Hydrogen Production and Uses

- Hydrogen is increasingly seen as a key component of future energy systems if it can be made without carbon dioxide emissions.

- It is starting to be used as a transport fuel, despite the need for high-pressure containment.

- The use of hydrogen in the production of liquid transport fuels from crude oil is increasing rapidly, and is vital where tar sands are the oil source.

- Hydrogen can be combined with carbon dioxide to make methanol or dimethyl ether (DME) which are important transport fuels.

- Hydrogen also has future application as industrial-scale replacement for coke in steelmaking and other metallurgical processes.

- Nuclear energy can be used to make hydrogen electrolytically, and in the future high-temperature reactors are likely to be used to make it thermochemically.

- The energy demand for hydrogen production could exceed that for electricity production today.

Hydrogen is not found in free form (H2) but must be liberated from molecules such as water or methane. It is therefore not an energy source and must be made, using energy. It is already a significant chemical product, about half of annual pure hydrogen production being used in making nitrogen fertilizers via the Haber process and about one-quarter to convert low-grade crude oils (especially those from tar sands) into liquid transport fuels. There is a lot of experience handling hydrogen on a large scale, though it is not as straightforward as natural gas.

Most hydrogen today is made by steam reforming of natural gas or coal gasification, both with carbon dioxide (CO2) emissions. Future demand will be mainly for zero-carbon hydrogen. Plans for increased hydrogen production are essentially based on electrolysis using electricity from intermittent renewable sources. Off-peak capacity of conventional nuclear reactors or other power plants can also be used. In future, a major possibility for zero-carbon hydrogen production is decomposition of water by direct use of heat from nuclear energy, using a thermochemical process enabled by high-temperature reactors.

The rapidly-growing demand for hydrogen by oil refineries and chemical plants favours technologies with low costs. Limited hydrogen pipeline networks already exist, allowing production facilities to be some way from users.

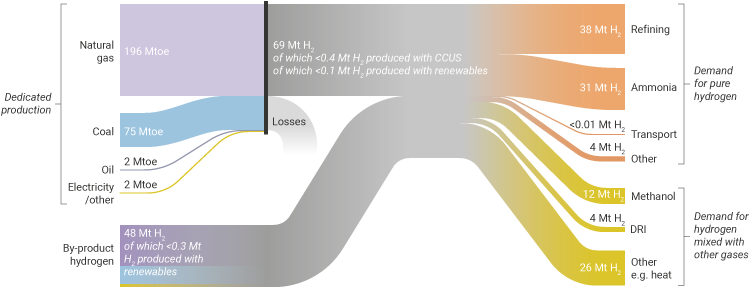

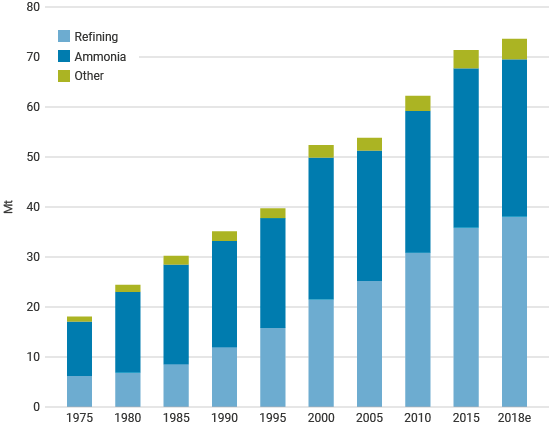

According to the International Energy Agency (IEA)1, in 2018 demand for pure hydrogen was about 74 million tonnes (Mt), of which 38.2 Mt was used in oil refining and 31.5 Mt in ammonia production. There was a further 42 Mt of demand for hydrogen mixed with other gases such as carbon monoxide. Of this, 12 Mt was used in methanol production and 4 Mt in direct-reduced iron (DRI) for steel.

Like electricity, hydrogen is an energy carrier (but not a primary energy source). Hydrogen has some potential to replace oil as a transport fuel and in other applications. It is the preferred fuel for fuel cell electric vehicles (FCEVs), though portable storage at vehicle scale is a challenge. Hydrogen can also be used in internal combustion engines.

While hydrogen can replace liquid hydrocarbons, it is never as energy-dense or convenient to store and transport. However, it does compare well with batteries, which is why it and hydrogen-based liquid fuels have a lot of potential.

Electricity and hydrogen are convertible one to the other as energy carriers. However, the overall efficiency of electricity-hydrogen-fuel cell-electricity is no more than 40%. One approach to mitigate intermittency of wind and solar electricity is to make hydrogen by electrolysis and feed this into the gas grid, the power-to-gas strategy. It has been suggested that most electricity from wind might be used thus, greatly simplifying electrical grid management.

In future some hydrogen produced for fuel may be converted into ammonia as a more energy-dense carrier medium volumetrically for trade or long-term energy storage. The mass energy density of hydrogen is 120 or 142 MJ/kg*, compared with methane 50 MJ/kg, propane 46 MJ/kg and ammonia 19 MJ/kg. Volumetrically, the energy density of hydrogen is low – 10.8 or 12.75 MJ/Nm3 (or as liquid: 8.5 or 10.0 MJ/L)**. Ammonia is the main hydrogen derivative in consideration for transport.

* Lower (net heat of combustion) and higher (gross heat of combustion) heating values, respectively. Thus 33.3 or 39.4 kWh/kg. The higher heating value includes the latent heat in the vapourized water, the lower heating value (or net calorific value) excludes this.

** Nm3 = normal cubic metre (0 °C temperature and 1.01325 bar (i.e. 1 atmosphere) pressure.

All this points to the fact that while a growing hydrogen economy already exists, linked to the worldwide chemical and refining industry, and potentially for steelmaking, a much greater one is in sight. With new uses for hydrogen as a fuel, the primary energy demand for its production may exceed that for electricity production.

Transport is expected to constitute the largest demand for hydrogen in both the EU and South Korea by 2050, reflecting the conversion of the heavy vehicle and large passenger car fleet from diesel to hydrogen FCEVs. Heating for buildings is expected to be the next largest demand, replacing natural gas. Railways can replace diesel fuel with hydrogen.

If hydrogen is to fuel shipping or aviation, refuelling needs to be available worldwide, so Europe’s ambitious plans will need much wider take-up.

A September 2020 report by LucidCatalyst said that in addition to deployment of renewables for power generation: “The only known way to address the ‘difficult-to-decarbonize’ economic sectors is with the large-scale use of hydrogen as a clean energy carrier and as a feedstock for synthetic fuels such as ammonia.” But clean hydrogen needs to come from non-fossil sources, at a lower price – under $1/kg – than is prospective today.

An abundant supply of low-cost hydrogen would greatly boost world agricultural productivity through increased availability of nitrogen fertilizers, as well as fuelling transport.

The role of nuclear power

Nuclear power already produces electricity as a major energy carrier with well-known applications. Operating at very high capacity factors, nuclear energy is well placed to produce zero-carbon hydrogen as an emerging energy carrier with a wide range of applications. The evolution of nuclear energy's role in hydrogen production over perhaps two decades is seen to be:

- Cold electrolysis of water, using off-peak capacity (needs 50-55 kWh/kg).

- Low-temperature steam electrolysis, using heat and electricity from nuclear reactors.

- High-temperature steam electrolysis, using heat and electricity from nuclear reactors.

- High-temperature thermochemical production using nuclear heat.

In addition, nuclear heat can assist the process which provides most of the world's hydrogen today:

- Use of nuclear heat to assist steam reforming of natural gas (methane).

Steam reforming of methane (SMR) requires temperatures of over 700 °C to combine methane and steam to produce hydrogen and carbon monoxide. A nuclear heat source would reduce natural gas consumption by about 30% (i.e. that portion of feed which would simply be for heat), and eliminate flue gas CO2 emissions.

Starting with electrolysis, the efficiency of the whole process (primary heat to hydrogen) moves from about 25% with today's reactors driving electrolysis (33% for reactor x 75% for cell) to 36% with more efficient reactors doing so, to 45% for high-temperature electrolysis of steam, to about 50% or more with direct thermochemical production.

Electrolysis at ambient temperature is being undertaken in at least four US projects at nuclear power plants and produced hydrogen from the Kola plant in Russia for the first time in December 2022. Alkaline and proton exchange membrane (PEM) technology is employed. In August 2021 Nel Hydrogen was contracted to build a 1.25 MW PEM electrolyser at Exelon’s Nine Mile Point nuclear power plant to show integrated production, storage and normal use at the plant.

Low-temperature steam electrolysis improves the efficiency of electrolysis at ambient temperatures and utilizes waste heat at up to 200 °C from a conventional reactor. The US Department of Energy in October 2020 selected two projects to advance flexible operation of light water reactors with integrated hydrogen production systems to receive cost-shared funding. Two other projects are already under way.

The IEA’s Global Hydrogen Review 2021 described about a dozen projects that are intended to use electricity from nuclear power plants to produce hydrogen using electrolysis. Most of these projects are based in Canada, China, Russia, the USA and the UK. However, only a few of these were actually launched.

High-temperature steam electrolysis (HTSE, at 550-750 °C or more) in solid oxide electrolysis cells (SOEC) to use both heat and electricity has been demonstrated, and shows considerable promise. It is a reverse reaction of the solid oxide fuel cell technology. It requires about one-third less energy than low-temperature electrolysis but has not yet been commercialized due to the poor durability of the ceramic components in a hot hydrogen environment. US research is at Idaho National Laboratory in conjunction with Ceramatec and FuelCell Energy in a $12.5 million project part-funded by the US Department of Energy (DOE). LucidCatalyst shows it producing hydrogen at two-thirds the cost of low-temperature electrolysis across a range of capacity factors. One of the four DOE projects mentioned above will focus on a solid oxide electrolysis cell at high temperature. Idaho National Laboratory will work with Xcel Energy to demonstrate HTSE technology using heat and electricity from one of Xcel Energy’s nuclear plants.

The International Atomic Energy Agency (IAEA) has developed the Hydrogen Economic Evaluation Program (HEEP) to assess the economics of large-scale hydrogen production using nuclear energy.

Nuclear hybrid energy systems for hydrogen production

| Alkaline electrolysis | PEM electrolysis | Solid oxide electrolysis | Steam methane reforming | Thermochemical S-I | |

|---|---|---|---|---|---|

| Technology readiness | 9 | 6-8 | 5 | 9 | 4 |

| Temperature (°C) | 60 | 60 | 800 | 870 | 910 |

| Pressure (atm) | 1 | 1 | 1.57 | 4.1 | 3.85 |

| Efficiency (HHV, %) | 30 | 27 | 36 | 79 | 25 |

| Electricity (MJ) | 180 | 200 | 146 | 1.4 | 75 |

| Heat (MJ) | 26 | 26 | 30 | 0 | 375 |

| Water (kg) | 11.5 | 11.5 | 83 | 10.3 | 9 |

| Natural gas (kg) | 0 | 0 | 0 | 2.9 | 0 |

| CO2 out (kg) | 0 | 0 | 0 | 5-11 | 0 |

| Production cost | $5.92 | $3.56-5.46 | $2.24-3.73 | $1.54-2.30 | $2.18-5.65 |

Efficiency assumes 40% heat to electricity conversion

Source: Pinksy et al. 2020, Table 4

Hydrogen directly from nuclear heat

Several direct thermochemical processes are being developed for producing hydrogen from water. For economic production, high temperatures are required to ensure rapid throughput and high conversion efficiencies. They essentially do not use electricity.

In each of the leading thermochemical processes the high-temperature (800-1000 °C), low-pressure endothermic (heat absorbing) decomposition of sulfuric acid produces oxygen and sulfur dioxide:

2H2SO4 ⇒ 2H2O + 2SO2 + O2

There are then several possibilities. In the iodine-sulfur (I-S) process invented by General Atomics in the 1970s, iodine combines with the sulfur dioxide and water to produce hydrogen iodide. This is the Bunsen reaction and is exothermic, occurring at low temperature (120 °C):

I2 + SO2 + 2H2O ⇌ 2HI + H2SO4

The HI then dissociates to hydrogen and iodine at about 350-450°C, endothermically:

2HI ⇌ H2 + I2

This can deliver hydrogen at high pressure.

Combining all this, the net reaction is then:

2H2O ⇒ 2H2 + O2

All the reagents other than water are recycled, there are no effluents, hence it may be called the sulfur-iodine cycle, with zero-carbon hydrogen and oxygen byproducts.

In February 2010 the Japan Atomic Energy Agency (JAEA) set up the HTGR Hydrogen and Heat Application Research Centre at Oarai to progress operational technology for an I-S plant to make hydrogen thermochemically. It has demonstrated laboratory-scale and bench-scale hydrogen production with the I-S process, up to 30 litres/h. In parallel with JAEA’s High Temperature Engineering Test Reactor (HTTR) developments, a pilot plant test project producing hydrogen at 30 m3/h from helium heated with 400 kW tested the engineering feasibility of the I-S process. An I-S plant producing 1000 m3/h (90 kg/h, 2 t/day) of hydrogen was to be linked to the HTTR to confirm the performance of an integrated production system, envisaged for the 2020s. In 2014 hydrogen production at up to 20 L/h was demonstrated. In January 2019 it used the HTTR to produce hydrogen using the iodine-sulfur process over 150 hours of continuous operation. JAEA aims to produce hydrogen at less than $3/kg by about 2030 with very high temperature reactors.

The US Nuclear Energy Research Initiative (NERI) launched in 1999 was refocused in 2004 to include the Nuclear Hydrogen Initiative (NHI), allied to the Next Generation Nuclear Plant (NGNP) programme established in 2005. NGNP envisaged construction and operation of a prototype high-temperature gas-cooled reactor (HTR) and associated electricity or hydrogen production facilities by 2021, but funding was cut back under the Obama administration and prelicensing activities were suspended in 2013.

Under an international NERI agreement, Sandia National Laboratories in the USA and the French CEA with General Atomics in the USA were also developing the I-S process with a view to using high-temperature reactors for it. They had built and operated a laboratory-scale loop for thermochemical water-splitting.

South Korea has also demonstrated thermochemical water-splitting at laboratory scale, supported by General Atomics. In December 2008, the Korea Atomic Energy Commission officially approved nuclear hydrogen development as a national programme, with the development of key and basic technologies through 2017 and the goal of demonstrating nuclear hydrogen production using the I-S process and a very high-temperature reactor (VHTR) by 2026.

The economics of hydrogen production depend on the efficiency of the method used. The I-S cycle coupled to a modular high-temperature reactor is expected to produce hydrogen at about $2.00/kg. The oxygen byproduct also has value. General Atomics earlier projected $1.53/kg based on a 2400 MWt HTR operating at 850 °C with 42% overall efficiency, and $1.42/kg at 950 °C and 52% efficiency (both 10.5% discount rate). Such a plant could produce 800 tonnes of hydrogen per day.

Production reactor requirements for process heat

For thermochemical hydrogen production, high temperature – 750-1000 °C – is required, and at 1000 °C the conversion efficiency is three times that at 750 °C. The chemical plant needs to be isolated from the nearby reactor, for safety reasons, possibly using an intermediate helium or molten fluoride salt loop.

Three potentially-suitable nuclear reactor concepts have been identified, though only the first is sufficiently well-developed to move forward with:

- High-temperature gas-cooled reactor (HTR), either the pebble bed or hexagonal fuel block type. Modules of up to 600 MWt will operate at 950 °C.

- Advanced high-temperature reactor (AHTR), a modular reactor using a coated-particle graphite-matrix fuel and with molten fluoride salt as primary coolant. This is similar to the HTR but operates at low pressure (less than 1 atmosphere) and higher temperature, and gives better heat transfer. Sizes of 1000 MWe/2000 MWt are envisaged.

- Lead-cooled fast reactor, though these operate at lower temperatures than HTRs – the most developed is the Russian BREST reactor which runs at only 540 °C and is now under construction. A US project is the STAR-H2 which would deliver 780 °C for hydrogen production and lower temperatures for desalination.

These are described more fully in the Small Nuclear Power Reactors information page (with coolant characteristics) and the Advanced Nuclear Power Reactors page.

For temperatures beyond 750 ºC, molten fluoride salts are a preferred interface fluid between the nuclear heat source and the chemical plant. The aluminium smelting industry provides substantial experience in managing them safely. The hot molten salt can also be used with secondary helium coolant generating power via the Brayton cycle, with thermal efficiencies of 48% at 750 °C to 59% at 1000 °C. There remain significant challenges in achieving sustained temperatures for commercial hydrogen production in a plant built for these chemical and thermal conditions.

National and regional plans and projections for hydrogen

The demand for pure hydrogen in 2019 was 39 Mt for oil refining and 32 Mt for ammonia production (80% of that from fertilizers). Methanol production used 14 Mt of the 45 Mt of hydrogen in syngas for chemical production or iron reduction. Total hydrogen use was about 115 Mt in 2020.

The International Energy Agency Net Zero by 2050 (May 2021) and Global Hydrogen Review 2021 reports project annual hydrogen demand of slightly more than 200 million tonnes in 2030 and 530 Mt in 2050. The proportion of this which is low-carbon rises to 70% in 2030 and about 90% in 2050, from both electrolysers and gas with CCS. By 2050 hydrogen is expected to account for about 10% of world final energy consumption. In transport, hydrogen provides one-third of fuel for trucks and 60% of that in some form for shipping, with demand from this sector of 48 Mt in 2050.

The IEA reports about $37 billion pledged in national hydrogen strategies in 2021 and $300 billion in private hydrogen production projects, with low-cost clean electricity being a key requirement.

Figure 1: Today's hydrogen value chain (source: IEA)

The April 2021 report, Making the Hydrogen Economy Possible, by London, UK-based think-tank Energy Transitions Commission sets out the role of clean hydrogen in achieving a highly electrified net-zero economy. It outlines a ramp-up of clean hydrogen to 50 million tonnes by 2030 and projects 500 to 800 million tonnes of annual clean hydrogen consumption by 2050. About 85% of this is likely to be green hydrogen. Hydrogen and fuels derived from it would then account for some 17% of total final energy demand (on top of 68% being electricity). The main increase in demand would be from those sectors which are hard or expensive to directly electrify, such as steel production and shipping.

All this hydrogen needs to be zero-carbon via electrolysis using up to 30,000 TWh/yr (on top of 90,000 TWh/yr for direct electrification). The report said that 50 GW of electrolysis capacity globally would enable a $2/kg cost of green hydrogen in "average" locations.

The International Energy Agency's (IEA's) Energy Technology Perspectives 2020 in its Sustainable Development Scenario projects global hydrogen production growing rapidly to about 445 Mt for energy use plus 75 Mt for process use by 2070. The 520 Mt hydrogen would be produced 58% by electrolysis and 40% from fossil fuels with carbon capture and storage (CCS). Of the energy demand, 60% is for transport, and of the process used, 60% is chemical and 40% steel production.

Figure 2: Global annual demand for pure hydrogen (source: IEA)

'Green hydrogen' is produced by electricity from intermittent renewables.

'Grey hydrogen' is that produced from methane with corresponding CO2 emissions.

'Brown hydrogen' is produced from gasified coal, with CO2 emissions.

'Blue hydrogen' is grey or brown hydrogen but with carbon capture and storage (typically 50-70% efficient).

'Yellow hydrogen' or 'pink hydrogen' uses nuclear electricity for electrolysis and possibly heat.

'Turquoise hydrogen' is produced from by molten metal pyrolysis of methane, with solid carbon byproduct.

Only green and yellow hydrogen are reliably zero-carbon. Future thermochemical production from nuclear power does not yet have a name. Green hydrogen may be from surplus supply to grids, or with dedicated supply capacity giving more economical utilization of electrolyser capacity (though it can never be greater than the capacity factor of the supply). Yellow hydrogen will probably work via grid supply.

An April 2021 report (Les modes de production de l’hydrogène) published by the French Parliamentary Office for Scientific and Technological Assessment (OPECST) said that only nuclear and hydropower could realistically produce low-carbon hydrogen, since the cost of green hydrogen from renewables would be four times as great. With high capital cost, “electrolysers must be made profitable by lengthening the duration of their use (a minimum threshold of 5000 hours per year and an optimal threshold of up to 8000 h/year), which the intermittence of renewables does not allow (2000-4000 h/year). In this regard, only nuclear energy and hydroelectricity present the double advantage of being controllable and carbon-free," the report says. Worldwide, 70 million tonnes per year of hydrogen could be supplied by 400 GWe of nuclear capacity.

A database of hydrogen projects worldwide is provided by the International Energy Agency.

In Europe, EU energy ministers signed the Hydrogen Initiative, a non-binding political declaration of support for hydrogen development, in September 2018. The EU has launched a massive ‘green hydrogen’ programme based on surplus power from intermittent renewables sources to decarbonise industry and aviation and to develop export opportunities. Green hydrogen is seen as key to reaching 'net-zero' emissions targets, but as yet, costs are high due to expensive equipment and the amount of electricity required.

The EC’s hydrogen strategy for the EU published in July 2020 calls for the installation of at least 6 GWe of electrolysers powered by renewable energy by 2024 (compared with 1 GWe in 2020), producing up to one million tonnes per year of green hydrogen by 2024. From 2025 EU member states should treat hydrogen as an intrinsic part of their energy system, “with a strategic objective to install at least 40 GWe of renewable hydrogen electrolysers by 2030 and the production of up to ten million tonnes of renewable hydrogen in the EU.” Hydrogen use will be expanded to transport and steelmaking. From 2030 to 2050 “renewable hydrogen technologies should reach maturity and be deployed at large scale.” The EC expects “cumulative investments in renewable hydrogen in Europe [to] be up to €180-470 billion by 2050, and in the range of €3-18 billion for low-carbon fossil-based hydrogen” (i.e. with CCS).

In July 2021 the EC published plans for new laws across numerous sectors designed to achieve its target of a 55% cut in greenhouse gas emissions by 2030 compared with 1990 levels, the so-called ‘Fit for 55’ programme. The EU has also set a 40 GW electrolyser capacity target by 2030, to produce 10 Mt/yr of renewable hydrogen. This would require additional renewable power generation amounting to 477 TWh, according to Platts Analytics – over half of the total EU renewable generation in 2019.

In June 2020 the trade body Hydrogen Europe said that EU hydrogen demand by 2030 would be about 16.9 Mt, of which 7.4 Mt would be green hydrogen produced from renewables, some imported from Ukraine and North Africa. Clean hydrogen from electrolysis using other low-carbon electricity such as nuclear, and natural gas with CCS, would provide 8.2 Mt, and 1.3 Mt would come from coal gasification with CCS. The report envisaged 20 Mt of green steel production using 1 Mt hydrogen by 2030. Other uses would be blending with natural gas, power generation and transport fuel.

EU grid operator Energas and ten others propose the 22,900 km European Hydrogen Backbone by 2040. Meanwhile up to about 20% hydrogen will be blended into natural gas grids.

Hydrogen Europe notes that the EU plans will have considerable manufacturing implications, including expansion of electrolyser manufacturing from 1 GW/yr to 25 GW/yr, increasing fuel cell manufacturing to 10 to 100 GW/yr, plus much ancillary equipment.

In February 2023 nine nations led by France – including Poland, the Czech Republic, Romania, Bulgaria, Slovenia, Croatia, Slovakia, and Hungary – have called for the EC to recognize hydrogen production from nuclear as a green energy source. The same month, the EC published a set of draft rules that could allow some hydrogen produced from nuclear to count towards EU renewable energy targets. EU countries and lawmakers have two months to object to the rules before they enter into force.

Germany’s national hydrogen strategy approved in June 2020 offers about €7 billion to bring electrolyser capacity to 5 GW by 2030 for 14 TWh of green hydrogen requiring 20 TWh of renewable electricity. The strategy also provided €2 billion for projects abroad, as hydrogen imports will be needed – only a small proportion of estimated 2030 demand will be produced domestically. While the objective is to use green hydrogen, both blue and turquoise hydrogen will play a part.

France is providing €7 billion for green hydrogen from 6.5 GW electrolyser capacity by 2030, with €2 billion of this over the two years to 2022, in support of its 2018 hydrogen strategy. Some 40% of this will be funded from the EU’s €750 billion coronavirus recovery programme.

Spain's government has approved a 2030 hydrogen roadmap targeting the installation of 4 GW of electrolysis capacity, green hydrogen quotas for industrial consumers, and the use of hydrogen in transport among other measures aligned with the EU hydrogen strategy. Spain now produces and uses 0.5 million tonnes per year of hydrogen.

Netherlands' hydrogen strategy aims for 500 MW of electrolysers by 2025 and 3-4 GW by 2030. Green and blue hydrogen fed into the gas grid at 2% initially and 10-20% eventually. Several scenarios give rise to an estimated hydrogen demand of 250 to 430 PJ (70 to 120 TWh) per year in 2050.

The UK's strategy around hydrogen production considers carbon intensity as the primary factor in market development, aiming to be low-carbon. The UK Hydrogen Strategy published in August 2021 aims to decarbonize transport and industry, using both green and blue hydrogen. It projects 5 GW of low-carbon hydrogen production capacity by 2030, mainly blue hydrogen, to produce one-fifth of the 2050 target. The UK Nuclear Industry Association's Hydrogen Roadmap published in February 2021 showed how the country might achieve 225 TWh (6.8 or 5.7 million tonnes) of low-carbon hydrogen by 2050. It proposed 12-13 GW of nuclear reactors of all types using high-temperature steam electrolysis and thermochemical water-splitting to produce 75 TWh (2.3 or 1.9 Mt) of hydrogen by mid-century.

A detailed report from Aurora Energy Research in September 2021 looked at multiple possibilities for much increased use of hydrogen in the future in the UK and showed that nuclear power would enhance this and reduce costs.

In Italy the gas transmission company Snam is partnering with ITM to install 100 MW of electrolysers by 2025 for green hydrogen.

In Slovakia a national hydrogen strategy adopted in April 2021 envisages production from nuclear power by electrolysis.

China has not set such aggressive targets for green hydrogen as Europe, but in 2020 hydrogen-related policies and targets increased markedly. The China Hydrogen Alliance, composed of companies, universities and research institutes, predicted in 2019 that the majority of hydrogen production would shift from fossil fuels to renewable energy by mid-century. Most of China’s hydrogen production of 22 million tonnes per year (one-third of world total of clean hydrogen) is from coal, and only 3% from renewables. It has almost 1000 coal gasifiers in operation accounting for 5% of its coal use, according to Cleantech Group. China plans to have one million FCEVs and 1000 hydrogen refuelling stations by 2030. Its target for 2050 is for hydrogen, mostly grey hydrogen, to comprise 10% of total energy, requiring about 60 Mt per year.

Japan’s Ministry of Economy, Technology and Industry (METI) produced a comprehensive hydrogen strategy roadmap in 2016 and updated it in 2019. This is to replace fossil fuel use in Japan with mainly blue and grey hydrogen. Rapid expansion of hydrogen fuel cell use is anticipated in both buildings and mobility applications such as trucks and cars by 2030. It aims to reduce the cost to JPY 30/Nm3 by then, and to ¥20 later. Japan plans to import zero-carbon hydrogen and ammonia. Annual demand by 2030 is expected to be 110,000 tonnes, with less than 20% being for pure grade for fuel cells. METI’s December 2020 Green Growth Strategy Through Achieving Carbon Neutrality in 2050 aims for hydrogen and ammonia fuelling 10% of power generation as well as providing energy for shipping and steelmaking.

In March 2020 METI's New International Resource Strategy identified ammonia as a promising means of “importing renewable energy produced in other countries.” In October 2020 METI set up the Ammonia Energy Council with major companies from the private sector and aiming to position Japan as a global leader in ammonia as an energy source, especially in power stations and marine transport, via dissemination of technology and development of supply chains.

South Korea has plans for increasing use of FCEVs, especially buses and trucks fuelled by zero-carbon hydrogen, and expects hydrogen demand to double by 2030. Its national hydrogen roadmap says: “The total potential of hydrogen in Korea amounts to 17 Mt (equivalent to 564 TWh) in 2050, accounting for more than 20% of total national energy demand.” This is mainly blue hydrogen.

Russia is planning a new hydrogen industry by 2024. Gazprom is to test a new hydrogen turbine in 2021, and a partnership between Gazprom Energieholding and Siemens is reported to be pending. Gazprom aims to produce turquoise hydrogen by pyrolysis of methane (rather than steam reforming) to leave solid carbon rather than CO2. Rosatom produced for the first time in December 2022 at the 1,760-MW Kola nuclear power plant and is planning to increase it to 10 MW as a demonstration project for wider adoption.

In April 2021 Rosatom announced plans with Gazprom to produce 30-100 Mt/yr of hydrogen on the island of Sakhalin from 2024 using steam methane reforming with CCS. It has agreed to supply fuel for hydrogen-powered trains there and envisages possible exports to Japan and South Korea from 2025.

In the USA, the Department of Energy’s (DOE's) H2@Scale initiative supports innovations to produce, store, transport, and utilize hydrogen across multiple sectors. The 11 Mt/yr of US hydrogen production has thermal potential of 1.3 EJ, and consumes nearly 5% of US natural gas usage by steam reforming, releasing 77 Mt CO2 annually. The use of hydrogen for all US transport would require some 200 Mt/yr of hydrogen, though this scenario is some way off.

In November 2020 the DOE released its Hydrogen Program Plan to provide a strategic framework for its hydrogen research, development, and demonstration (RD&D) activities. It incorporates the RD&D efforts of multiple DOE offices to advance the production, transport, storage, and use of hydrogen across different sectors of the economy. “Unlike other fuels, hydrogen requires more integration of the fossil, nuclear, and renewable energy systems, and it will take an integrated approach from all energy sectors to realize the full potential and benefits of hydrogen." A key aspect of the strategy is to enable hydrogen production from a diverse array of low-carbon domestic energy resources, including renewables, nuclear energy, and fossil fuels with CCS.

The DOE in October 2020 selected two projects to advance flexible operation of light water reactors with integrated hydrogen production systems to receive cost-shared funding. Two other projects are already under way. One of the four will focus on using a solid oxide electrolysis cell at high temperature. The Idaho National Laboratory will work with Xcel Energy to demonstrate high-temperature steam electrolysis (HTSE) technology using heat and electricity from one of Xcel Energy’s nuclear plants.

In Australia, gasification of lignite in Victoria’s Latrobe Valley is planned in the National Hydrogen Roadmap, eventually with CCS in the nearby Gippsland Basin. The Hydrogen Energy Supply Chain project will transport hydrogen by road from Loy Yang to Hastings where it will be liquefied for export to Japan. The A$500 million pilot project is expected to produce only three tonnes of hydrogen from 2020. Costs of about US$2/kg are envisaged with commercial-scale production by the 2030s. Japan’s hydrogen roadmap says of this project that “the status of progress and the likelihood of success should be confirmed by FY2025.” The Australian Roadmap suggests that in the meantime alkaline electrolysis may be used at under US$4/kg. Export markets for large amounts of liquefied hydrogen are anticipated.

Hydrogen production

Almost all hydrogen today is made from carbon-based materials, with significant CO2 emissions. World production is about 75 million tonnes* of pure hydrogen, plus 45 Mt mixed with other gases and used in industries such as steel and methanol production, both growing steadily.** A small amount is made by electrolysis of water.

* In thermal terms: 9 EJ/yr, about the same as the thermal output of US nuclear plants.

** International Energy Agency, The Future of Hydrogen – Seizing today’s opportunities, Report prepared by the IEA for the G20, Japan (June 2019)

IEA modelling has made it clear that with natural gas prices above about $6/GJ, nuclear and renewables are more cost-effective than steam reforming of methane for making hydrogen.

Cost estimates in 2019-21 (without costing CO2 emissions):

- ING: about €1.50/kg for grey hydrogen, €2.50/kg for blue hydrogen and €5-6/kg for green hydrogen.

- Bloomberg New Energy Finance: green hydrogen ranging from $2.50/kg to $6.80/kg, but potentially reducing to $1.40/kg by 2030.

- Aurora Energy Research in 2020 put levelized costs of production (higher heating value, real, 2018) at around €40/MWh (€1.6/kg) for conventional grey hydrogen, €50/MWh (€2/kg) for blue hydrogen and €80/MWh (€3.2/kg) for green hydrogen.

- S&P Global Platts in August 2020: conventional grey hydrogen at €1.24/kg, blue hydrogen at €1.31/kg and green hydrogen (polymer electrolyte membrane electrolysis including capex) at €3.43/kg.

- International Atomic Energy Agency (IAEA) figures in 2019 were: $4.15/kg for normal electrolysis, $3.23/kg for dedicated nuclear high-temperature steam electrolysis (HTSE), and $2.50/kg for off-peak HTSE, competitive with large-scale steam reforming of methane (grey hydrogen).

- LucidCatalyst in 2020: $2/kg yellow hydrogen from conventional nuclear power, potentially dropping to half that by 2030. In basic energy terms, $2/kg is $16.7/GJ (lower heating value) – well above most natural gas prices. LucidCatalyst suggests that $1.50/kg for clean hydrogen would be competitive generally with high oil prices, but under $1/kg would be needed with cheap oil.

- IEA (2020): $0.7-1.6/kg for grey hydrogen from steam reforming of natural gas (unabated), but $3.2-7.7/kg for green hydrogen from electrolysis.

- Platts: green hydrogen €4.05/kg March 2021, compared with grey hydrogen €1.64/kg.

- Platts in October 2021: green hydrogen $3.61/kg with PEM electrolyser, $3.12 with alkaline in Southern California; $2.89/kg PEM and $2.50 alkaline in southeast USA.

As well as the financial cost, the energy cost is significant. Input energy exceeds the energy content of the hydrogen output by a factor of at least 1.5.

In mid-2020, 14 new hydrogen production projects mostly based on renewable energy were under construction, some with a view to international trade. The Institute for Energy Economics and Financial Analysis (IEEFA) conservatively estimates that 2.9 million tonnes per year from such sources is likely to be online in 2030. The International Energy Agency (IEA) estimates that global hydrogen production in 2019 released 830 million tonnes of carbon dioxide, equivalent to 2.2% of energy-related emissions.

Steam methane reforming, coal gasification

Most hydrogen today is made by steam reforming of natural gas (methane, hence ‘SMR’). About one-quarter of supply is from coal, by reacting it with steam and oxygen under high temperature and pressure to form synthesis gas comprising hydrogen with carbon monoxide. These produce so-called grey hydrogen, unless the CO2 emissions are substantially mitigated by carbon capture and storage (CCS) in which case it is blue hydrogen.

In steam-methane reforming, methane reacts with steam under 3-25 bar pressure in the presence of a catalyst to produce hydrogen and carbon monoxide (with a small amount of carbon dioxide). Steam reforming is endothermic and uses steam at 700 °C to 1000 °C.

2CH4 + 2H2O ⇌ 2CO + 3H2 ∆H +206 kJ/mol

CO + H2O ⇌ CO2 + H2 ∆H -41 kJ/mol – water-gas shift reaction (exothermic)

Coal gasification is similar, reacting carbon in coal with oxygen and steam under high temperature and pressure:

3C + O2 + H2O ⇌ 3CO + H2

CO + H2O ⇌ CO2 + H2 ∆H -41 kJ/mol – water-gas shift reaction (exothermic)

With about 76% of pure hydrogen being made from natural gas and 23% from coal gasification, this gives rise to 830 Mt of CO2 emissions annually – each tonne of hydrogen produced by SMR gives rise to at least 11 tonnes of CO2.

The Great Plains Synfuel plant in the USA produces 1300 tonnes of hydrogen per day in the form of hydrogen-rich syngas from brown coal gasification, with CCS. About half of the CO2 is captured and sold to two oilfields for enhanced oil recovery.

Air Products at Port Arthur, Texas, employs SMR using vacuum-swing adsorption gas separation technology (rather than amine absorption) for carbon capture from 2013. It captures about 90% of the CO2 and sells about 1 Mt/yr for enhanced oil recovery nearby. The US Department of Energy (DOE) funded two-thirds of the cost of the project.

At the Quest project in Alberta, Canada, hydrogen is produced by SMR and an unknown proportion of the CO2 – up to 1 Mt/yr – is stored 2 km underground.

Australian plans for gasification of lignite envisage plants of over 500 t/day to be economical, hence relying on exports to achieve scale.

The IEA reported in 2021 that 16 projects producing hydrogen from fossil fuels with CCS were operational, more were planned, and 9 Mt/yr hydrogen production by 2030 was expected, led by Canada and the USA.

Pyrolysis

So-called turquoise hydrogen can be made by pyrolysis decomposition of methane, using a molten metal reactor with a catalytic active Ni-Bi alloy, leaving a solid carbon residue. The process heat can be from burning hydrogen product or methane, or electric arc. Alternatively a plasma reactor may be used.

CH4 -> C + 2H2 (endothermic)

Electroylsis

Electrolysis of water at ambient temperatures requires 50-55 kWh per kilogram of hydrogen produced* (hence 60% and potentially 70% efficient with improved catalysts). It also requires 9 litres of water for every kilogram produced. Electrolysis is undertaken on a fairly small scale today, producing only about 2% of world supply (IEA, 2019). Electrolyser plants of 1 MW are typical today, the largest is a 20 MW proton exchange membrane (PEM) plant at Becancour, Canada which can produce 8.2 t/day hydrogen. Worldwide capacity in 2019 was 25 MW, planned capacity is over 100 GW.

Worldwide capacity in mid-2021 was 300 MW, planned capacity by 2030 is 54 GW, to produce 8 Mt/yr hydrogen then, led by Europe. The IEA's Global Hydrogen Review 2021 report predicts 60% of all hydrogen production being from electrolysis by 2050, requiring 1500 TWh/yr.

The main technology considered – proton exchange membrane (PEM) electrolysis – requires high-purity water, so electrolysers need an integrated deionizer allowing them to use fairly low-grade potable water.

* The thermodynamic efficiency limit is 40 kWh/kg, and 45 kWh/kg is considered the likely best achievable. Nevertheless Rolls-Royce suggests a yield of 87,000 t hydrogen per year from electrolysis using its UK SMR producing 3.5 TWh/yr.

There are three main types of electrolyser: alkaline (AE), polymer electrolyte membrane also known as proton exchange membrane (PEM), and solid oxide.

- Alkaline, using potassium hydroxide, is the most mature technology and is widely used in fertilizer and chlorine industries, but has some limitations. Most large-scale hydrogen production by electrolysis is using alkaline electrolysers (AE). Needs 50 kWh/kg hydrogen.

- PEM units use pure water and are relatively small but can be flexible in operation. They can also generate hydrogen at high pressure (30-60 bar, compared with alkaline 1-30 bar). However they use expensive electrode catalysts (platinum, iridium) and membrane materials and have short lifetimes. Needs 55 kWh/kg hydrogen.

- Solid oxide electrolysers use ceramic materials and operate at high temperatures. Very slow ramp time, less durable than other types. Needs 40 kWh/kg hydrogen.

An anion exchange membrane (AEM) type is being developed, with dilute alkaline electrolyte in 2.4 kW modules. Efficiency of 4.8 kWh/m3 hydrogen is claimed, with low costs.

Recent plans in several countries have focused on green hydrogen production by electrolysis. The plans for massively increased electrolyser deployment, fed by surplus electricity from renewables, are based on this. It would mean that increased deployment of intermittent renewables would result in less curtailment, and thus justify such overcapacity with low utilisation (due to wind and solar intermittency). However, low capacity factors for the electrolysers would result in higher costs for the hydrogen.

High-temperature steam electrolysis based on solid oxide electrolysis cells (SOECs) requires about one-third less energy but is not yet commercial.* SOECs operate at over 600 °C (and are essentially solid oxide fuel cells run in regenerative mode). The solid oxide electrolyte is typically zirconia (zirconium dioxide, ZrO2). A source of heat such as nuclear would help commercialize SOECs and the IEA notes that nuclear power is ideally suited to this application.

* Bloom Energy is commercially deploying its solid oxide electrolysers in South Korea in 2021, where with SK E&C it has 120 MW of fuel cells.

The IEA points out that SOECs can be used in reverse mode as fuel cells to produce electricity and hence: "Combined with hydrogen storage facilities, they could provide balancing services to the power grid, increasing the overall rate of utilisation of equipment. SOEC electrolysers can also be used for co-electrolysis of steam and carbon dioxide, thereby creating a syngas mixture for subsequent conversion into synthetic fuel."

The largest SOEC system in operation in 2021 (720 kW capacity) uses renewable electricity and waste heat to produce hydrogen for a DRI steel plant. However, a 2.6 MW SOEC system is being developed in Rotterdam, and several European companies are manufacturing SOEC systems. Denmark plans to launch a manufacturing plant with an annual capacity of 500 MW by 2023.

Since the hydrogen is able to be stored much more readily than electricity, this is an important potential application of surplus power from intermittent renewable sources, as well as for nuclear power especially off-peak. Two US nuclear plants are installing small electrolysers to pilot hydrogen production off-peak, with a view to possibly moving to high-temperatrue steam electrolysis. However, production from electrolysers is expensive.

Hydrogen Europe quoted electrolyser costs in 2020 at €600/kW for AE and €900/kW for PEM. These are expected to decrease to €400 and €500 by 2030 (ITM expects about €420/kW for PEM by 2030). Solid oxide electrolysers decrease from €2130/kW to €520 in the same period. On a different basis, PEM electrolysers are quoted to produce hydrogen at $4.9/kg, AE ones at $3.8/kg.

*AE units use potassium hydroxide to form H2 and O2 at the electrodes, PEM units catalytically split water.

The IEA's The Future of Hydrogen suggests that lowest hydrogen costs will be with 2500 or more full-load hours per year of electrolyser use. At less than this, capital expenses comprise a high proportion of cost.

The IEA's Energy Technology Perspectives 2020 in its Sustainable Development scenario projects global electrolyser capacity increasing from about 170 MW in 2019 (with 25.4 MW added that year) to about 500 GW by 2040, about 1400 GW by 2050 and over 3300 GW by 2070 running at 46% capacity factor – about 4000 full-load hours per year. This would require the equivalent of around half of global electricity generation today.

Germany aims for 5 GW of installed electrolyser capacity by 2030.

BP is leading a study into producing up to 45,000 tonnes of hydrogen per year in a 250 MW electrolysis plant at Rotterdam connected to offshore wind farms. If two-thirds of this production replaced hydrogen from steam reforming natural gas it would eliminate 350,000 tonnes of CO2 emissions per year from the BP refinery.

In Germany, Ørsted and EdF Germany plan a 30 MW pilot electrolyser plant at Heide on the North Sea coast, where a number of wind farms connect, by 2023. The €89 million project has €30 million in government subsidy. Germany's biggest PEM electrolyser – 10 MW – was being commissioned in late 2020 at the Shell Rhineland refinery. A 300 MW expansion is part of the HyScale 100 project. Some of the hydrogen will make methanol for jet fuel (sustainable aviation fuel, SAF).

Ørsted and BP have a 50 MW electrolyser project at Lingen. RWE also plans a scalable electrolyser here as part of the 300 MW GETH2 project.

Siemens Smart Infrastructure and WUN H2 have been contracted to build a hydrogen production plant at Wunsiedel in northern Bavaria by the end of 2021, next to an existing 8 MW battery unit. The plant will use a 'Silyzer 300' PEM electroyser from Siemens Energy, powered by 6 MW solely from renewable energy, producing 900 t/yr in the first phase, expandable to 2000 t/yr. Siemens sees it as a demonstration plant.

Linde has ordered a 24 MW PEM electrolyser from ITM Power for its Leuna petrochemical plant in Saxony-Anhalt. It is due to start up in 2022.

At Eemshaven in Netherlands Shell's NorthH2 project is planned to produce 800,000 tonnes of green hydrogen per year from 10 GWe of offshore wind capacity. It targets 1 GW of electrolysis capacity by 2027, ramping up to 4 GW by 2030 (producing 0.4 Mt/yr hydrogen) and over 10 GW by 2040. Equinor and RWE joined the project in 2020.

Ørsted plans to develop a 1 GW electrolyser supplying industrial demand for renewable hydrogen in the Netherlands and Belgium by 2030. The SeaH2Land project would link to a new 2 GWe Dutch wind farm offshore and supply about 20% of local demand.

In Belgium, the Hyport Ostend project aims to use curtailed power from the country’s wind generation, initially from 2.26 GWe and increasing to 4 GWe. It will start with a 50 MW electrolyser to produce 100,000 t green hydrogen per year.

In Norway, Nel is setting up to produce 500 MW of electrolysers per year at Heroya from late 2021, both AE and PEM types, at about $500/kW. With expansion to 2 GW/yr it targets $300/kW. Nel has also supplied over 100 hydrogen refuelling stations in 13 countries. It projects a green hydrogen cost of $1.5/kg with renewable energy cost of $20/MWh.

In Denmark Ørsted is linking two 3.6 MWe near-shore wind turbines to a 2 MW electrolyser as a demonstration project, with €5 million government support. Also in Denmark, green hydrogen company Everfuel has contracted Norway’s Nel to supply a 20 MW alkaline electrolyser by 2022 to produce 8 tonnes per day of hydrogen from wind power.

In France, Engie’s planned Masshylia project at Martigues, west of Marseilles, will be powered by a 100 MW solar farm with a 40 MW electrolyser set to produce 5 t/day of green hydrogen from about 2024 to meet the needs of Total’s biofuel production nearby.

In Provence, France, the HyGreen project plans 12,000 tonnes per year of green hydrogen production from 900 MWe of solar power, using 760 MW of electrolysers, with storage in salt caverns. Phase 1 is planned for 2022, and the full project in 2027.

In the UK, the National Grid’s Project Union launched in March 2021 aims to develop a UK hydrogen “backbone” connecting several major industrial clusters with a 2000 km network of 100% hydrogen pipelines by 2030. It could possibly link with the EU hydrogen backbone.

The EDF Energy Hydrogen to Heysham (H2H) project in the UK demonstrated technical and commercial feasibility of producing hydrogen by electrolysis using electricity directly from nuclear with a heavily reduced carbon footprint. The report on the trial estimated that future electrolyser capacity of about 550 MW across EDF’s UK nuclear fleet could produce about 220 tonnes of hydrogen per day by 2035, with a levelized cost of hydrogen as low as £1.89/kg ($2.44/kg) depending on power price and falling technology costs over a 20-year project cycle.

Also in the UK, ITM Power is commissioning a new PEM electrolyser factory in Sheffield, with 100 MW/yr capacity increasing to 1 GW/yr about 2024.

Also in the UK, Equinor’s H2H Saltend project is planning to produce 125,000 tonnes of blue hydrogen per year for an industrial park from a 600 MW auto thermal reformer with CCS.

In Spain, Iberdrola is building a 20 MW green hydrogen unit coupled to a 100 MW solar PV array and a 20 MWh battery system for €150 million at Puertollano for ammonia production.

In Italy the gas transmission company Snam is partnering with ITM to install 100 MW of PEM electrolysers by 2025 for green hydrogen.

In Japan a 10 MW electrolyser paired with 20 MWe of solar PV started operation in 2020.

In Saudi Arabia, a $5 billion project near Neom is planned to employ 4 GWe of renewables to produce 237,000 tonnes per year of green hydrogen using Thyssenkrupp electrolysers and then green ammonia, by 2025. Production of 1.2 Mt of ammonia per year for export would be from Haldor Topsoe technology (essentially Haber-Bosch). The ammonia would be dissociated to make hydrogen for FCEV trucks and buses in Europe or elsewhere. It could be online in 2025.

In Oman, Intercontinental Energy plans a project focused on green ammonia exports. It is to produce 1.75 Mt/yr of hydrogen by electrolysis from 16 GWe wind and 10 GWe solar capacity feeding 14 GW electrolysers to make 9.9 Mt/yr ammonia. First production is expected in 2028 and it will ramp up capacity to 2038. Prior desalination may or may not be required.

In northwest Australia, east of Port Hedland and south of Broome, the Asian Renewable Energy Hub is planned with 26 GWe renewables capacity on 65,000 sq km of land with most of its output used for green hydrogen products for domestic and export markets, ammonia in particular for export. Some 12 GWe of output producing 500,000 tonnes per year of green hydrogen, largely for export, using about 1 GW of electrolysers. In October 2020 the first stage of 15 GWe received environmental approval but in June 2021 the second stage including port facility for ammonia was ruled to “have clearly unacceptable impacts”. Final investment decision by Intercontinental Energy, CWP Energy Asia and Vestas is expected in 2025 with construction start in 2026. Total capital cost is AUD $36 billion.

In South Australia, at Port Lincoln the Hydrogen Utility (H2U) is developing a 30 MW electrolyser to produce green hydrogen and ammonia. Product will be 18,000 t of ammonia for local agriculture along with 32 MWe of open cycle gas turbines running on hydrogen to supply peak load. At Crystal Brook, Neoen is considering plans to build a Hydrogen Superhub with 50 MW electrolyser fed by 300 MWe of wind and solar capacity to produce green hydrogen at 20 tonnes per day.

At Dongara in Western Australia Infinite Blue Energy aims to have its A$300 million Arrowsmith project operational in 2022. It will use 160 MWe of wind and solar capacity and produce about 900 tonnes of green hydrogen per year.

In Tasmania, a Fortescue Metals Group subsidiary plans to build a 250 MW green hydrogen plant at Bell Bay using hydropower. It would produce 250,000 tonnes per year of green ammonia.

In Canada, Hydro-Quebec has ordered an 88 MW electrolyser from ThyssenKrupp for Varennes in Quebec. After commissioning in late 2023 it is expected to supply 11,000 t/yr of hydrogen to a biorefinery for transport fuels.

At Eqianqi, Inner Mongolia, Chinese state-owned utility Jingneng Power plans to spend RMB 23 billion ($3 billion) on a 5 GWe hybrid solar, wind, hydrogen and storage facility, to be online in 2021. Green hydrogen production will be over 400,000 tonnes per year.

S&P Global Platts Analytics’ hydrogen global production database in 2020 identified 1 GW of announced electrolyser production capacity set to come online across the next five years, half of which is expected by the end of 2022. Germany has about a 20% share in the world electrolyser market, followed by Japan and China.

The IEA's Energy Technology Perspectives 2020 in its Sustainable Development scenario projects electrolyser manufacturing to increase from about 1.5 GW/yr in 2019 to about 60 GW/yr by 2070, and the cost (apparently for PEM) to fall from $850-1100/kWe today to below $300/kWe about 2070.

Hydrogen directly from nuclear heat

See section above under Role of Nuclear Power.

Hydrogen uses

Supplement in reticulated natural gas

In most pipelines, 15-20% hydrogen can be added to natural gas, but with new trunk pipelines like Nord Stream in Europe the proportion could be up to 70% to convey hydrogen to international markets. One limitation is that hydrogen has only one-third the calorific value of methane by volume, hence boilers need modification to run on higher mixes of hydrogen than about 20%. Also hydrogen can cause embrittlement of steel.

In the USA, the Gas Technology Institute is currently testing all US natural gas transport and distribution infrastructure components for various hydrogen fraction blends with natural gas to determine how much hydrogen can be blended into existing natural gas systems.

With the power-to-gas strategy, Uniper has a 2 MW pilot plant to produce up to 360 m3/h of hydrogen at Falkenhagen, Germany, to feed into the Ontras gas grid, which can function with 5% hydrogen. Vattenfall at Prenzlau in Germany is also experimenting with hydrogen production and storage from wind power via electrolysis. Also in Germany, near Neubrandenburg in the northeast, WIND-projekt is using surplus electricity from a 140 MWe wind farm to make hydrogen, storing it, and then burning it in a combined heat and power (CHP) unit to make electricity when demand is high. However, there is an 84% loss in this RH2-WKA (renewable hydrogen - Werder, Kessin, Altentreptow) demonstration process.

Germany’s biggest operating power-to-gas plant is a 6 MW unit at Energiepark Mainz. RWE and Siemens plan a 105 MW power-to-gas pilot project, GET H2, at Lingen, using wind power, and two other similar projects are planned: Element Eins and Hybridge. In the Netherlands, Gasunie plans a 20 MW unit. BNetzA forecasts a 3 GW potential for power-to-gas by 2030.

In France the H2V59 project plans to produce 28,000 t hydrogen per year using about 100 MW electrolyser capacity for injection into the natural gas grid.

In the UK, Project Union launched in March 2021 aims to repurpose around 25% of current gas transmission pipelines to carry “at least a quarter” of current British gas demand, according to National Grid.

Oil refining

Hydrogen is a key processing agent in petroleum refining, for desulfurizing and catalytic cracking of long-chain hydrocarbons.* About one-quarter of world production is used to convert low-grade crude oils (especially those from tar sands) into liquid and energy-dense transport fuels such as gasoline and diesel fuel. Heavy aromatic feedstock is converted into lighter alkane hydrocarbon products under a wide range of very high pressures (7000-14,000 kPa) and high temperatures (400-800°C), utilising hydrogen and special catalysts. It is also important for removing contaminants such as sulfur from these fuels.

* e.g. (CH)n tar sands or (CH1.5)n heavy crude to (CH2)n transport fuel about 42-45 MJ/kg (32-39 MJ/L). Upgrading heavy crude oil and tar sands requires 3 to 4 kilograms of hydrogen per barrel (159 litres) of product.

Production of ammonia

Synthesis of hydrogen and nitrogen to produce ammonia – about 180 Mt/yr or 1 PWh* – accounts for over half of the world's pure hydrogen demand. This uses the Haber-Bosch process.

* On the basis of 5.18 kWh/kg ammonia, quantities may be quoted in GWh, PWh, etc.

Most ammonia today is used for agricultural fertilizers. Some is used (as ammonium nitrate, with diesel fuel) for mining explosives. It may also be burned as transport fuel or cracked to yield hyrogen as fuel.

According to Norman Borlaug, 1970 Nobel laureate and 'grandfather of the green revolution', organic nitrogen in the world's soils is only sufficient to feed one-third of today's population. The rest must come from inorganic additions. Most of the world's nitrogen fertilizers are made using the Haber process (see below), combining hydrogen with abundant atmospheric nitrogen. The resulting ammonia is then oxidized to nitrates.

The Haber process

The Haber Process (Haber-Bosch Process) combines nitrogen from the air with hydrogen derived mainly from natural gas (methane) into ammonia. The reaction is reversible and the production of ammonia is exothermic.

German scientist Fritz Haber invented the process to combine atmospheric nitrogen with hydrogen in 1909 and received the Nobel Prize for chemistry in 1918 for creating "an exceedingly important means of improving the standards of agriculture and the well-being of mankind," which now looks like a considerable understatement. It was scaled up by the chemical engineer Karl Bosch, so is often known as the Haber-Bosch process. Bosch received a Nobel Prize in 1931.

N2 + 3H2 ⇌ 2NH3 ∆H -92 kJ/mol (exothermic, using a metal catalyst at high temperature and pressure)

The Haber process produces about 180 million tonnes of anhydrous ammonia per year for nitrogen fertilizers and consumes about 3-5% of the world's natural gas production to make the hydrogen for it. The nitrogen is obtained cryogenically from air.

Looking to the future, ammonia could have a key role in the storage and transport of hydrogen – see later section. It may also be used as a fuel. In Japan projects are exploring co-firing ammonia with coal in boilers, and ammonia with natural gas in combustion turbines. Ammonia also has potential use as a maritime fuel, since it can be used in ship engines with only minor modification. Also it can be used in some fuel cells.

Production of methanol and DME fuels

Considering the storage and portability challenges of hydrogen itself, as well as the radical change to fuel cell cars, there is some use of methanol as an additive to petrol/gasoline. Any future liquid fuel for cars needs to compete with petrol at 32 MJ/L or diesel fuel at 39 MJ/L and be no more difficult to store and refuel than LPG. Methanol (CH3OH) has 16 MJ/L. It may be used in fuel cells.

LNG has similar problem to hydrogen, ethanol generally comes from biomass, but methanol can be made from CO2 and hydrogen. Using zero-carbon hydrogen, and with abundant CO2, automotive fuel can be provided forever, using present engine technology.

For diesel engines, dimethyl ether (CH3-O-CH3, DME) is better, and this is made by dehydrating a couple of methanol molecules. It is a gas but can be stored under low pressure as a liquid, like LPG. DME has an energy density of 18-19 MJ/L, so less than oil-based fuels, but usable and easily stored. Any post-oil future may be methanol-based.

Methanol today is produced in a variety of ways, but ideally it will be produced from atmospheric CO2 with hydrogen produced by nuclear energy, and using more nuclear energy in the conversion process.

CO2 + 3H2 ⇒ CH3OH + H2O ∆H -49.5 kJ/mol at 25°C, -58 at 225°C, exothermic

(The endothermic reverse water shift reaction CO2 + H2 ⇒ CO + H2O will occur at same time, along with: CO + 2H2 ⇒ CH3OH ∆H -91 to -98 kJ/mol, exothermic)

Dimethyl ether is made in a dehydration reaction:

2CH3OH ⇒ CH3OCH3 + H2O ∆H -23 kJ/mol

Methanol and DME production is at relatively low temperature (compared with thermochemical hydrogen production) – 230-350°C.

DME is already used as propane replacement, and world production capacity is over 10 million tonnes per year. China alone was aiming for 20 million tonnes per year DME capacity by 2020. Sweden is producing BioDME from black liquor. Ford has produced a DME-powered car – a 1.6 litre Mondeo, as part of the three-year xME project led by Ford with members of the FVV, Germany's international combustion engine technology research network.

Most methanol production today is from synthesis gas (carbon monoxide and hydrogen) derived from biomass or fossil fuels, or from hydrogen by steam reforming of natural gas. Most methanol use is for making plastics. About 14% of it is used as a petrol additive and 7% to make DME. Methanol production accounts for about 13% of the word's hydrogen demand.

Ethanol production is covered in the Nuclear Process Heat for Industry information page.

Methanol, together with derived DME, can be used as:

- A convenient energy storage medium.

- A readily transportable and dispensable fuel for internal combustion engines and diesel (compression ignition) engines with little engineering change.

- As sustainable aviation fuel (SAF) for jet engines.

- A fuel for fuel cells.

- A feedstock for synthetic hydrocarbons and their products, including fuels, polymers and even single-cell proteins (for animal feed and/or human consumption).

In Iceland, methanol production is already occurring using CO2 captured from flue gas and hydrogen from electrolysis using renewable energy. The company Carbon Recycling International was set up in 2006 to produce renewable methanol for automotive use and also biodiesel.

In China, the Shanghai Advanced Research Institute has developed a process to convert CO2 and hydrogen into long-chain hydrocarbons such as in gasoline. A multifunctional catalyst containing indium oxide mixed with a zeolite initially produces methanol, which then interacts with the zeolite to produce long-chain hydrocarbons. Another research group at the Dalian Institute for Chemical Physics uses a magnetite and zeolite catalyst to also produce long-chain hydrocarbons from CO2 and hydrogen, but with different intermediate products. While there are a number of processes that can convert CO2 to single-carbon hydrocarbons such as methanol, the synthesis of longer-chain hydrocarbons has previously been elusive.

In 2018 global methanol capacity reached about 140 million tonnes and is expected to reach 280 Mt by 2030, according to Statista. The Methanol Institute quotes 110 Mt world capacity (undated, on its website) but publishes figures indicating about 150 Mt capacity and 100 Mt demand in 2020.

Hydrogen can also be reacted with carbon dioxide at 300-400°C to give methane, using the exothermic Sabatier process.*

* CO2 + 4H2 ⇒ CH4 + 2H2O. This seems of more relevance to space travel than transport on Earth, though on a small scale it will scrub CO2 and CO from hydrogen streams for fuel cells.

Use directly as fuel for land transport – fuel cells

Burning hydrogen produces only water vapour, with no carbon dioxide or carbon monoxide. However, unless it is liquid it is far from being an energy-dense fuel volumetrically, and this limits its potential use, especially for light motor vehicles. There is more potential for trucks. Ammonia is more energy-dense, and burns to water vapour and NOx or nitrogen.

Hydrogen can be burned in a normal internal combustion engine, and some test cars were thus equipped. Trials in aircraft have also been carried out. Until about 2010 the internal combustion engine was the main affordable technology available for using hydrogen.*

*One hundred BMW Hydrogen 7s were built, and the cars covered more than 2 million kilometres in test programmes around the globe. BMW is the only car manufacturer to have used hydrogen stored in its liquid state. BMW has abandoned this development and is collaborating with Toyota on fuel cell vehicles.

For transport, hydrogen’s main use is in fuel cell electric vehicles (FCEVs). A fuel cell is conceptually a refuellable battery, making electricity as a direct product of a chemical reaction. But where the normal battery has all the active ingredients built in at the factory, fuel cells are supplied with fuel from an external source and oxygen from the air. They catalyse the oxidation of hydrogen directly to electricity ideally at relatively low temperatures.

Proton exchange membrane or polymer electrolyte membrane (PEM) fuel cells are the main type used in cars and heavy vehicles. These operate at around 80-90 °C with high volumetric power density and an acidic electrolyte. They have high volumetric power density and long life but require high-purity hydrogen and a noble metal catalyst – typically platinum, adding to cost. They have about 60% efficiency in converting chemical to electrical energy to drive the wheels of an electric vehicle though in practice about half that has been achieved.

Alkaline fuel cells (AFCs) operate at about 200 °C, are relatively well-developed and are above 60% efficient. NASA has used AFCs since the 1960s in Apollo missions and on the space shuttle (they also produce potable water). They are the least expensive to make, using non-noble metal catalysts, and can use less-pure hydrogen from cracking ammonia – but poisoning by CO2 leading to formation of insoluble carbonate limits their commercialization.

Other fuel cell technologies, mostly fuelled by hydrogen, include:

- High-temperature proton exchange membrane fuel cell (PEMFC) operating up to 200 °C, which is less vulnerable to catalyst poisoning by CO.

- Phosphoric acid fuel cell (PAFC) – well-developed but high-temperature and expensive, about 40% efficient, used only for stationary power generation.

- Solid oxide fuel cell (SOFC) – operating at 800-1000 °C and 60% efficiency. These run on natural gas or hydrogen but have relatively low tolerance to being turned on and off and low volumetric power density, hence are mainly used for stationary power generation (though lower-temperature versions are being developed).

- Molten carbonate fuel cell (MCFC) – high-temperature (about 650°C) with non-noble catalyst and accepting a variety of fuels, for stationary power generation due to low volumetric power density.

- Direct methanol fuel cell (DMFC) technology, fuelled by methanol not hydrogen, is practical for portable electronic uses but not favoured for automotive use at present.

A comparison of fuel cells and description of fuel cells are published by the US Department of Energy.

At present fuel cells are much more expensive to make than internal combustion engines (burning petrol/gasoline or natural gas). In the early 2000s, PEM units cost over $1000 per kilowatt, compared with $100/kW for conventional internal combustion engine. The target cost for a PEM fuel cell stack for FCEV is below €100/kW, which will require reducing the amount of palladium catalyst.

The high cost of transporting hydrogen means that production is ideally close to where it is used.

The direct methanol fuel cell (DMFC) technology is practical for portable electronic uses but not favoured for automotive use at present. Other fuel cell technologies include: the high-temperature proton exchange membrane fuel cell (PEMFC) operating up to 200°C, which is less vulnerable to catalyst poisoning by CO; the phosphoric acid fuel cell (PAFC) – well developed but high-temperature and used only for stationary power generation; the solid oxide fuel cell (SOFC) – operating over 800°C, hence mainly used for stationary power generation; and the molten carbonate fuel cell (MCFC) – high-temperature (about 650°C) and accepting a variety of fuels, for stationary power generation.

For long-haul buses and trucks, FCEV powertrains have more promise than EV battery-based systems. The initial use of hydrogen for transport is municipal bus and truck fleets, already on the road in many parts of the world. These are centrally-fuelled, so avoid the need for a retail network, and onboard storage of hydrogen is less of a problem than in cars. Buses typically use two fuel cell stacks of about 100 kW plus a small traction battery topped up by regenerative braking. They carry 30 to 50 kg of compressed hydrogen, stored in polymer-lined, fiber-wound pressure tanks at 350 bar (35 MPa). Newer fuel cell buses use only 8 to 9 kg of hydrogen per 100 km, which compares well in energy efficiency with diesel buses.

Smaller FCEVs are further from widespread commercial use than EVs and PHEVs, though Japan had 3400 FCEV on the road in 2019. A significant ramp up in numbers is expected in the 2020s. China was aiming for 5000 FCEV by 2020 and one million by 2030. The EV30@30 campaign envisages 30% of new car sales being EVs by 2030. The IEA reported that 43,000 FCEVs were on the road in mid-2021, one-fifth being buses and trucks.

Fuel cell hybrid vehicles (FCHV), with an electric motor driven by the battery and the fuel cell keeping the battery topped up and giving it greater life (by being kept more fully charged) are being marketed. Battery capacity is smaller than normal battery EVs and PHEVs, but the whole fuel cell stack plus hydrogen tank is much lighter than comparable EV battery packs. Plug-in FCEVs are possible, with greater battery capacity. The main FCEV problem apart from cost is the very few refuelling stations as yet.

The fuel cell powertrain is a modular assembly. It comprises fuel cell stack, system module, hydrogen tanks, battery and electric motor. To August 2020 Ballard in USA had supplied over 670 MW of PEM fuel cell units, which – in medium and heavy vehicles, buses and trucks – had clocked up more than 50 million kilometres. About 70% of this was in China.

Proton Motor Power Systems in 2020 has a production line near Munich being expanded to 10,000 fuel cell stack modules per year. The single stack modular designs cover power ranges from 2 up to 16 kW in the lower power class (PM200) and from 15 to 75 kW in the upper power class (PM400). It has also designed a multi-stack system for power demands over 100 kW for larger trucks, trains, ships and stationary back-up power applications. Its first fuel cell train order for a 180 kW system is to be delivered early in 2021. It envisages its fuel cell stacks being used in combination with batteries for hybrid electric-driven light duty vehicles, inner city buses, or for industrial power supply. It is providing 37 kW and 67 kW fuel cell systems for China.

In 2019 Arizona-based Nikola Corporation embarked on a joint venture with IVECO in Europe to develop and market both EV trucks and fuel cell heavy trucks. Nikola’s main aim is to market FCEV trucks, and the Nikola Two FCEV truck is expected on the market in 2023, with 800-1200 km range, up to 750 kW power from 800 volt AC motors, up to 2700 Nm peak torque, through a single-speed transmission, and a 250 kWh lithium-ion battery.

Nikola also plans to market a 4x4 FCHV pick-up truck, the Badger, with 120 kW fuel cell stack and 960 km range (half each from fuel cell and battery). In 2020 GM bought 11% of the company and will make the Badger in BEV (battery electric vehicle) and FCEV versions. The company has ordered 85 MW of alkaline electrolysers to support hydrogen refuelling stations.

In April 2020 Daimler Truck and Volvo Group signed a non-binding agreement to develop, produce and commercialize hydrogen fuel cell systems for heavy-duty and especially long-haul vehicles. Daimler is to consolidate its fuel cell and hydrogen storage system activities in the joint venture.

The fuel cell stacks in cars have an output of about 100 kW or more. As compared with battery electric cars they usually have a better range than EVs – around 400 to 500 km – with a lower vehicle weight and much shorter refuelling times of three to five minutes. They usually carry 4 to 7 kg of hydrogen, stored in carbon fibre pressure tanks at 700 bar (70 MPa).

Honda, Toyota and Hyundai are the main car manufacturers developing FCEVs. Ford, Nissan, Renault and Mercedes have pulled back from FCEV development. See Electric Vehicles information page.

An issue with using hydrogen in fuel cells is overall energy efficiency. If a nuclear reactor generates electricity which is used for electrolysis of water and the hydrogen is compressed and used in fuel cell powered vehicle (assuming 60% efficient fuel cell), the efficiency is much lower than if the electricity is used directly in EVs and PHEVs.* However, if the hydrogen can be made by thermochemical means the efficiency doubles, and they are comparable with EV/PHEV.

* Say: 35% x 75% x 60% x 90% = 14% optimistically (reactor, electrolysis, fuel cell, motor) to:

50% x 60% x 90% = 27% for future thermochemical hydrogen

cf 35% x 90% = 31% for EV.

Apart from carbon-free production and then distribution to users, on-board storage is the principal problem for hydrogen as an automotive fuel – it is impossible to store it as simply and compactly as gasoline or LNG fuel. The options are to store it at very low temperature (cryogenically), at high pressure, or chemically as hydrides. The last is seen to have considerable potential, though refuelling a vehicle is less straightforward.

Pressurized storage is the main technology available now and this means that at 700 times atmospheric pressure (70 MPa), five times the volume is required than for an equivalent amount of petrol/gasoline. The weight penalty of a steel tank is reduced by use of carbon fibre. Earlier, the tank had been about 50 times heavier than the hydrogen it stored, now it is about 20 times as heavy, and the new target is ten times as heavy. Storage for buses can be at 35 MPa, but for cars needs to be twice that.

One promising hydride storage system utilizes sodium borohydride as the energy carrier, with high energy density. The NaBH4 is catalysed to yield its hydrogen, leaving a borate (NaBO2) to be reprocessed.

Fuel cells are currently being used in electric forklift trucks and this use is expected to increase steadily. They apparently cost a lot more than batteries but last twice as long (10,000 hours) and have less downtime.

The Hydrogen Mobility Europe (H2ME) project announced in 2015 extends over six years supported by the Fuel Cells and Hydrogen Joint Undertaking (FCH JU) with funding from the EU’s Horizon 2020 research programme. The initiative is aimed to significantly expand the European hydrogen vehicles fleet and in so doing, to confirm the technical and commercial readiness of vehicles, fuelling stations and hydrogen production techniques. It involves deploying FCEVs and hydrogen refuelling stations (HRS), initially mostly in Germany, as well as testing the ability of electrolyser-hydrogen refuelling stations to help balance the electrical grid. The hydrogen refuelling stations are designed so that vehicles can be refuelled in under five minutes.

Germany has a train powered by a hydrogen fuel cell, the Alstom Coradia iLint, with a range of 1600 km and in service since September 2018. Siemens is building a prototype hydrogen fuel cell railcar for Deutsche Bahn (DB), based on the Mireo Plus hybrid battery-electric train. It uses Ballard low-temperature fuel cells with higher power density and longer service life than those for buses and trucks. It will have 1.7 MW of traction power and 600 km range at up to 160 km/h and a 15-minute refuelling time. DB is aiming to replace all its diesel trains with hydrogen fuel cell electric trains.

In 2019 there were about 370 hydrogen refuelling stations worldwide, 270 of these publicly accessible. There were 152 in Europe, 136 in Asia and 78 in North America (most in California). In mid-2021 there were 134 active refuelling stations in Japan, 90 in Germany and 48 in California. South Korea and China had about 40 each.

Use directly as fuel for marine transport – fuel cells and ammonia

In April 2020 the Swiss electrical engineering company ABB signed an agreement with Hydrogène de France (HDF) to optimize fuel cell manufacturing to produce a megawatt-scale power plant for marine vessels to be built at HDF’s factory in Bordeaux, France. The arrangement will draw upon Ballard Power Systems proton exchange membrane (PEM) fuel cell technology. ABB said that hydrogen was not the sole energy carrier under consideration. “Although hydrogen is generally preferred because of its greater efficiency, ammonia and methanol with higher volumetric energy density makes it a good choice for deep-sea shipping. [It’s likely] we will see companies using a mix of energy carriers depending on their needs.”

In September 2019, Japan Engine Corporation announced a partnership with the National Maritime Research Institute (NMRI) to begin developing engines fuelled by hydrogen and ammonia. Ballard has developed the FCwave fuel cell module for marine applications. This builds on NMRI development of engines fuelled by ammonia.

The IEA's Energy Technology Perspectives 2020 in its Sustainable Development scenario projects about 12% of marine transport being fuelled by hydrogen and 55% by ammonia by 2070, mostly in internal combustion engines rather than fuel cells, with these fuels increasing slowly from 2030 and more rapidly from 2050. Fuel cells with hydrogen are likely to be confined to short-range shipping due to storage costs. (Nuclear power for propulsion is not considered at all.)