) |

3 | Phase 1 | Jan 2017 | On hold (at vendor's request) | 430 |

| ARC Clean Technology | ARC-100 (sodium fast reactor) |

100 | Phase 1 | Sept 2017 | Complete | 510 |

| Phase 2 | February 2022 | In progress | ||||

| Moltex Energy | Moltex Energy Stable Salt Reactor (molten salt) |

300 | Series phase 1&2 |

Dec 2017 | Complete | 600 |

| SMR-160, LLC (Holtec) | SMR-160 (PWR) |

160 | Phase 1 | July 2018 | Complete | 320 |

| GE Hitachi Nuclear Energy | BWRX-300 (boiling water reactor) |

300 | Phase 2* | Jan 2020 | Complete | 290 |

| X-energy | Xe-100 (high-temperature gas) |

75 | Phase 2* | July 2020 | Complete | 750 |

| Westinghouse | eVinci Micro | Up to 5 | Phase 2* | June 2023 | In progress | 800 |

| Candu Energy Inc. | CANDU MONARK | Familiarization and planning** |

* Phase 1 objectives will be addressed in phase 2 scope of work.

** The service agreement is for familiarizing CNSC staff with the CANDU MONARK design, and for planning the scope and timeline of a future pre-licensing design review.

Source: Canadian Nuclear Safety Commission and companies.

Fuel cycle

Uranium mining in Canada is covered in the information page on Uranium in Canada.

Cameco's refinery at Blind River, Ontario takes uranium oxide concentrate (U3O8) from mines in Canada and abroad and refines it to UO3, an intermediate product. It has a licensed capacity of 24,000 tU.

The UO3 is trucked to Port Hope, Ontario where Cameco has about one-fifth of the Western world's uranium hexafluoride (UF6) conversion capacity – 12,500 tU per year – and provides the only commercial supply of fuel-grade natural (unenriched) uranium dioxide (UO2). The uranium hexafluoride is enriched outside Canada for use in light water reactors, while natural UO2 is used to fabricate fuel bundles for Candu reactors in Canada and abroad. About 80% of the UO3 from Blind River is converted to UF6, while the remainder is refined to UO2.

Two fuel fabrication plants in Ontario process some 1,900 tonnes of uranium per year to UO2 fuel pellets, mainly for domestic Candu reactors. Between 15 and 20% of Canada's uranium production is consumed domestically.

Waste management

Canada's Nuclear Waste Management Organization (NWMO) was set up under the 2002 Nuclear Fuel Waste Act by the nuclear utilities operating in conjunction with AECL. Its mandate is to explore options for storage and disposal, to then make proposals to the government and to implement what is decided. NWMO, working with AECL’s successor, Canadian Nuclear Laboratories (CNL), is also required to maintain trust funds for used fuel management and probable disposal. Less than 1500 tonnes of used fuel per year from Candu reactors is involved.

Used fuel, high-level waste

Used fuel bundles are stored in cooling ponds at each nuclear power plant for 5 to 10 years until they cool somewhat. They are then placed in large dry concrete and steel containers, thick enough to shield the radiation effectively. Until a permanent disposal repository for used nuclear fuel is built, nuclear power plant operators store this fuel under licence at their plant sites in these containers. There are three main types of dry storage units:

- Concrete canisters or silos, each holding 325 to 600 fuel bundles, vertical and above ground, at Point Lepreau.

- Modular air-cooled storage (MACSTOR) units, each holding 12,000 fuel bundles, above ground at Gentilly.

- Cylindrical containers made of reinforced concrete with steel shells inside and outside, holding 384 fuel bundles. They weigh 60 tonnes empty, 70 t full, are portable and filled with helium. Designed by OPG and used for Pickering, Bruce and Darlington.

Canadian nuclear power plant operators make extensive use of dry cask storage: the Western Waste Management Facility provides dry fuel storage for the Bruce reactors; the Pickering Waste Management Facility provides dry fuel storage for the Pickering reactors; and the Darlington Waste Management Facility provides dry fuel storage for the Darlington reactors.

For high-level wastes long-term, in 2005 NWMO published three conceptual designs for the technical options specified in the Nuclear Fuel Waste Act:

- Reactor site extended storage (at seven sites) – found to be feasible, requiring only some further dry storage facilities to be built.

- Centralized extended storage – similar to systems already operating in 12 countries, but longer term.

- A deep geological repository, allowing later retrieval if required. This option, known as adaptive phased management (APM), was the one recommended by the NWMO and chosen by the government in June 2007.

The use of a deep geological repository is most closely aligned with international consensus and had already been the subject of detailed scrutiny by the federal Environment Assessment Panel over three years in the 1990s, involving public hearings. NWMO is now responsible for implementing it.

A deep geological repository involves burying high-level nuclear wastes 500 to 1000 metres deep in the stable rock of the Canadian Shield, the large formation that extends northward across central and eastern Canada. The waste would be placed below the water table in containers packed in bentonite clay. The waste may consist of used fuel bundles or solidified high-level waste from reprocessing, sealed in copper or titanium containers.

Early in 2007, NWMO stated that a final repository would probably be in Ontario, Quebec, New Brunswick or Saskatchewan, and host localities would need to volunteer for the role. The organization designed a siting process and commenced technical and socio-economic assessment of potential candidate sites late in 2012.11 It expected within five years to narrow down 21 possibilities put forward by communities interested in hosting the repository to one or two. Of the 21, fifteen were on the Canadian shield, six were sedimentary. The timeline will be determined by potential host communities, but NWMO expects to have a repository operating by 2035.

After preliminary assessment, 11 of the 21 areas were selected for phase 2 studies, in the field and with community engagement. In June 2017 NWMO said six of these remained under consideration: Blind River and Elliot Lake, Ignace, Hornepayne, Huron-Kinloss, Manitouwadge, and South Bruce – all in Ontario. In November 2017 the first geological core samples were drilled at Ignace. In a December 2017 statement NWMO said that the Blind River and Elliot Lake site was no longer under consideration, reducing the number of potential sites to five. In November 2019 Hornepayne and Manitouwadge were eliminated from further consideration, with further work focused on Huron-Kinloss and South Bruce in southern Ontario, and Ignace in northwestern Ontario. In March 2020, NWMO said it remained on track to select a single, preferred site by 2023. The NWMO said a repository would need about one square kilometre on the surface and about four times that underground. It estimated that the total cost of the repository and transport system would be C$22.8 billion (2015 dollars). In August 2022 NWMO announced a one-year delay of the site selection due to the impacts of the Covid-19 pandemic.

As of June 2022, Canada had about 3.1 million used nuclear fuel bundles, with about 90,000 bundles added annually.

In July 2024 Ignace confirmed its willingness to move forward to the next phase of the site selection proves, with 77.3% of community participants in favour of becoming a willing host community. In October 2024 residents of South Bruce also voted in favour of becoming a willing host of a repository.

In November 2024 NWMO announced that the Wabigoon Lake Ojibway Nation and the Township of Ignace had been selected as host communities for the country’s proposed deep geological repository, concluding a 14 year consent-based siting process.

Low- and intermediate-level waste

The nuclear utilities and Canadian Nuclear Laboratories (CNL) remain responsible for low- and intermediate-level waste, which are currently stored above ground. The Western Waste Management Facility stores all the low- and intermediate-level nuclear waste from the operation of OPG's 20 nuclear reactors, including those leased to Bruce Power.

Following a strong positive response to polling of local residents, OPG in 2005 proceeded with plans to construct a deep geologic repository for 200,000 cubic metres of its low- and intermediate-level wastes from three plants. The repository was to be located 680 metres beneath OPG's Western Waste Management Facility on the Bruce site, which it has operated since 1974. In April 2011, OPG submitted its 12,500-page environmental assessment to the CNSC. A federally-appointed review panel considered this assessment and in May 2015, released a 457-page report approving it. A final ministerial decision was then expected in September, but has twice been delayed. In January 2020 the Saugeen Ojibway Nation voted against the repository, following which OPG announced that it would seek alternative sites and in June 2020, withdrew its application to the CNSC. OPG is the owner and licensee of the repository; however, NWMO was contracted to manage development of it from the beginning of 2009.

Legacy waste

Canadian Nuclear Laboratories (CNL) is responsible for managing all legacy waste and historic LLW.

In June 2006, the Canadian government announced a five-year C$ 520 million program to clean up legacy waste from R&D on nuclear power, and medical isotopes and military activities in the 1940s and early 1950s. The program covered clean-up of AECL's contaminated lands, radioactive wastes and decommissioning old infrastructure which the government is responsible for. A large amount of low-level legacy waste from former radium and uranium refinery operations at Port Hope, Ontario, will be permanently emplaced in an above-ground repository.

In mid-2012, AECL began a comprehensive review of its nuclear liabilities through the Nuclear Legacy Liabilities Program (NLLP). The review is intended to reflect best practices in nuclear decommissioning and waste management of Canada's nuclear legacy, mainly comprising AECL's Chalk River Laboratories. The last such review was completed in 2005. In March 2013, AECL advised the government that its estimated liabilities for nuclear decommissioning and waste management had increased by two-thirds to C$6 billion. The main reason for the increased liabilities estimate was "an increase in the indirect costs attributed to the decommissioning and waste management over the period of up to 70 years of the program." The Chalk River Laboratories in Ontario account for about 70% of the liabilities, with 20% attributable to Whiteshell Laboratories and 10% to three decommissioned prototype reactors. The NLLP is a program to manage Canada's nuclear legacy liabilities at AECL sites that is funded through Natural Resources Canada (NRCan). It is based on a 70-year timeline, which started in 2006. Over time, activities will increasingly focus on designing, building and operating facilities for the safe and cost-effective management of waste.

There is also a category of historic low-level waste consisting of soil contaminated with uranium and radium at sites located in the Northwest Territories, British Columbia, Alberta and Ontario. This waste was originally managed in a way that is no longer considered acceptable, but for which the current owner cannot be reasonably held responsible, so the government has stepped in.

Reactor decommissioning

Six power reactors have been shut down and are being decommissioned: the first three are Gentilly 1, Douglas Point and Rolphton NPD – all owned by AECL. They were shut down in 1977, 1984 and 1987 respectively and are expected to be demolished in about 30 years. Gentilly 1 was a steam-generating heavy water reactor with vertical pressure tubes, light water coolant and heavy water moderation. It was not successful and had only about 180 full-power days in six years operation. The other two were prototype Candu designs. These three are the responsibility of CNL, in the realm of legacy wastes.

A fourth unit is Gentilly 2, a more modern Candu 6 type was shut down at the end of 2012 after 30 years operation. It is being defuelled and the heavy water was to be treated over 18 months to mid-2014. A decommissioning licence was issued for 2016 to 2026 and the main part of the reactor will be closed up and left for 40 years to allow radioactivity to decay before demolition. All 27,000 fuel bundles are expected to be in dry storage (Macstor) by 2020. The decommissioning cost is put at C$ 1.8 billion over 50 years.

At the Pickering site, units A2 and A3 were shut down in 2007 and 2008 respectively.

Shutdown power reactors in Canada

Research and development

Canada is a longtime leader in nuclear energy research and development. The Chalk River Laboratories in Ontario were set up by the government in the 1940s and have been the locus of much the world's successful R&D into the peaceful uses of nuclear energy.

In 1952, the federal government established Atomic Energy of Canada Ltd (AECL) with the responsibility for managing Canada's national nuclear R&D programme. AECL has undertaken all the developmental work on the Candu reactor types. It later consisted of two divisions: the Nuclear Laboratories, and the CANDU Reactor Division, which in 2011 was sold to Candu Energy Inc. Candu Energy has taken over development of the third-generation Advanced Candu Reactor (ACR) but the Generation IV supercritical water-cooled reactor (SCWR – see information page on Generation IV Nuclear Reactors) project remained with AECL. In 2012-13 AECL was reorganized so that R&D became contractor-operated under Canadian Nuclear Laboratories (CNL), centred at Chalk River, Ontario.

There are several operable research reactors in Canada today, including:

- Three SLOWPOKE-2 units at the Royal Military College of Canada, Saskatchewan Research Council and École Polytechnique.

- A pool reactor located at McMaster Nuclear Research Reactor.

- A ZED-2 reactor located at Chalk River Laboratories.

National Research Experimental reactor

The 42 MWt National Research Experimental (NRX) reactor was built there in 1947, followed in 1957 by the 135 MWt National Research Universal (NRU) reactor, as a world leader in the development and production of nuclear medical isotopes (see below). NRX was shut down in 1993 and NRU was retired in March 2018.

The 60 MWt WR-1 research reactor was built by GE at Whiteshell Laboratories and started up in 1965. The original purpose of the unit was as a test reactor for a proposed organic-cooled CANDU power reactor. When that program ceased in 1972 it was used for other R&D until shut down in 1985. The reactor had vertical fuel channels cooled by organic liquid (an oil), moderation was by heavy water in a calandria vessel, and control was by varying the level of moderator. The organic coolant meant low operating pressure and very low corrosion rates for metallic fuel, with 425ºC outlet temperature.

Multipurpose Applied Physics Lattice Experiment reactors

Two 10 MWth MAPLE (Multipurpose Applied Physics Lattice Experiment) reactors at Chalk River Laboratories were to replace most of the radioisotope production at the ageing NRU reactor. Intended to be the world's first reactors dedicated exclusively to medical isotope production, the reactors could have supplied the entire global demand for molybdenum-99, iodine-131, iodine-125 and xenon-133. The reactors were originally scheduled to start up in 2000. One unit went critical in 2000, the second in 2003, but commissioning encountered major technical problems and in May 2008 AECL decided to cancel the project after spending $680 million on them.12, e In August 2013 AECL and Nordion settled on damages from the MAPLE cancellation.

The delay and eventual cancellation of the MAPLE reactors led to the extended operation of the NRU research reactor. In December 2007, the CNSC declined to allow the restart of NRU. A five-year licence renewal in mid-2006 had specified certain back-up modifications, which AECL had not fully implemented. Parliament then intervened and passed a bill authorising the restart. The government later made it clear that it was dissatisfied with both parties to the dispute, and the Chairman of AECL then resigned. The head of CNSC was relieved of her role soon afterwards, creating widespread concern about political interference in regulatory function. The modifications were completed early in February 2008.13

In May 2009, NRU was shut down due to leakage of heavy water through corrosion. Repairing this was a major undertaking costing some $70 million, and the reactor did not come back online until August 2010. Since it produced about 40% of the world's Mo-99 (for Tc-99m) this had a significant impact on the supply of radioisotopes. The reactor was finally retired in March 2018.

While the MAPLE reactors were intended to take over medical isotope production from NRU, the neutron scattering research and Candu materials testing activities of NRU were to be replaced by the Canadian Neutron Facility (CNF). AECL saw the CNF as essential to both Candu R&D and materials science research, but little has been heard of it since about 2003.

In mid-2009 the Saskatchewan government proposed to the federal government that it should build a new 20 MWt research reactor – the Canadian Neutron Source – at the University of Saskatchewan. This would cost some C$ 500-750 million depending on how it was equipped, and the federal government was asked for 75% of this, plus 60% of operating costs. It would be optimized for Mo-99 production, mainly for export, to take over from NRU and produce 74 six-day TBq of Mo-99 per week (about one-sixth of global demand). The design is based on Australia’s Opal reactor, built by Invap of Argentina. To minimize cost it would exclude R&D on fuel for power generation. There is already a Slowpoke-II research reactor on the campus, operated by the Saskatchewan Research Council, and a synchrotron.

Zero Energy Deuterium reactor

CNL’s Zero Energy Deuterium (ZED-2) reactor is a versatile tank type, heavy water moderated low-power research reactor that achieved first criticality in 1960. It is used for performing reactor physics measurements and fuel studies.

The government has an Isotope Technology Acceleration Program (ITAP) to promote R&D on non-reactor based isotope production, particularly through the Medical Isotope Program (MIP). However, a key finding of the Natural Resources Canada Expert Panel on Medical Isotope Production was that reactors represent the best primary option for producing Mo-99. Canada Light Source Inc (CLS) in Saskatoon is using a linear accelerator to bombard Mo-100 targets with X-rays, and has produced some Mo-99 for the MIP.

Small modular reactors

Since 2016, Chalk River has become a centre of expertise and commercialization for small modular reactors (SMRs). In October 2017 CNL reported a strong response to a request for expressions of interest on its SMR programme. It included 19 expressions of interest for building a prototype or demonstration reactor at a CNL site, representing a wide range of designs. Other responses were from potential host communities, the supply chain, and academic institutions, suggesting widespread positive interest. Among the responses there was consensus that the establishment of an SMR industry in Canada would be beneficial economically, and that SMR deployment would help fulfil Canada's climate change commitments whilst providing an attractive solution for remote off-grid communities and industries. Respondents also expressed a belief that SMRs have the potential to offer enhanced safety, noting that passive and inherent safety are key components of next-generation nuclear energy systems.

Regulation, safety & non-proliferation

The Canadian Nuclear Safety Commission (CNSC) is responsible for regulating and enforcing strict safety standards at domestic nuclear facilities and charged with administering the country's safeguards agreement. It was set up in 2000 under the new Nuclear Safety & Control Act and subsequent regulations as successor to the Atomic Energy Control Board, which had served since 1946. The CNSC reports to parliament through the Minister of Natural Resources.

Non-proliferation

Canada's uranium is sold strictly for electrical power generation only, and international safeguards are in place to ensure this. Nuclear equipment and services are also for peaceful uses only. The CNSC assists the International Atomic Energy Agency (IAEA) by allowing access to Canadian nuclear facilities and arranging for the installation of safeguards equipment at the sites. It reports regularly to the IAEA on nuclear materials held in Canada. The CNSC also manages a programme for research and development in support of IAEA safeguards, the Canadian Safeguards Support Programme.

Canada is a party to the Nuclear Non-Proliferation Treaty (NPT) as a non-nuclear weapons state. Its safeguards agreement under the NPT came into force in 1972 and the Additional Protocol in relation to this came into force in 2000. A bilateral safeguards agreement is required with each customer nation as a precondition of trade, placing additional requirements on them beyond those of the NPT and the IAEA. These are in place with long-standing customer countries and early in 2012 an agreement was signed with China. Canada is also a member of the Nuclear Suppliers Group.

Notes & references

Notes

a. The four Pickering A reactors were laid up in 1997. Pickering A4 was restarted in 2003 and Pickering A1 in 2005. There are no plans to bring Pickering A2 and A3 back into service. Bruce A2 was taken out of service in 1995, A1 followed in 1997, and Bruce A3 and A4 in 1998. Bruce A3 and A4 were restarted in 2004 and 2003, respectively. Bruce A1 and A2 were restarted in 2012, following refurbishment. Bruce B8 achieved a 3% uprate to about 822 MWe in March 2010, the last of the Bruce B units to do so through re-ordering the fuel bundles since 2004. The Bruce A units had been done prior to 2001. [Back]

b. In October 2009, the Premiers of New Brunswick and Quebec signed a memorandum of understanding where Hydro-Québec would acquire the majority of New Brunswick Power's (NB Power's) generation assets, comprising seven hydroelectric stations (895 MWe), two diesel peaking units (499 MWe), the Point Lepreau nuclear power plant (635 MWe), and transmission rights associated with these assets. Hydro-Québec was to make two payments totalling C$3.2 billion; the first (C$1.8 billion) in March 2010, and the second (C$1.4 billion) at the time of closing of the Point Lepreau transaction, which was to be when the refurbishment was completed (then expected around January 2011). As part of the deal, NB Power would have become a subsidiary of Hydro-Québec.

As a result of a due diligence review, Hydro-Québec requested amendments to the contract on the grounds that the Mactaquac hydroelectric station and Point Lepreau would incur substantially higher future costs than Hydro-Québec initially believed. Following this request, in March 2010, New Brunswick Premier Shawn Graham called off the deal. [Back]

c. When the government selected Darlington for new nuclear capacity, it affirmed the importance of privately-run Bruce Power and the need for it to contribute 6300 MWe of nuclear capacity, and maintaining this level of capacity beyond the present planned operating lifetime of Bruce B. A decision on refurbishing Bruce B (3290 MWe) is pending but highly probable, now that the alternative proposal to build four new reactors there as Bruce C has been shelved. [Back]

d. AECL was the only compliant bidder in the procurement process for two new units at Darlington, although AECL's bid price was higher than the provincial government was willing to accept. In May 2009, the federal government announced that it would sell AECL, leading to uncertainty over the procurement process. This uncertainty led the Ontario government in June 2009 to suspend the procurement process until the restructuring of AECL is finalized. The environmental assessment and application for a licence to prepare site processes remain in progress. [Back]

e. South Korea (KAERI) has built a 30 MWt version of MAPLE – Hanaro – which started up in 1995 and is operating successfully. MAPLE had also been shortlisted for Australia's 20 MWt replacement research reactor in 1999. [Back]

References

1. Smitherman rejects Nanticoke nuclear plant plan, Toronto Star (31 October 2008); Nanticoke a potential nuclear site, World Nuclear News (31 October 2008) [Back]

2. Ontario’s Long-Term Energy Plan: Delivering Fairness and Choice, Ontario Ministry of Energy (2017) [Back]

3. Energy Alberta files Candu site application, World Nuclear News (28 August 2007) [Back]

4. Bruce Power Alberta Completes Purchase of Energy Alberta Corp., Bruce Power press release (13 March 2008); Bruce Power to prepare Alberta site, World Nuclear News (14 March 2008) [Back]

5. Withdrawal of Application for Approval to Prepare a Site for the Future Construction of a Nuclear Power Generating Facility Municipal District of Northern Lights, Alberta, letter from Bruce Power to the Canadian Nuclear Safety Commission (6 January 2009) [Back]

6. Bruce Power Alberta Narrows Focus to Whitemud Site, Bruce Power press release (23 March 2009) [Back]

7. Bruce Power Responds to Alberta Nuclear Consultation Results, Bruce Power press release (14 December 2009) [Back]

8. Saskatchewan 2020 - Clean energy. New opportunity. Report on Bruce Power’s Feasibility Study, Bruce Power (November 2008) [Back]

9. Capturing the full potential of the uranium value chain in Saskatchewan, Uranium Development Partnership (31 March 2009) [Back]

10. The Government’s Strategic Direction on Uranium Development, Government of Saskatchewan (December 2009). [Back]

11. Implementing Adaptive Phased Management - 2009 to 2013, Nuclear Waste Management Organization (January 2009) [Back]

12. AECL halts development of MAPLE project, World Nuclear News (19 May 2008) [Back]

13. Isotope producer is to restart amid controversy, World Nuclear News (12 December 2007); Fallout from isotope crisis hits top regulator, World Nuclear News (16 January 2008) [Back]

General sources

The Canadian Nuclear Industry and its Economic Contributions webpage on the Natural Resources Canada website

The Canadian Nuclear Industry: Contributions to the Canadian Economy, Canadian Energy Research Institute (June 2008)

Canadian Nuclear Association website

Darlington refurbishment section on the Ontario Power Generation's website

Richard Florizone and Dean Chapman, The Canadian Neutron Source: Strengthening Canada’s Isotope Supply and R&D Capacity, Physics in Canada Vol. 66 No. 1 (January-March 2010)