Electric Vehicles

- Fully electric road vehicles and hybrid electric vehicles, which are able to be charged from mains power, are starting to increase the base-load power demand from grid systems.

- Development of these depends on battery technology.

- The best-known hybrid cars today are simply a step on the way to plug-in versions which will get most of their power from the grid.

- By the end of 2020 there were some ten million electric cars on the road.

- Hydrogen fuel cell electric vehicles have been developed.

In 2017-2018, 3.2 million electric cars were sold, taking the global fleet to over 5 million. For 2019, InsideEVs reported 2.21 million electric car (74% fully electric, rather than plug-in hybrid) sales worldwide. In 2020 sales were 3.125 million, with 68% battery electric only. Top five in 2020 by manufacturer: Tesla 500,000 (all BEV); Volkswagen group 422,000; SAIC 272,000 (most BEV); Renault-Nissan-Mitsubishi 227,000; BMW group 196,000. Europe recorded 1.36 million EV & PHEV sales, China recorded 1.27 million, and US sales were about 320,000. The most popular models were Tesla Model 3 with over 365,000 sold, followed by SAIC Wuling HongGuang Mini EV (119,000) and Renault Zoe (100,000).

In Norway, with the help of government incentives, electric car sales accounted for 56% of new car sales in 2019, 42% being fully electric. Tesla Model 3 led the field, followed by VW e-Golf and Nissan Leaf.

Electric vehicle (EV) deployment has been driven by policy related to reducing carbon dioxide emissions. There are already procedures under consideration in some countries such as China, India, Norway, UK, France and Netherlands to phase out petrol and diesel vehicles in the next few decades. But whether electric vehicles reduce CO2 emissions depends on the source of electricity, how much energy is used to make the batteries, and how long the batteries last.

Apart from the battery which may be expensive, the rest of the drive train of an EV is relatively simple, leading to prospects of very inexpensive vehicles. Japanese manufacturer Nidec predicts car prices below $3000, citing the $4200 Chinese Wuling HongGuang Mini EV released in mid-2020, made by SAIC-GM-Wuling, which sold rapidly. Dartz in Latvia plans to produce them in Europe. In Japan Idemitsu Kosan plans to market a similar vehicle for $14,000 in 2022.

In July 2017 Volvo, owned by Geely of China, announced that from 2019 all its models would be available in either fully electric or hybrid options, and that this move “marks the end of the solely combustion engine-powered car.” In the same week, the French government said it planned to end the sale of internal combustion (IC) engine cars by 2040. Most mainstream car, truck and bus manufacturers are increasing their range of electricity-powered vehicles.

Nuclear power (which has no CO2 emissions) is relevant to road transport and motor vehicles in three respects:

- Hybrid and fully electric vehicles potentially use off-peak power from the grid for recharging.

- Nuclear heat can be used for production of liquid hydrocarbon fuels from coal.

- Hydrogen for oil refining and for fuel cell electric vehicles may be made electrolytically, and in the future, thermochemically using high-temperature reactors.

The latter two points are outlined in the information page on Hydrogen Production and Uses.

The principal aim of incentivising the use of EVs is to curb carbon emissions, but it should be noted that EVs are only as 'clean' as the energy they utilize. As a main source of non-carbon emitting base-load electricity, nuclear power can play an important role in providing the energy needed by EVs.

Health effects

Using traditional health impact assessment methods in 25 European cities with 39 million inhabitants, the EC-funded Aphekom project in 2011 showed that present air pollution levels, mainly from vehicle traffic driven by internal combustion engines, petrol and diesel, resulted in 19,000 deaths per year. Widespread adoption of electric vehicles would dramatically reduce this. It estimated that the monetary health benefits of complying with the World Health Organization (WHO) guidelines for particulate matter would total some €31.5 billion annually. Some cities were three times the 10 µg/m3 WHO guideline level for PM2.5 particles.

Towards electromobility: cars

Hybrid electric vehicles are powered by an internal combustion (IC) engine and battery, which is charged by the IC engine and regenerative braking. They depend entirely on liquid fuels, while using regenerative braking to increase efficiency. Their advantage is in urban driving, and their significance is mostly as an important step towards plug-in hybrid vehicles.

They may be parallel hybrid (also known as full hybrid) technology, with both battery and/or engine propelling the vehicle (with sophisticated controls), or series hybrid, with the engine simply charging the battery. Both types may be capable of plugging into mains electricity from the grid, in which case they need much larger battery packs, as plug-in hybrid electric vehicles (PHEV). For the series hybrid the engine then is used only when needed, so it can run at optimum speed and efficiency.

Mild hybrid vehicles have a parallel motor/generator replacing the conventional starter motor and alternator, and a 36- or 48-volt lithium-ion battery of about 2 kWh, but no means of electric propulsion. These have better fuel economy than conventional IC vehicles and are less expensive than full hybrids. Many Chinese manufacturers were taking up this technology by 2019, and Honda’s Integrated Motor Assist system (described below) is in this category.

Battery packs are typically 10-20 kWh for PHEVs, but for an 80 km electric range an 18 kWh battery pack is needed with 16 or 30 amp charging at home and workplace, but DC charging is not required. London PHEV taxis have a 31 kWh battery pack.

Battery electric vehicles (BEVs) with no IC motor have been used for many years in a limited way, using heavy lead-acid batteries. Today’s BEVs use lithium-ion batteries charged from the grid and are rapidly improving in performance and especially range. As well as BEV cars corresponding to small conventional IC cars, low-speed BEVs (LSEVs) which are smaller and with a top speed of about 60 km/h are strongly promoted in China. China also has several hundred million electric scooters and bicycles.

Future BEV needs have been distinguished:

- 200 km range, needs 43 kWh battery pack, 30 amp level 2 charging at home and workplace, also 250 volt DC charging (10 minutes).

- 400 km range, needs 90 kWh battery pack, 30 amp level 2 charging at home and workplace, also 150 volt DC charging (30 minutes).

The higher capital cost of hybrids is offset by the prospect of slightly lower running costs and lower emissions. Better batteries will allow greater use of electricity in driving, and will also mean that charging them can be done from mains power, as well as from the motor and regenerative braking. These PHEVs and a new generation of full BEVs are practical and becoming economic today.

The electric motors are generally 'synchronous', with a permanent magnet in the rotor, hence permanent magnet synchronous motor (PMSM). The stator's rotating magnetic field imposes an electromagnetic torque on the rotor, causing it to spin in sync with the stator field. As permanent magnets have improved greatly due to the incorporation of neodymium or dysprosium, motors have become cheaper and more compact. However, they require cooling, with radiator, fan, water pump, etc.

Some manufacturers use 'asynchronous' AC induction motors which do not require the strong permanent magnets (nor expensive neodymium). Here the rotor has several sets of windings so that it creates a rotating magnetic field which chases the stator's rotating field, generating torque. The AC induction motor is used for higher performance cars and it tolerates a wider range of temperatures than the synchronous motor. It is simple and rugged but requires a complex inverter circuit. The Tesla S and BMW/Mini E cars use these motors, and TATA plans to use them. They generally need no conventional multi-speed gearbox, since the motor functions even at high loads without overheating.

Towards electromobility: buses and trucks

Most buses are used on fixed routes with set timetables and recharge can be made routine. Also many are funded in some way by governments, so upfront costs are not a major disincentive if operating costs are significantly less than diesel.

There are over 400,000 electric buses operating, about 98% of these in China. By the end of 2017 Shenzhen's fleet of 16,400 buses of various sizes run by three companies were all electric. 80% of the fleet were made by BYD, and they are served by 300 charging stations and 5000 charging piles supplying 60 kW. Charging takes two hours. The buses cost more than three times the diesel equivalent, but purchases were significantly subsidised, and high capital costs are offset by lower operating costs. In 2017, 89,546 electric buses were sold in China, less than in 2016 due to reduced government subsidies. Yutong sold 24,857 of these, BYD 12,777 and Zhongtong 8167 buses. Beijing aims to have 10,000 electric buses in 2020.

In September 2016, following trials, 51 BYD electric buses were commissioned in London, able to run for 16 hours without recharge. US urban bus fleets are moving to increase electric vehicles. BYD is setting up a large bus factory in California.

Regarding electric trucks, range is obviously the main issue. However, concern about diesel emissions and the simplicity of the electric drive train (hence low lifetime maintenance) is driving innovation here. The global logistics company DHL is the biggest buyer in the world of trucks. Having failed to find manufacturers who would build electric trucks for it, DHL acquired a company called Scooter and is reported to be producing trucks with a view to having 35,000 on the road by 2023, mainly in urban applications involving less than 200 km per day.

In November 2017 Tesla announced its Semi, a class 8 heavy truck, driven by four motors from Tesla 3, hence about 770 kW, with battery pack estimated to be 960 kWh. Fast charging – for 650 km in 30 minutes – requires some 1.2 MWe, though other figures suggest 8 x 72 amp charging modules of 216 kW, hence 1.73 MWe. A full charge takes it 800 km, so about 1.2 kWh/km. A 800 kWh lithium-ion battery pack is expected to weigh about 5 tonnes. Limited production of the Tesla Semi was planned from the end of 2020. Peterbuilt, Daimler and Cummins are also working on class 8 trucks, with more modest claims regarding range.

London, UK has hybrid buses from five manufacturers. Elsewhere in Europe, Siemens is supplying hybrid drive systems for buses. New York also has about 1000 hybrid buses.

Targets and projections

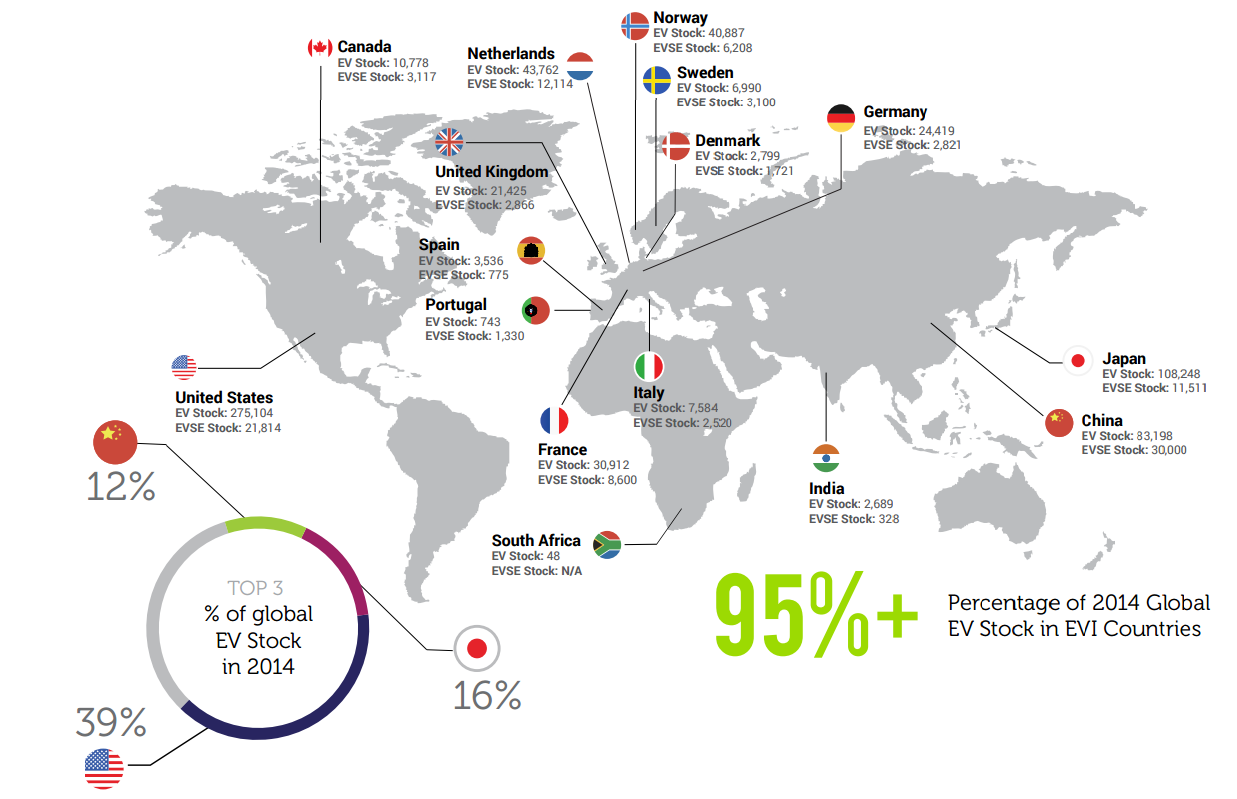

The international Electric Vehicles Initiative was launched in October 2010 at the Paris Motor Show by a consortium including the OECD International Energy Agency (IEA) and eight countries: China, France, Germany, Japan, South Africa, Spain, Sweden and the USA. It aimed to achieve rapid market development of BEVs and PHEVs around the world, targeting about 20 million BEVs and PHEVs on the road by 2020. According to the IEA, this target would put global BEV/PHEV stock on a trajectory to exceed 200 million by 2030, and one billion by 2050. However the 2020 total will be closer to 10 million electric vehicles, about half of these in China.

Electric vehicle numbers in Electric Vehicle Initiative countries (Image: IEA)

The BP Energy Outlook published in January 2018 projected that by 2040, about 300 million electric vehicles (15% of the total) would account for about 30% of passenger vehicle kilometres and 15% of truck kilometres. About one-quarter of total sales would be PHEV. The IEA World Energy Outlook 2017 forecasts about 280 million electric vehicles (15% of the total) in 2040 in its central New Policies scenario, or nearly 900 million in its Sustainable Development Scenario, compared with 2 million in 2017. Different assumptions regarding battery technology or bans on the sale of cars with internal combustion engines lead to higher projections.

In February 2016 Bloomberg New Energy Finance published a contrasting report estimating that by 2040 sales of electric vehicles would be 41 million, representing 35% of new light duty vehicle sales, compared with 462,000 in 2015. Its high case was 50% and low case 25% of sales. Bloomberg expects EVs to represent one-quarter of cars on the road in 2040.

In 2018 it was estimated that over 11,000 fuel cell electric vehicles (FCEV) were in use. A significant ramp up in numbers was expected by the early 2020s. According to the Hydrogen Council, which was launched in January 2017, China has set a goal of having 50,000 FCEVs on the road by 2025 and one million by 2030. Under its New Energy Vehicle roadmap, it plans to build 300 hydrogen refuelling stations by 2025 and 1000 by 2030. Japan earlier planned to deploy 200,000 FCEVs by 2025 and 0.8 million by 2030.

At the June 2017 Clean Energy Ministerial meeting in Beijing, with energy ministers from 24 countries and the EU, an objective of member countries having 30% of their new car sales being EVs by 2030 was adopted, the EV30@30 campaign. Under this scenario, EV sales would reach 44 million per year in 2030. By September 2018 Canada, China, Finland, France, India, Japan, Mexico, Netherlands, Norway, Sweden and the UK had joined EV30@30, taking in most of the largest EV markets worldwide. Seven companies had also joined: ChargePoint, Enel X, E.On, Fortum, Iberdrola, the Renault-Nissan-Mitsubishi Alliance and Vattenfall, according to the International Energy Agency.

Towards electromobility: system and efficiency

Widespread use of PHEVs and BEVs which get much or all of their energy from the electricity grid overnight at off-peak rates will increase electricity demand modestly – in the order of 10-15%. The US Energy Information Administration (EIA) expects that with many EVs on the roads, electricity demand will increase by about 25% by 2040. More importantly it will mean that a significantly greater proportion of a country's electricity can be generated by base-load plant and hence at lower average cost. Where the plant is nuclear, it will also be emissions-free (see later section).

Partnerships are emerging between power utilities and automotive companies in anticipation of wider use of PHEVs and BEVs in Europe. Deploying them is more of a challenge in Europe than in the USA because most cars are not garaged overnight so must be charged elsewhere, often more rapidly. Part of the corporate collaboration relates to how users are billed, as well as how the cars are recharged.

In its Global EV Outlook 2019, the IEA reported that by the end of 2018 there were about 5.2 million electric vehicle supply equipment (EVSE) outlets, up 44% from the previous year, with most of the increase being private ones. At the end of 2016 there were 212,000 publicly available 'slow' AC outlets (up to 22 kW) and 110,000 publicly available 'fast' outlets (80% of the latter in China), mostly DC.

There are four types of charging station, collectively known as EVSE points:

- Residential, typically for overnight charging, and workplace, also for slow charging.

- Parking station, diverse types and speeds.

- Public fast charging >40 kW (EU mode 3&4 below), including CHAdeMO and SAE CCS (Combined Charging System).

- Battery swaps.

According to S&P Global Platts Analytics monthly EV statistics, in April 2019 there were 161,426 public charging points installed across the EU-28. In the USA, in 2018 there were 18,000 public charging stations.

Germany has major policies supporting EVs. Following a major trial supported by the federal Ministry of Transport, a draft national action plan in late 2014 proposed that companies would be able to immediately write off half the costs of electric vehicles from 2015. The aim was to have one million PHEVs/BEVs on the road by 2020 (now 2022). In March 2017 the transport ministry launched a €300 million support scheme to install a network of 15,000 charging points for electric vehicles by 2020. €200 million was earmarked for 5000 fast charging stations (S-LIS) and €100 million for 10,000 normal charging stations (N-LIS). By April 2019 there were 17,400 charging points to serve about 100,000 BEVs and over 300,000 PHEVs. Utilities operate most of the public charging points and about 12% are fast chargers. About 2.5 TWh/yr is estimated as demand for one million BEVs and PHEVs (Volkswagen sees fuel cell vehicles as unlikely to be cost-effective in the near future.)

Connection standards, EV charging architecture

The International Electrotechnical Commission (IEC) has produced an international standard defining charging modes and relevant electrical connectors for BEVs and PHEVs – IEC 62196. The North American standard SAE J1772 and the European standard VDE-AR-E-2623-2-2 ‘Mennekes connector’ IEC 62198-2 broadly complies with this.

US Charging Standards for BEV & PHEV

| Level | Original definition | New definition | Connectors |

|---|---|---|---|

| 1 | AC energy to the vehicle's on-board charger; from 120 volt outlet. | 120V, 16A, 1.92 kW or up to 3.7 kW (IEA) | SAE J1772 (16.8 kW) 'Yazaki' |

| 2 | AC energy to the vehicle's on-board charger; 208-240 volt, single phase, up to 32 amps (continuous, circuit breaker at 40 amps). To 7.68 kW. | 208-240V AC, 12-80A, 2.5-19.2 kW or 3.7 to 22 kW (IEA) | SAE J1772 (16.8 kW), IEC 62196 (44 kW), IEC 62198-2 Type 2 - 'Mennekes connector' (43.5 kW), and others |

|

3 (DC) |

DC energy from an off-board charger; up to 400 amps and 240 kW continuous power supplied. | 300-600V DC; very high currents (hundreds of amps) up to 400 kW | CHAdeMO (62.5 kW), SAE J1772 Combo, IEC 62196 'Mennekes Combo' |

| 3 (AC) | Being developed, 43 kW |

The SAE J1772 standard was adopted in California in 2001. In EU the IEC 62196 Type 2 connector is used to allow for three-phase charging.

The Combined Charging System (CCS) combines single-phase AC, three-phase AC and DC rapid charging in both Europe and the USA. Type 1 or Yazaki connectors are single-phase, Type 2 or Mennekes are single or three-phase, and have become the EU and US standard. CHAdeMO is another DC connector formerly favoured by Japanese manufacturers. Both are open international standard. Tesla has its own charging system, but adapters can connect to CCS2.

European IEC 61851-1 charging modes

Mode 1: up to 16 amp, 250V (4 kW) AC or 480V three-phase.

Mode 2: up to 32 amp, 250V (8 kW) AC or 480V three-phase.

Mode 3: up to 63 amp, 690V (43 kW) AC or 480V three-phase; Sodetrel quotes 400V, 16, 32 or 63 amp for three-phase.

Mode 4: up to 400 amp, 600V DC (240 kW); Sodetrel quotes 400V, 125 amp.

In March 2017 Engie said it would acquire Europe’s main company involved in EV charging infrastructure, Amsterdam-based EV-Box, with over 40,000 charging points across almost 1000 cities, mainly in northwestern Europe.

Battery swaps

Rather than recharging the actual vehicles, the entire battery pack can be swapped in a few minutes. This requires substantial infrastructure, and European plans for widespread deployment foundered in 2013. However, plans for reviving the concept are reported in China, led by BJEV, the electric-car subsidiary of motor manufacturer BAIC. Batteries would be rented, lowering the upfront cost of BEVs.

Demand and efficiency

Energy return on investment (EROI) – a subset of energy analysis generally – is useful for evaluation of electromobility options. The UK-based Low Carbon Vehicle Partnership compared a range of low-emissions vehicle options in the UK. This considered the full life-cycle of the vehicle including production of the vehicle with a driving range of 150,000 km. The conventional vehicle was based on the VW Golf, and the electric vehicle was based on the Nissan Leaf. Within the current European grid, it concluded that BEVs generally have lower life-cycle emissions than an equivalent petrol vehicle, but the outcome is dependent on the electricity grid and other factors. The most important outcome of these life-cycle assessments is that the embodied energy of the battery and the emissions intensity of the grid are the crucial determinants of the emissions intensity of BEVs. The report assumed a battery capacity of 24 kWh for the EV.

BEVs equivalent to a small petrol or diesel four-seat car use 12-20 kWh/100km in normal city traffic (see later section).

With BEVs or equivalent mains electrical usage from PHEVs of 20,000 km per year, each would use 3-4 MWh/yr, so for each ten million cars thus depending on the grid an extra 30-40 TWh would be required, mostly off-peak.

Comparing the use of electricity to make hydrogen for fuel cell cars (FCEV) with using it direct for BEVs, there is a two- to threefold advantage in the latter. Conservative figures suggest 80% overall efficiency for an all-electric system from grid to traction, compared with less than half that for electrolysis to produce hydrogen then supplying and using it for traction.

Analysis by the Energy Supply Association of Australia (ESAA) found that an equivalent litre of electricity, or e-litre, could cost from 37 cents off-peak up to 62 cents with peak prices. It found that electric cars have the equivalent fuel costs of approximately 3 cents per kilometre, compared to 10 cents per kilometre for conventional cars.

Sources of electricity; demand implications

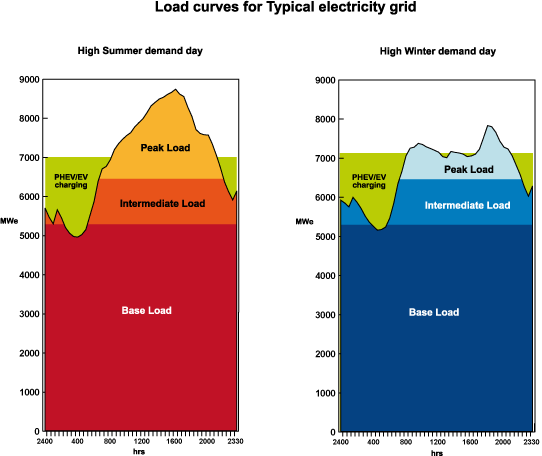

The IEA says that due to high power requirements during charging phases, the deployment of electric cars and EVSE infrastructure can have a sizeable impact on the load profile of the power generation system (see Figure below) and the load distribution across the electricity network. The local nature of these effects suggests that they would be taking place at much lower penetration levels than those impacting the total energy demand. Electric car charging, in particular, can become a major flexibility source, but also a major strain on system flexibility depending on charging patterns. About 125,000 cars could be equivalent to 300 MWe of flexible provision for slow charging overnight.

No strain on electricity supply is anticipated at up to 15% penetration of electric vehicles, especially with off-peak charging. A 2015 study by Cambridge Econometrics suggested that a wholesale switch to BEVs in the UK would require 40-45 TWh per year in 2040, adding only 10% to the total UK demand. In July 2017, the National Grid’s update of Future Energy Scenarios had different scenarios concerning electric vehicles, which would increase peak demand by 6 GWe, 11 GWe or 18 GWe by 2050 depending on when the majority are charged, and assuming 7 kW charging (30 amps). The corresponding increases in annual demand ranged up to 45 TWh (equivalent to 14% of 2016 UK demand), offset by reduced oil refinery power demand of up to 5 TWh. However, the Cambridge study points to an intrinsic mismatch between daily charging patterns and supply from intermittent renewables.

The IEA World Energy Outlook 2017 forecast of almost 280 million electric vehicles (15% of total) in 2040 in its central New Policies scenario, would account for only 690 TWh of demand in 2040 (2% of 34,470 TWh, p.235). The February 2016 Bloomberg projection for 2040 has electric vehicles using 1900 TWh of electricity per year (equivalent to nearly 8% of global electricity demand in 2015), and incidentally displacing consumption of 13 million barrels of oil per day (15% of global production).

A 2017 study by Energy Brainpool said that if the decarbonisation of the transport sector is implemented through e-mobility technologies, electricity demand will drastically increase. It states: "With a share of 100% e-mobility in the private transport sector in the EU28 countries by 2050, this will result in an additional electricity demand of around 830 TWh/yr" – about one-quarter of the current total European electricity demand. In addition, this will have major implications for the European and national targets in terms of greenhouse gas emission reductions. The report originally concluded (though now redacted): “If climate goals are to be achieved, e-mobility needs to be powered by carbon-free generating technologies.”

PHEVs and BEVs to a large extent will be able to utilise power at off-peak times (and at lower rates), hence drawing on base-load grid capacity and increasing the demand for that. This will mean lower average cost of power generated in the grid system, since the base-load component will become a larger proportion of the peak demand. If vehicle to grid (V2G) feed in peak periods is enabled, that will help reduce costs further, but there are some complexities to be overcome for this to happen. In 2017 Consolidated Edison in New York started offering a 5 c/kWh ‘reward’ for charging between midnight and 8 am, even for customers already on off-peak rates then.

The UK Department of Transport and the Royal Academy of Engineering (2010) both estimated that if the UK switched to battery electric vehicles, electricity demand (kWh) would rise about 16%. The US Electric Power Research Institute modelled 60% of US vehicle use being electric and found a 9% increase in electricity demand. As can be seen from the graphs above, this need not increase the system's peak capacity if most charging is off-peak, thereby greatly increasing the proportion of total generating capacity supplied by base-load plant – see below. A study conducted by the Pacific Northwest National Laboratory for the US Department of Energy in 2006 found that the idle off-peak grid capacity in the USA would be sufficient to power 84% of all vehicles in the USA if they all were immediately replaced with electric vehicles. Areva has calculated that if 10% of cars in France were electric it would increase base-load demand by more than 6000 MWe ("four EPRs", or 10% of nuclear capacity). In the above diagrams, assuming a significant move to electric cars mostly charged off-peak, the continuous base-load demand (GWe) is increased by about 35% and the daily electricity supplied increases by around 10%.

Some battery technologies allow short-duration high-current opportunity charging that means an overall increase in power generating and distribution demand. The increasing electrical load will occur at a rate that can be accommodated by normal planning for additional power resources and infrastructure.

A further development of BEVs, or at least the infrastructure for them, was pioneered by Better Place, in what are effectively 'islands' for car populations – Israel initially and then Denmark. Here, full changeover battery packs were offered. Nissan was involved with the project. A further development of the idea was for Tokyo's taxis. However, many manufacturers do not see this concept as viable since the battery design and structure is integral to the vehicle and they have no intention of standardizing batteries. This concept seems to have faded out.

PHEV technology is seen as the base for later utilization of fuel cells simply because hydrogen is likely to be at least as expensive as petrol/gasoline and therefore any ability to use mains power will be economically attractive. Supplementing this is energy conservation (from regenerative braking) to a battery. The choice of technology for a PHEV power plant is likely to have much less impact than the plug-in aspect of the design enabling use of base-load mains power.

While all electricity generation technologies including renewables will play a part in meeting increased electricity demand for PHEVs and BEVs, the positive implications of the scenario on nuclear power are:

- The PHEV and BEV requirement for electrical power (particularly off-peak power) may increase relatively soon as the concept of PHEVs gains wider acceptance, because the technology is universally available.

- When fuel cells using hydrogen are in common use, PHEVs will remain attractive because if drivers can charge batteries from the mains power for just 15 cents/kWh, or from their on-board generator at a dollar per kWh, they will choose the less expensive method some of the time, especially because it provides zero emission driving.

Vehicle to grid – V2G

A further aspect of EVs' interaction with grid systems is the potential for parked vehicles to contribute to the grid to compensate for fluctuations due to intermittent renewable supplies. This is known as V2G and will enable EV owners when not actually charging batteries to sell electricity back to the grid when needed for stabilization of it. This will mean that the low-voltage layer of the grid becomes a low-voltage exchange network, analogous to a computer LAN. Considerable development is needed to bring this into effect, and current charging standards do not generally allow for it. In setting European standards for charging in 2012, "no direct communication from vehicle to grid is foreseen."

In the USA, NRG Energy has set up a company (eV2g) with the University of Delaware and grid operator PJM Interconnect to develop the potential, as transmission networks "become increasingly reliant on fluctuating renewable energy sources such as wind and solar." However, V2G requires owners to plug in habitually rather than just when they need a charge, battery cycles will increase with effect on their longevity, and there may be implications for vehicle warranty also.

Hybrid electric vehicles

Hybrid electric vehicles have been on the market for several years.

The Toyota Prius is the best-known full-hybrid car. The later version has a 1.8 litre, 72 kW engine, a 10 kW AC generator/motor, a very small (1.34 kW) NiMH battery* and a 53 kW AC synchronous electric motor, all with sophisticated power electronics and controls. Combined maximum output is 90 kW. The vehicle cost is about 30% more than a comparable conventional vehicle. Toyota also has larger full-hybrid vehicles such as Camry and Rav4.

* The nickel metal hydride (NiMH) battery pack is 6.5 Ah at 201.6 volts (1.34 kWh) delivering 27 kW and had an eight-year/160,000 km warranty (expected life is quoted at 240,000 km). The battery mass is quoted at 54 kg. From 2009 the battery was to be lithium-ion type, but NiMH has been retained. The range on battery-only is very small however.

Honda has a different hybrid system, Integrated Motor Assist (IMA), using nickel metal hydride batteries charged (in the Civic and new Insight hybrids) by a 1300cc engine. The batteries mainly assist acceleration via a thin 10 or 20 kW electric motor/generator between the 60 kW engine and transmission. Unlike Toyota and Ford systems, IMA cannot function to any extent solely on battery power. The whole system has an eight-year warranty. This is an example of what is called a ‘mild hybrid’ system, where there is minor electrical assistance to the IC motor, and little battery capacity.

Ford has several hybrid models. The Escape Hybrid was launched in 2004. Like others, it utilizes an electronically controlled continuously variable transmission (eCVT) to allow the distribution of power between the 2.5 litre internal combustion engine of 121 kW and the 28 kW synchronous AV motor to be determined by driving conditions, so that the engine is shut off when the electric motor can provide enough power to run it. It has a 1.1 kWh lithium-ion battery pack. In 2021 a PHEV version will be available.

The comparable Toyota Rav4 hybrid has a 2.5 litre internal combustion engine of 131 kW and two synchronous AC motors of 88 and 40 kW, a 1.6 kWh nickel metal hydride battery pack and a continuously variable transmission.

The basic (non plug-in) hybrid vehicle's battery simply stores regenerated braking energy and that generated by the IC engine, helps with acceleration, and provides a very small amount of low-speed electric functioning.

Plug-in hybrid electric vehicles

A further stage of the hybrid EV technology is plug-in hybrid-electric vehicles (PHEVs) or 'gasoline-optional hybrid-electric vehicles' with a much larger battery than the hybrids described above and drawing most of their power, at least for short trips, from the electricity grid via the batteries rather than from liquid fuels. (Incidentally, in some systems these may also supply power back to the grid when they are plugged in – see V2G subsection above.) However, in contrast to the hybrid where the small battery is mostly kept topped up, PHEVs (and full electric vehicles) need to be capable of repeated deep discharge.

As with plain hybrids, there are two basic concepts with PHEVs: parallel and series. The parallel PHEV is like the Prius and Ford Escape, with drive from either battery or IC motor or both. The series PHEV such as the original GM Volt and the BMW i3 simply used the motor to charge the battery. With larger batteries this becomes an EV with 'range extender' engine.

With PHEVs a lot of driving, particularly short trips, can be in battery-only mode, hence zero on-road emissions. They can reduce overall petrol/gasoline consumption by something like 30 to 50 percent, but will consume most of the difference as electrical power – predominantly from the grid. Power consumption is variously quoted at around 0.16 kWh per kilometre but requiring 50% more capacity than power used (IEA 2008), to 0.3 kWh/km per tonne vehicle mass.

A PHEV with 16 kWh battery giving 50 km range cuts fuel consumption greatly, given that many cars do not travel much more than this daily, though the nickel metal hydride battery pack can weigh four or five times as much as a small hybrid's normal one. The electrical efficiency (mains power to wheels) in PHEV is about 75-80%, or 25-30% overall from primary heat.

The Toyota Prius PHEV has a 1.8 litre, 73 kW IC engine plus a 60 kW synchronous motor driving the front wheels and a 42 kW auxiliary motor. The second-generation Prius Prime PHV in 2016 has an 8.8 kWh lithium ion battery pack of 120 kg mass and the second electric motor has a role in driving giving 90 kW 'system net power'.

The Chinese BYD (build your dreams) F3DM, F6DM and S6DM are plug-in hybrid vehicles (DM = dual mode). They use lithium-ion iron phosphate batteries and have solar panels on the roof to help charging. The F3DM sedan claims to be the world’s first mass-produced PHEV, on sale to the public since March 2010. It has two permanent-magnet AC synchronous electric motors, powered by a 16 kWh battery pack. The 50 kW motor drives the wheels and a 25 kW one backs it up and doubles as generator driven by regenerative braking. Electric-only range is up to 100 km. A one-litre 50 kW three-cylinder IC motor charges the batteries when the level drops to 20%, and connects to the wheels in parallel hybrid mode, so that up to 125 kW is available.

In the UK, the London Taxi Company which makes London's black cabs was taken over by Zhejiang Geely Holdings in 2013. In March 2017 a new £325 million plant was opened in Coventry by the London EV Company (LEVC) to build a new TX5 range of PHEV cabs for domestic and export markets. The London taxi has a 120 kW electric motor and 130 km pure EV range, or 600km with its 1.5 litre 60 kW turbocharged petrol engine as range-extender generator (using a 36-litre fuel tank). The 31 kWh lithium-ion batteries are made by LG Chem, and some top-up is by regenerative braking. Mains charging is 50 kW DC CHAdeMO or 22 kW AC CCS Combo or with a 7 kW home charger. Mass is 2.3 tonnes. Transport for London wants 9000 of the city's 23,000 diesel cabs to be "zero-emission capable" by 2021. LEVC has sold 3800 to the end of 2019, many for London.

General Motors marketed a Volt or Ampera PHEV for several years to 2019.

PHEVs are likely to remain competitive even if in future there is an option for the on-board energy carrier to be hydrogen rather than simply a battery and the on-board electric powerplant is then supplied through a fuel cell, so plug-in hybrid-electrics have a long-term application.

Full electric vehicles, aka battery electric vehicles

These are an extension of the PHEV concept, as well as substantially predating it. Plenty of these have been built, but mostly with heavy lead-acid batteries and for uses other than motor cars. Today a number of manufacturers are building BEVs with over 35 kWh on board, using lithium-ion (or lithium magnesium oxide) batteries and regenerative braking to help charge them. In 2019 three times as many BEVs as PHEVs were sold.

A range of electric cars now coming onto the market have energy usage of 13-20 kWh/100 km, with 15 kWh/100 km being typical best,* albeit without considering heating or air conditioning. A safety issue with BEVs is their quietness among pedestrians, and some may have an external sound generator operable at speeds of below 20km/h to warn pedestrians. EUVs – electric utility vehicles – extend the BEV range.

* David MacKay, Sustainable Energy – without the hot air, Chapter 20.

General Motors produced the EV1 in the 1990s, first with lead-acid batteries then with NiMH batteries, but the 18 to 26 kWh on board did not give enough range and recharge was slow.

BEVs and series PHEVs can eliminate the mechanical transmission (as well as the complex parallel PHEV control system) and have a drive motor/generator in each wheel, though this will affect the unsprung weight adversely and hence roadworthiness. But this is a very simple system and requires minimal further development apart from optimising batteries.

The Renault-Nissan alliance has formed numerous alliances with states, municipalities, utility companies and others to develop infrastructure for these. It has invested €4 billion overall, with 1000 staff working on the project at each of Nisan and Renault. The French postal service used 5000 Renault Kangoo BEVs in 2015 and planned to double this fleet by 2020.

The Nissan Leaf has laminated lithium-ion batteries driving an 80 kW synchronous AC motor with drive train on the front axle. It can be charged overnight at 240 volts at 6.6 kW, or at 100 kW DC. It uses 16 kWh/100 km. With its original 24 kWh battery pack it had a range of about 160 km, but it now has 62 kWh giving a range of 360 km. Mass is about 1500 kg. This was the world’s best-selling BEV early in 2017.

The BYD e6 was the top-selling BEV in China in 2016. It has a 48 kWh lithium-ion iron phosphate battery giving it a range of 240-300 km and a battery life of 2000 cycles. It consumes 21.5 kWh/100 km in taxi service, and can be recharged in 30 minutes. An 80 kWh battery gives it 400 km range and 4000 charge cycles. There are four different power combinations for the e6: 75 kW, 75+40 kW, 160 kW and 160+40 kW. The two-motor options are 4WD. BYD e6 taxis are used in Hong Kong. A successful trial in Shenzhen in 2010 resulted in 300 e6 taxis being commissioned there, and some 12,000 BEV taxis are now in service. The Shenzhen police use 500 BYD e6 vehicles. The mass is 2020 kg.

Toyota stood back from BEV developments while enjoying the success of its hybrid Prius. But in May 2010 it announced that it would invest $50 million in US-based Tesla and jointly develop a new low-priced BEV – basically a Toyota Rav4 with a Tesla powertrain. In October 2010 Tesla bought the Toyota-GM NUMMI car plant at Fremont in California as a base for all its manufacturing, including many of the components. The plant has a capacity of half a million vehicles per year and uses the Toyota Production System. The Tesla-Toyota collaboration ended in 2014, after development of the Rav4 BEV, and Toyota sold its stake in Tesla in 2017.

For the Tesla Model 3, the company claims a 500 km range, and over 300,000 were sold in 2019. Battery capacity (lithium-ion) is 75 kWh, with eight-year warranty. Mass is 1850 kg. Initially the model has a single 192 kW three-phase motor driving the rear wheels, but a dual-motor 336 kW 4WD version is available. It uses 14 kWh/100 km. Home charging is 40 amps (11.5 kW), 240 volts. Superchargers are 480 volts DC (250 kW).

The Tesla S has three-phase AC induction motors, a variable-frequency drive inverter and a single-speed rear transaxle gearbox with fixed 9.7 reduction ratio. With 100 kWh lithium-ion battery pack giving 500 km range it has 2240 kg mass, or with 75 kWh giving 410 km it is 80 kg lighter. It has 193 kW motors driving front and rear. Charging is from domestic power (110 or 240 volt) at 10 amps, a 40-amp charge, or 45-minute quick charge option from three-phase 480-volt/100 amp supply. A Universal Mobile Connector is the basic equipment for household or J1772 public charging stations, giving 10 kW charge (20 kW twin charge is optional). Battery and drive unit warranty is 8 years/unlimited km, after which Tesla guarantees replacement cost of $12,000. Tesla is now marketing the model X, an SUV variant of Tesla S with an additional motor driving the front wheels, and a 90 kWh battery. Vehicle mass is 2400-2500 kg depending on model.

The BAIC EU series made in Beijing sold 111,000 cars in 2019. The EU5 has a 53.6 kWh battery which can be charged at 7 kW AC or 60 kW DC. The synchronous motor is 163 kW and it uses 13 kWh/100km giving a range of 416 km. The BAIC Lite has a 30 kWh battery and range of 300 km.

Early in 2015 GM announced its Bolt BEV, designed to compete with Tesla’s Model 3. The Chevrolet Bolt has a 150 kW motor with 66 kWh lithium-ion battery pack from LG Chem and 7.2 kW (or 11.5 kW) onboard charging, with 55 kW SAE combo DC fast charging optional. It uses 13 kWh/100 km, and range is 500 km. Mass is 1620 kg. In Europe it is the Ampera-e. A Bolt EUV has been announced. In 2021 LG Chem agreed to reimburse GM $1.9 billion for Bolt recall due to fires in the battery pack caused by a manufacturing defect. The two companies are building two new battery plants in the USA through joint venture Ultium Cells.

BMW’s i3 was on the EU market by the end of 2013, as a small five-door car. The eDrive motor on the rear axle is 135 kW, and uses 12.6 kWh/100 km. Its 42 kWh (net) lithium-ion battery under the floor gives it an electric range of 330 km. Charging is 7.4 kW AC, 11 kW AC (3-phase) or 50 kW DC. With much of it being made of carbon fibre, mass is about 1245 kg, 230 kg of which is the battery pack. A range-extender (REX) option is available, with a two-cylinder petrol engine to charge the battery, making it a PHEV with 330 km range (9-litre tank).

The Volkswagen e-Golf has a 36 kWh lithium-ion battery with a 100 kW motor and a range of 200 km.

In mid-2020 SAIC-GM-Wuling released the Wuling HongGuang Mini EV and at a price of $4200 it immediately became very popular, with sales for the first six months of 119,000. A more upmarket model is $5600. The concept is for a small and affordable 2-door, 4-seat car, with 665 kg kerb weight. It has a 13 kW motor and a 9.2 kWh battery, giving 120 km range. A 13.8 kWh battery gives 170 km range.

Shenzhen planned for all its 17,000 taxis to be electric by 2020. By the end of 2017, 12,500 were. Beijing is planning to replace 67,000 IC-engine taxis with BEVs by the mid-2020s.

All Daimler Smart cars sold in the USA from 2017 to 2019 were BEVs. Future Smart BEVs are to be built in China in partnership with Geely, as well as in Europe.

For many uses batteries on their own will be inadequate on several counts – they have poor performance in hilly regions, in winter temperatures and when the driver wants to run heating and air conditioning. While many battery vehicle drivers become well disciplined in their vehicle use so they can plan their journeys around the requirements of battery charging, the PHEV technology remains attractive to give greater versatility.

Battery technology and charging

This is the key for both PHEV and BEV: achieving high capacity with low mass and low cost, coupled with safety and a long life. Batteries need to be capable of repeated deep discharge. Also they are likely to need to run heating and air conditioning where there is no IC engine or where it switches off part time. They also need to be able to function to a satisfactory level in very cold weather.

While current automotive fuels provide 12-14 MJ per kilogram mass (net of IC engine efficiency, 45 MJ/kg gross thermal), the best batteries under development provide only 2-3 MJ/kg (550-800 Wh/kg net), and that at twice the volume. Commercial batteries are much less than this (see below).

As well as being heavy and bulky, batteries are expensive. Lithium-ion battery costs for grid storage dropped by two-thirds from 2000 to 2015, to about $700/kWh, driven by the vehicle market and a further halving of cost is predicted to 2025. Bloomberg New Energy Finance has launched an index tracking the price of EV batteries. It expects the cost of lithium-ion batteries to drop to $150/kWh by 2030, compared with just under $400/kWh in 2016. The Boston Consulting Group suggests that costs need to get down to $200/kWh before electric cars are generally competitive, and this is reported to be Tesla’s target. Batteries make up around 25% of the cost of electric vehicles like the Nissan Leaf or Tesla Model S.

Lead-acid batteries are well known in traction roles as well as for starting cars and running accessories. But they are very heavy and only last a few years.

Nickel metal hydride (NiMH) batteries are well-proven and reasonably durable, though can be damaged under some discharge conditions.* They are similar to nickel cadmium (NiCd) batteries, but use a hydrogen-absorbing alloy as the cathode instead of cadmium. The bipolar version represents a further development of these, from 2021.

* If a cell in a multiple assembly fully discharges, the others may drive it to reverse the polarity and permanently damage it.

Lithium-ion batteries* deliver more power from less mass and are constantly being improved in relation to safety, reliability and durability. China produces about two-thirds of the world's supply of lithium-ion batteries. For BEVs, high energy density per kg and rapid charging are key attributes, whereas lithium iron phosphate versions are less energy dense but have longer cycle life to suit fixed installation.

* Regarding lithium resources, see Lithium Abundance - World Lithium Reserve, a report on the world's lithium resources and reserves by Keith Evans.

Research continues particularly on their cathodes – early ones used cobalt oxide (LCO) cathodes, others use manganese oxides (LMO), iron phosphates (LFP), or a combination of LMO and lithium nickel manganese cobalt oxide (NMC) cells. The LMO part of the battery – about 30% – provides high current boost on acceleration; the NMC part gives long driving range. Nickel cobalt aluminium oxide (NCA) batteries are favoured in some premium EVs. A spinel structure for LMO (3D lattice with manganese) gives fast charge and discharge but lower capacity that cobalt-based type (though still 50% more than NiMH). A123 Systems claims that its lithium-ion batteries will last for at least ten years and 7000 charge cycles, while LG Chem claims 40 years life for lithium-manganese spinel batteries for the GM Volt. A variety of lithium-ion battery considered to have great potential is the nickel manganese cobalt (NMC811) version which is being developed to use more nickel and less cobalt.

Anodes are mostly graphite, but research is heading for silicon. Other research is on replacing the liquid electrolyte with a solid, to improve safety and energy density. Toyota expects to have solid state batteries ready for market in 2022.

There have been some well-publicized fires in lithium-ion power sources, particularly following crashes and where the battery has then not been discharged, or de-powered. Also a minor manufacturing defect can make lithium-ion batteries prone to fires. See Chevrolet Bolt account above.

Arizona State University is researching metal-air-ionic liquid (MAIL) batteries which promise lower cost and with long life, where the oxidation of a metal yields energy. Lithium-sulfur batteries have potential to 600 Wh/kg.

Lithium-ion batteries may be categorized by the chemistry of their cathodes; the different combination of minerals gives rise to significantly different battery characteristics. A 2021 International Energy Agency report set out some figures:

- Lithium nickel cobalt aluminium oxide (NCA) battery: specific energy range (200-250 Wh/kg), high specific power, lifetime 1000 to 1500 full cycles. Favoured in some premium EVs (e.g. Tesla), but more expensive than other chemistries.

- Lithium nickel manganese cobalt oxide (NMC) battery: specific energy range (140-200 Wh/kg), lifetime 1000-2000 full cycles. Most common battery used in electric and plug-in hybrid electric vehicles. Lower energy density than NCA, but longer lifetimes.

- Lithium iron phosphate (LFP) battery: specific energy range (90-140 Wh/kg), lifetime 2000 full cycles. Low specific energy a limitation for use in long-range EVs. Could be favoured for stationary energy storage applications, or vehicles where size and weight of battery are less important.

- Lithium manganese oxide (LMO) battery: specific energy range (100-140 Wh/kg), lifetime 1000-1500 cycles. Cobalt-free chemistry seen as an advantage. Used in electric bikes and some commercial vehicles.

Solid-state lithium-metal batteries are becoming available in the early 2020s. They have greater capacity (energy density) and faster charging than conventional lithium-ion batteries and longer service life.

Regarding energy density, indicating capacity and hence run time, lithium-ion batteries hold about 120-200 watt hours per kilogram of battery mass, the much safer and more durable lithium-ion iron phosphate and lithium-ion manganese batteries being at the lower end of this range. BYD quotes 100 Wh/kg for “inherently safe” and more chemically stable lithium-ion iron phosphate batteries in its F3DM car, compared with 150-200 Wh/kg for lithium-ion cobalt types and 100-150 Wh/kg for LMO types. LFP batteries are generally quoted at 90-120 Wh/kg but have good safety and long life. Nickel cobalt aluminium (NCA) batteries have high energy density (200-260 Wh/kg) but are high cost and apparently used by Tesla. One of the safest lithium-ion batteries has LMO or NMC cathodes with lithium titanate (LTO) anode, but low capacity – 50-80 Wh/kg. These compare with up to 90 Wh/kg from metal hydride (NiMH) batteries, 60 Wh/kg from NiCd batteries and 30-40 Wh/kg from lead-acid batteries.

For cars, nickel manganese cobalt (NMC) alloy is favoured in cathodes. There are many kinds of NMC. NMC111 is a common cathode alloy, with equal parts of nickel, manganese and cobalt, but with greatly increased costs of cobalt NMC 532 and NMC811 are being developed. Nickel-based systems have higher energy density (150-220 Wh/kg), lower cost, and longer cycle life than the cobalt-based cells but they have a slightly lower voltage.

A123 Systems announced in mid-2015 that it was doubling world production capacity of advanced lithium-ion batteries to 1.5 GWh over three years. Most automotive production is in China, but some is in Europe, and though US-based it became a subsidiary of China’s Wanxiang Group in 2013. The company produces a 12-volt ‘UltraPhosphate’ starter battery with half the mass of comparable lead-acid units. In 2014 it bought Leyden Energy’s lithium titanate battery technology. It supplies 48-volt batteries to all Chinese carmakers for mild hybrid vehicles. In 2017 it bought Solid Power with its solid-state technology enabling the safe application of lithium metal anodes “as a means to achieving outstanding energy density”. (An associated company is A123 Energy Solutions, focused on grid storage and ancillary services.)

(A 2012 contract for back-up power sources for CGNPC nuclear power plants went to BYD for 3.5 MWh lithium-ion iron phosphate batteries able to supply 2.5 MWe. BYD launched the world's first MWh-level iron-phosphate energy storage system in 2010, which was attached to China's Southern Power Grid. In 2011, it supplied an even larger 36 MWh system for China's State Grid's 'National Sun' project – a renewable, base-load power generation plant.)

What was claimed to be the world’s largest lithium-ion battery factory was opened in 2011 at Novosibirsk in Siberia. It is owned by Liotech, a 50-50 joint venture between the Russian Nanotechnologies Corporation (RUSNANO) and the Chinese holding company Thunder Sky. The total investment in the project amounted to more than RUR 13.5 billion. All the machinery used by the plant was manufactured by Chinese companies, all the raw materials for the LT-LYP 200, LT-LYP 300 and LT-LYP 700 batteries come from China and all of the factory's finished products are destined for the Chinese market through Thunder Sky. It aims to use only Russian raw materials by 2015, and presumably this will be depleted lithium tails with an elevated proportion of Li-6 from Novosibirsk Chemical Concentrates Plant (NCCP) Li-7 enrichment activities.

Using ecofriendly nanostructured cathode lithium iron phosphate material (LiFePO4), the LIOTECH plant will output batteries with nominal capacities of 200, 300 and 700 Amp-hours. The planned capacity of new plant will amount over 1 GWh of battery capacity or about one million batteries per year. This enables about 5000 electric buses annually to be equipped with the batteries.

Lithium-ion batteries are specified for many BEVs and PHEVs. However, most of those are likely to use more advanced ones with lithium-ion iron phosphate (LiFePO4 or Li2FePO4F) cathode, the latter giving a lower power density but greater service life. Both kinds are much safer than early ones with lithium cobalt dioxide cathodes.

Nissan has joined with NEC and a subsidiary, NEC TOKIN, to set up Automotive Energy Supply Corporation (AESC) to develop and market advanced laminated Li-ion batteries for use in PHEVs and BEVs. AESC commenced operation in May 2008.

Tesla uses Panasonic Li-ion batteries and is looking at a joint venture in USA to produces them. It aims to get the cost down to $200/kWh capacity.

Focusing on the home base, using a 13 amp plug such as standard in UK, and 240 volt system, a 16 kWh battery pack could be recharged in 5.5 hours. Many battery packs will be much larger than this, so 40 amp charge points may often be necessary for overnight charging, particularly with 110 volt systems. See above section on Connection standards and EV charging architecture.

Lithium-ion batteries generally have short lives (under ten years) and are very difficult to recycle. Also their environmental virtue depends greatly on the source of electricity which charges them. And the critical minerals used to make them are not always abundant.

Ultracapacitors are another research frontier to provide electricity storage for cars, to supplement batteries in providing for acceleration, and also being able to accept high inputs from regenerative braking.

Fuel cell electric vehicles

Experimental fuel cell electric vehicles (FCEVs) using hydrogen fuel are now appearing, starting with buses. FCEV technology seems more suited to heavy vehicles requiring a long range between refuelling than to small vehicles. For sources of hydrogen for these and fuller treatment of the subject, see companion page on Hydrogen.

FCEVs are further from widespread commercial use than BEVs and PHEVs. A significant ramp up in numbers is expected by the early 2020s.

Fuel cell hybrid vehicles (FCHV), with an electric motor driven by the battery and the fuel cell keeping the battery topped up and giving it greater life (by being kept more fully charged) are being marketed. Battery capacity is smaller than BEVs and PHEVs, but the whole fuel cell stack plus hydrogen tank is much lighter than comparable BEV battery packs. Plug-in FCEVs are possible, with greater battery capacity.

Proton exchange membrane (PEM) fuel cells are the main type used in cars and heavy vehicles, and these operate at around 80-90°C and have about 60% efficiency. The main FCEV problem apart from cost is the very few refuelling stations as yet.

The US Department of Energy’s Fuel Cell Technologies Office puts the 2017 cost of automotive FC stacks at $53 per kW for manufacturing volumes of half a million units annually, half of what it was in 2006. FCEVs all use high-pressure gaseous hydrogen stored in polymer-lined, fibre-wound pressure tanks.

Honda tested its FCX Clarity hydrogen-powered fuel cell vehicle with lithium-ion battery pack on US roads and started marketing it for lease. The motor is 100 kW AC, with PEM fuel cell stack and 170-litre compressed hydrogen tank giving a range of 380 km. Vehicle mass is 1.6 tonnes. The first US deliveries were in 2008 in southern California with a three-year lease term at a price of $600 per month, including maintenance and collision insurance. In September 2010 there were reported to be 32 on the road: 19 in California, 11 in Japan and 2 in Europe.

The Honda Clarity Fuel Cell replaced it in 2016. It has a range of 480 km (US EPA range rating: 585 km) and five-minute refuelling. It has a 114 kW PEM fuel cell with single speed direct drive delivering total 130 kW with 300 NM torque. The hydrogen storage tank holds 5 kg. The three-year lease term is at $369 per month in California, including a lot of fuel.

The Toyota FCHV-adv – equipped with a high-performance fuel cell stack and nickel metal hydride batteries. The design of the membrane-electrode-assembly (MEA) was optimised to allow for low-temperature start-up and operation down to minus 30°C. Fuel cell output is 90 kW, matching the motor which delivers 260 Nm. Efficiency was improved by 25% from the earlier FCHV through improving fuel cell unit performance, enhancing the regenerative brake system and reducing energy consumed by the auxiliary system. In the 1.9 tonne five-seat vehicle a 70 MPa pressure vessel is used to store hydrogen which allows for an operating range of more than 800 km in the Japanese driving-cycle.

The production model Toyota Mirai sedan was launched in Japan in 2014 and California a year later for $57,500 to purchase or $349 per month for three years lease with complimentary fuel. Refuelling time is five minutes. It has a range of 500 km (EPA rated). The hydrogen is stored in two carbon fibre pressure tanks, and feeds a fuel cell stack. The power control unit is based on that in the Prius, and a boost converter takes voltage to 650 volts to drive the 114 kW motor, from a Lexus hybrid. Warranty is eight years/160,000 km. Toyota expects to sell 30,000 FCEVs per year from 2020.

The Hyundai Tucson Fuel Cell compact SUV claims to be the first mass-produced FCEV. Hyundai claims that its 0.95 kWh lithium-ion polymer battery is more compact and lighter than Toyota’s in the Mirai. The PEM fuel cell stack produces up to 100 kW and drives through a 100 kW electric motor. Battery power is 24 kW. The 140-litre hydrogen storage tank holds 5.63 kg at 69,000 kPa. Range is 425 km. It is being leased in California for $499 per month over three years.

For long-haul buses and trucks, FCEV ones have more promise than BEV battery-based systems. In 2019 Arizona-based Nikola Corporation embarked on a joint venture with IVECO in Europe to develop and market both BEV trucks and fuel cell heavy trucks. The Nikola TRE is the first product of this joint venture, based on an IVECO platform with Nikola drive train technology. It is for urban use with 500-1200 km range, and has a 750 kW motor, 1800 Nm (or up to 2700 Nm) peak torque, and a battery up to 750 kWh. Production in Germany is expected in 2021.

However, Nikola’s main aim is to market FCEV trucks, and the Nikola One FCEV truck is expected on the market in 2023, with 800-1200 km range, up to 750 kW power from an 800 volt AC motor, up to 2700 Nm peak torque, through a single-speed transmission, and a 250 kWh lithium-ion battery.

Nikola also plans to market a 4x4 FCHV pick-up truck, the Badger, with 120 kW fuel cell stack, 676 kW motor and 960 km range (half each from fuel cell and battery). In September 2020 GM took a 11% stake in the company with a view to building the Badger as BEV and FCEV versions from 2022. GM will also be exclusive supplier of fuel cells (outside Europe) for large Nikola trucks and will also supply batteries.

In April 2020 Daimler Truck and Volvo Group signed a non-binding agreement to develop, produce and commercialize hydrogen fuel cell systems for heavy-duty and especially long-haul vehicles. Daimler is to consolidate its fuel cell and hydrogen storage system activities in the joint venture, in which Volvo is to acquire a 50% stake for €600 million on a cash and debt-free basis.

Beyond the electric vehicle initiatives described above, the Renault-Nissan Alliance was developing fuel cell-powered electric vehicles. From 2008 two prototypes demonstrated the viability of the fuel cell concept.

In 2013, Daimler, Ford and Nissan, under the Alliance with Renault, signed an agreement for joint development of a common fuel cell EV system, with the aim of launching affordable, mass-market FCEVs in 2017. However, in 2018 Nissan and Renault pulled out of this and abandoned plans to commercialise FCEVs, and Ford and Daimler ended their FCEV joint venture. Then, after working on fuel cell vehicles for 30 years with the aim of producing cars with long range, three-minute refuelling, and no emissions beyond water vapour, Mercedes (Daimler) in 2020 concluded that costs remained at about double that of an equivalent battery electric car. The Mercedes-Benz GLC F-CELL was its only production model, developed in collaboration with Nissan and Ford and the only outcome of that 2013 agreement.

In the Mercedes B-class FCEV, the compact electric motor develops 100 kW peak (70 kW sustained) power and a maximum torque of 320 Nm, surpassing the performance of a standard two-litre petrol engine. Range is 400 km. At the same time, it uses the equivalent of just 2.9 litres/100 km of fuel (diesel equivalent).

An issue with using hydrogen in fuel cells is overall energy efficiency. If a nuclear reactor generates electricity which is used for electrolysis of water and the hydrogen is compressed and used in fuel cell powered vehicle (assuming 60% efficient fuel cell), the efficiency is much lower than if the electricity is used directly in BEVs and PHEVs.* However, if the hydrogen can be made by thermochemical means the efficiency doubles, and they are comparable with BEV/PHEV.

* Say: 35% x 75% x 60% x 90% = 14% optimistically (reactor, electrolysis, fuel cell, motor)

to: 50% x 60% x 90% = 27% for future thermochemical hydrogen

cf 35% x 90% = 31% for EV.

In 2019 there were about 370 hydrogen refuelling stations (HRS) worldwide, 270 of these publicly accessible. There were 152 in Europe, 136 in Asia and 78 in North America (most in California).

Notes & references

General sources

Australian Academy of Science, Australia’s renewable energy future (December 2009)

The Royal Academy of Engineering, Electric Vehicles: charged with potential (May 2010)

EPRI 2011, A Consumer's Guide to the Electric Vehicle

Energy Supply Association of Australia, Sparking an Electric Vehicle Debate in Australia (November 2013)

Energy Technology Perspectives 2016, Towards Sustainable Urban Energy Systems, International Energy Agency (May 2015)

Global EV Outlook 2017: Two million and counting, International Energy Agency (June 2017)

The Role of Critical Minerals in Energy Transitions, World Energy Outlook Special Report, International Energy Agency (May 2021)

Roger Arnold, Energy Post, The lowdown on hydrogen – part 1: transportation (12 April 2017)