Appendix 1: Impact on demand for nuclear fuel services

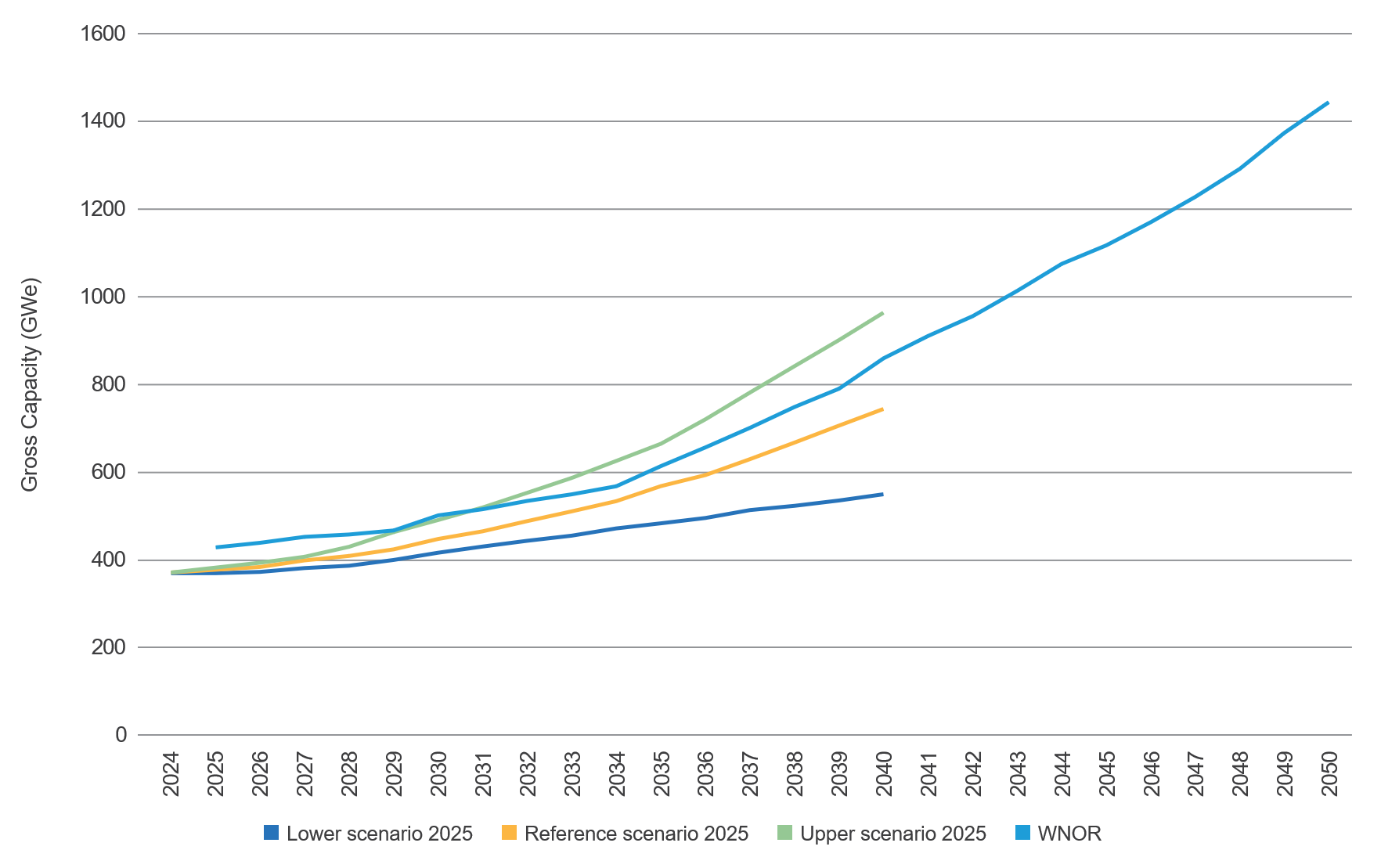

The 2025 edition of World Nuclear Association's World Nuclear Fuel Report presents three scenarios for nuclear capacity growth for the period 2025-2040 – referred to as the Reference, Upper and Lower Scenarios. Figure A1.1. shows the projected nuclear generation capacities in these scenarios alongside the World Nuclear Outlook Report (WNOR) projection of nuclear capacity.

The trajectory for nuclear capacity outlined in the WNOR between 2025 and 2040 lies predominantly between the World Nuclear Fuel Report’s Reference and Upper Scenarios. Note that the World Nuclear Fuel Report’s capacity figures do not include the operable nuclear capacity classified as in a suspended operation status by the International Atomic Energy Agency (IAEA) – such as reactors that have not restarted in Japan following their shutdown after the March 2011 accident at the Fukushima Daiichi nuclear plant. Approximately 20 GWe of nuclear capacity was classed as suspended operation in 2024.

A nuclear capacity increase to 1200 GWe to meet the Declaration to Triple Nuclear Energy goal would need to be supported by growth in the supply of uranium and fuel services. The front end of the nuclear fuel cycle consists of uranium mining, conversion, enrichment and fabrication. For the level of global nuclear capacity in 2025, approximately 70,000 tU per year is required to fuel the nuclear fleet. According to the 2025 edition of the World Nuclear Fuel Report, in the Upper Scenario almost 200,000 tU per annum of uranium would be required to support the 2040 capacity projection of 966 GWe. For 1200 GWe of global nuclear capacity, annual uranium requirements would be 250,000 tU, assuming no significant change in the mix of different reactor types.

World Nuclear Fuel Report generation capacity scenarios compared to WNOR

As of 2025, annual primary production of uranium was around 60,000 tU, so over a fourfold increase in annual uranium production would be needed to fuel the tripling of global nuclear capacity.

Some considerations for the required growth in uranium production include:

• New mines will be needed for additional supply as well as to replace depleted assets.

• There are sufficient uranium resources to meet high growth scenarios in 2050. However, resources in the ground need to be brought into production in a timely manner. Resources need to be explored, developed and licensed, along with associated infrastructure developments before these can become operating uranium mines. The lead times from exploration to first commercial delivery are long.

• The economics of extracting the uranium from the deposits will play a role in how quickly and when mines will come online.

• Uranium is a very abundant mineral, and it can be found all over the world.

At the same time, uranium mining is currently largely concentrated in a few countries (such as Kazakhstan, Canada and Australia) while demand for uranium exists across the globe. Geopolitical factors and uncertainties could raise supply risks for the uranium to get from where it is mined to where it is needed.

Uranium could be considered as a strategic mineral by certain countries and regions in order to achieve their set goals of reaching certain nuclear capacities and ensuring security of supply. In the subsequent stages of the front end of the nuclear fuel cycle, growth in capacity would also be required to support the tripling global nuclear capacity goal.

Where conversion is concerned, the market remains tight and if existing LWR technologies will continue to dominate in the mix of the global reactor fleet, then conversion will remain an essential process. Similar to uranium mining, conversion primary production capacity will need to increase by over threefold based on the assumption that a large portion of the reactor fleet will continue using LWR technology. Challenges in ensuring a sufficient supply of conversion include:

• As of 2025, there were only four conversion suppliers globally. Production capacities would need to be increased significantly and new plants would need to be developed.

• Uranium conversion facilities are capital-intensive plants that requiring financing.

• Reliable and sufficient supplies of essential materials used in the conversion process, such as hydrofluoric acid, would be required.

For enrichment, while the market on a global level is able to meet the nuclear reactor fleet demand, the regional perspective is somewhat different largely due to geopolitical risks and uncertainties. With only four enrichment providers globally, some countries or regions are diversifying their supply to move away from production from certain producers. Where new build is concerned, this may include more advanced technologies with such reactors requiring higher levels of enrichment, thus new enrichment plants and facilities would also be needed.

Fabrication of fuel assemblies is a highly engineered and technical stage of the nuclear fuel cycle. Each fuel assembly must be tailored to a particular reactor design. While there is sufficient capacity to supply fabrication services for the global nuclear fleet, this would need to significantly increase to support the tripling of global nuclear power capacity. The reliable availability of materials required for fabrication, such as zirconium, is also important.

The growth estimates provided here are based on reactor fuel efficiencies and reactor requirements. Newer reactor designs, including small modular reactors (SMRs) and advanced reactors, may have different fuel efficiencies and therefore reactor requirements. In the 2040s, recycling spent fuel and advanced fuel cycles could reduce fresh uranium needs.

For all stages of the front end of the nuclear fuel cycle it is clear that significant financing would be needed to support the expansion of existing facilities as well as building new plants. A key factor – not limited to fuel supply in the nuclear industry – is the availability of a skilled workforce.

While there has been substantial political support for growth in nuclear capacity globally, from a fuel perspective, timely decisions would need to be made for fuel supply capabilities to be ready when they are needed.