Nuclear Power in Ukraine

- In February 2022, Russia launched a military offensive against Ukraine. For further information see page on the Russia-Ukraine War and Nuclear Energy.

- Ukraine is heavily dependent on nuclear energy – it has 15 reactors generating about half of its electricity.

- Ukraine had been receiving most of its nuclear services and nuclear fuel from Russia, but is reducing this dependence. In June 2022 an agreement was signed with Westinghouse that will see the company provide all fuel for the Ukrainian fleet.

- In 2021 Westinghouse was contracted to finish building a new reactor at Khmelnitsky using AP1000 components from an aborted US project.

- The government is looking to the West for both technology and investment in its nuclear plants. An agreement to build nine AP1000 reactors at established sites has been signed with Westinghouse.

Reactors

Construction

Shutdown

Operable nuclear power capacity

Electricity sector

Total generation (in 2023): 105 TWh

Generation mix: nuclear 52.0 TWh (49%); coal 23.3 TWh (22%); hydro 12.4 TWh (12%); natural gas 11.0 TWh (10%); solar 4.6 TWh (4%); wind 1.0 TWh; biofuels & waste 0.7 TWh.

Import/export balance: 0.4 TWh net import (0.8 TWh imports; 0.4 TWh exports).

Total consumption: 82.4 TWh

Per capita consumption: c. 2800 kWh in 2023

Source: International Energy Agency and The World Bank. Data for year 2023.

Total capacity in 2021 was about 56 GWe, including 28 GWe coal-fired/gas, 13.8 GWe nuclear, 8.1 GWe solar and wind, and 6.3 GWe hydro. A 750 kV link from Rovno to Kiev was commissioned in December 2015, and allowed the Rovno and Khmelnitski plants to operate at full power (4840 MWe gross) for the first time. In 2021 Ukraine generated 156 TWh of electricity, but following Russian attacks on its energy infrastructure generation has reduced significantly. Ukraine has reported that half of its power-generating capacity has been disrupted due to Russian attacks on energy infrastructure.

Energy policy

A large share of primary energy supply in Ukraine comes from the country's uranium and substantial coal resources. The remainder is oil and gas, mostly imported from Russia, but increasingly from the European Union (EU). In 1991, due to the breakdown of the Soviet Union, the country's economy collapsed and its electricity generation declined dramatically from 296 TWh in 1990 to 170 TWh in 2000, all the decrease being from coal and gas plants. In December 2005 Ukraine and the EU signed an energy cooperation agreement which links the country more strongly to western Europe in respect to both nuclear energy and electricity supply. Ukraine has investigated developing its significant shale gas deposits, but domestic production remains modest.

In mid-2012 the Ukraine energy strategy to 2030 was updated, and 5000-7000 MWe of new nuclear capacity was proposed by 2030, costing some $25 billion. A major increase in electricity demand to 307 TWh per year by 2020 and 420 TWh by 2030 was envisaged, and government policy was to continue supplying half of this from nuclear power. This would have required 29.5 GWe of nuclear capacity in 2030, up from 13.8 GWe (13.1 GWe net) through to 2021. The new government formed in 2014 confirmed these targets, and said that Ukraine aimed to integrate with the European power grid and gas network to make the country part of the European energy market by 2017. In 2016 TSOs of continental Europe signed agreements with Ukrenergo and Moldelectrica for the future interconnection of power systems. In February 2022 Ukraine requested emergency synchronization to the EU grid and on 16 March the grids of Ukraine and Moldova were synchronized with the continental European network on a trial basis.

Earlier in February 2021 the government confirmed the need for three more nuclear power reactors, notably completing Khmelnitsky 3&4 and building Rivne 5 to replace the two older units there, as well as implementing the 'energy bridge' project to Poland and Hungary. In June 2022 Energoatom and Westinghouse signed an agreement to construct nine AP1000 units in Ukraine (see below). In December 2023 Ukraine's energy minister, Energoatom and Westinghouse signed an agreement on the purchase of equipment for what would become Khmelnitsky 5.

Ukraine-EU ‘energy bridge’ (Energomost)

In March 2015 an agreement was signed by Ukraine’s Ukrenergo distribution company and Polenergia, a Polish counterpart, to export electricity as part of the Ukraine-European Union ‘energy bridge’, and related to the Baltic Energy Market Interconnection Plan. This would enable greater use of Ukraine’s nuclear capacity and is to generate funds to pay for increasing that capacity at Khmelnitski by completing units 3&4. The plan is for a 750 kV, 2000 MW transmission connection from Khmelnistki 2 to Rzeszow in Poland, taking in also Ukraine’s Burshtyn coal-fired plant in the far west of the country, with Khmelnistki 2 then being disconnected from the Ukraine grid and synchronized with the EU grid, as Burshtyn already is*. Albertirsa in Hungary is also to be linked. In June 2015 the government approved the project, but it has not yet proceeded.

* The 2300 MWe Burshtyn power station was disconnected from the national grid in 2002 to form the Burshtyn Energy Island, synchronized with the EU grid – ENTSO-E – and with a 400 kV connection to Hungary, Slovakia and Romania and a HVDC link proposed. Replacement of one-third of its old capacity with a new supercritical unit is proposed. However, Burshtyn partly relies on coal from eastern Ukraine mines now controlled by pro-Russian rebels. In 2017, 550 MWe effective capacity was reported.

The project consortium comprises Polenergia, EdF Trading and Westinghouse, which had already assisted in its feasibility study. The estimated project cost is $2.6 billion.

In August 2016 Energoatom signed an agreement with Korea Hydro & Nuclear Power (KHNP), one objective of which is to cooperate in the Ukraine-EU energy bridge project, as well as completing Khmelnitski 3&4. In September 2020 KHNP was proposing to build an APR1400 reactor at Rovno.

Nuclear power industry

Operable reactors in Ukraine

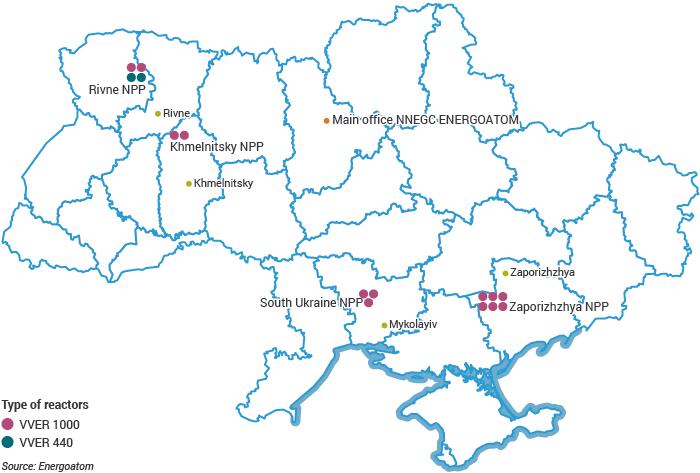

Ukraine's nuclear power plants are operated by NNEGC Energoatom, the country's nuclear power utility. All reactors are Russian VVER types, two being upgraded 440 MWe V-312 models and the rest the larger 1000 MWe units – two early models and the rest V-320s.

Nuclear industry development

Nuclear energy development started in 1970 with construction of the Chernobyl power plant, the first unit being commissioned in 1977. Unit 4 came online in 1983 and was destroyed in 1986.

Though the Ukrainian nuclear industry was closely involved with Russia for many years, it remained relatively stable during the changes that occurred when the country became independent of the former Soviet Union. In fact, during that period and since, there have been continuing improvements in the operational safety and output levels of Ukraine's nuclear reactors.

Load factors increased steadily since the first reactor was commissioned in 1977 and reached 81.4% in 2004. A decrease of the country's load factor after 2005 is related to restrictions imposed by the national electricity grid. In 2019 it was 75%.

At the end of 1995 Zaporozhe 6 was connected to the grid making Zaporozhea the largest nuclear power station in Europe, with a net capacity of 5700 MWe. (The second largest station operating is Gravelines, near Dunkerque in France, with a net capacity of 5460 MWe.) The Zaporozhe plant has been under Russian occupation since March 2022, with all six units in cold shutdown since September 2022.

In August and October 2004 Khmelnitski 2 and Rovno 4 respectively were connected to the grid, bringing their long and interrupted construction to an end and adding 1900 MWe to replace that lost by closure of Chernobyl 1&3 in 1996 and 2000 respectively. They were completed by Energoatom using a consortium of Framatome ANP and Atomstroyexport. See fuller account of K2-R4 in Appendix below.

Earlier in 1990 construction of three reactors (units 2-4) at Khmelnitski had been halted, though the site infrastructure for all four units was largely completed. Unit 3 was (and is) 75% completed; unit 4, 28% completed. These have been maintained to some extent since. See section on Building further nuclear power capacity below.

Other, single VVER-1000 reactors were under construction at Chyhyryn, Odessa, Kharkiv and in Crimea at Shcholkine, but work on all ceased in 1989-90.

In June 2014 the energy ministry said that a new concept for the development of nuclear power would include the technical and financial aspects of the construction of new power units, as well as advancing plans for a fuel fabrication plant and a waste repository. In July the cabinet reviewed the situation, affirmed the priority of nuclear power, and said that a western-design reactor might be built at South Ukraine, which had access from the sea for large equipment delivery.

In August 2018, the Russian government and representatives of Rosatom met to discuss building a nuclear power plant for desalination of seawater in Crimea.

Lifetime extension and upgrades

Original design lifetime of the Russian reactors was 30 years. Energoatom initially planned to extend the lifetimes of Rovno 1&2 and South Ukraine 1 by 15 years and final checking of the pressure vessels (for embrittlement) and the internals of all three units was in 2008-9. In mid-2012 Energoatom announced that the 11 oldest 1000 MWe reactors were to have 20-year life extensions by 2030.

A 10-year extension of the operating licences for Rovno 1&2 was granted by the State Nuclear Regulatory Inspectorate of Ukraine (SNRIU) in December 2010. A further ten-year extension to 2030 was granted for unit 1 in December 2020. Energoatom said that more than $300 million had been invested in upgrading the two units since 2004, in collaboration with the IAEA. In 2006 Rovno was the first Russian-designed plant to host an IAEA OSART mission to review safety. Then in 2016 it hosted the first IAEA cross-regional joint-centre peer review, incorporating post-Fukushima aspects. In July 2018, Rovno 3 was granted a 20-year extension by the SNRIU.

In February 2013 the SNRIU said that South Ukraine 1 could have an operating lifetime extension after a major upgrade during 2013, and in October it approved plans for a ten-year extension to 2023. In May 2015 South Ukraine 2 was shut for major upgrading over seven months costing $114 million to enable a ten-year operating lifetime extension, which was confirmed by the SNRIU in December. In January 2016 the government approved a $38 million project over three years to increase the cooling water supply to the South Ukraine plant so as to achieve up to a 2.5 TWh increase in annual output. In May 2019 unit 3 was shut down for upgrading over six months to enable a ten-year operating lifetime extension to 2030, confirmed by the SNRIU in December. In November 2023 the SNRIU approved a ten-year licence extension for South Ukraine 1, allowing the reactor to operate until December 2033.

Zaporozhe (Image: Energoatom)

In May 2015 Energoatom applied for a 15-year licence extension for Zaporozhe 1, and in September 2016 the licence was extended to December 2025 after an extended outage for upgrading. With a similar upgrade underway, in August 2016 Zaporozhe 2 was cleared for operation to 2026, and the licence was extended in October. Zaporozhe 3 shut down in February 2017 for a similar upgrade. Unit 4 was closed in March 2018 for upgrade work, and the SNRIU granted a ten-year operating licence extension to 2028 in October. The SNRIU granted a 10-year licence extension to 2030 for unit 5, after a major upgrade in 2020.

In July 2019 a 10-year extension to the operating licence of Khmelnitski 1 was granted by the SNRIU so that it can operate to December 2028. A series of upgrades to allow for the lifetime extension were undertaken over 2018-19. In August 2025, the SNRIU authorized Khmelnitsky 2 to operate until September 2035.

The lifetime extension programme was challenged under the UN Convention on Environmental Impact Assessment in a Transboundary Context – informally known as the Espoo Convention – which has been ratified by 44 countries and the EU. The convention comes under the Economic Commission for Europe and the challenge was on the basis of inadequate environmental assessment.

Earlier in March 2013 the European Bank for Reconstruction and Development (EBRD) announced a €300 million loan for comprehensive reactor safety upgrading, matching €300 million from Euratom. The €1.4 billion project includes up to 87 safety measures addressing design safety issues comprising the replacement of equipment in safety-relevant systems, improvements of instrumentation and control for safety-relevant systems and the introduction of organisational improvements for accident management. The programme began in 2011 and was to be completed by the end of 2017, but was delayed by three years to 2020 due to delays in the loans following the 2014 change in government.

In October 2015 Energoatom signed agreements with Tractebel Engineering from Belgium for safety upgrades and capacity uprates of reactors. Tractebel has offered technical and engineering assistance with completing Khmelnitski 3&4. In March 2016 Energoatom announced an agreement between Turboatom and Westinghouse to uprate the capacity of 13 VVER-1000 turbine generator sets by up to 10%.

In November 2015 Energoatom signed an agreement with Areva “for safety upgrades of existing and future nuclear power plants in Ukraine, lifetime extension and performance optimization.” It said that its “very strong modernization and reconstruction programme… is being funded by the European Community, Euratom and the EBRD” as part of a new phase in the development of EU-Ukraine contractual relations, aiming at political association and economic integration. A 2012 agreement for Rosatom to complete two Russian reactors had been revoked in September 2015.

In October 2016 Energoatom signed an agreement with GE Power Sp. Zo. – formerly Alstom’s Polish subsidiary – to upgrade nuclear power plant turbine hall equipment and to expand cooperation in the long-term service of such equipment.

In September 2017, Energoatom signed a contract with Westinghouse to supply monitoring instrumentation systems to the Zaporozhe plant as part of the ongoing Complex (Consolidated) Safety Upgrade Program of Power Units of Nuclear Power Plants.

In October 2018 Energoatom signed a strategic partnership agreement with Kharkov-based Electrotyazhmash for the replacement of old 1000 MWe turbogenerators.

In August 2019, Energoatom embarked on a modernisation programme for all 15 operable reactors to be completed over 2020-2024. The programme involves the replacement of turbine condensors, as well as turbine upgrade work.

Building further nuclear power capacity

Interruptions in natural gas supply from Russia in January 2006 sharply focused attention on the need for greater energy security and the role of nuclear power in achieving this. A nuclear power strategy involving building and commissioning 11 new reactors with total capacity of 16.5 GWe (and 9 replacement units totalling 10.5 GWe) to more than double nuclear capacity by 2030 was approved by the government in 2006 to enhance Ukraine's energy independence. No significant progress has been made on this.

Ukraine's 2006 strategy envisaged completing Khmelnitski 3&4, which were respectively 75% and 28% complete when work stopped in 1990.

Initially it was expected that an international tender would open up the choice of technology and in March 2008 Areva, Westinghouse and South Korean suppliers were invited to bid on completing or replacing them, along with Atomstroyexport and Skoda – all involving pressurized water (PWR) types. In the event only Atomstroyexport and Korea Hydro & Nuclear Power (KHNP) submitted bids, with the former being chosen to complete the partially-built units. KHNP renewed its interest in the project in 2016 and proposed building a new unit at Rovno in 2020 (see below).

The government announced in September 2008 that construction of Khmelnitski 3&4 would resume in 2010 for completion in 2016 and 2017, these completion dates being reaffirmed in the mid-2011 energy policy update. An intergovernmental agreement with Russia on completing the two units was signed in June 2010, and in February 2011 a framework contract was signed for Atomstroyexport to complete them as AES-92 plants with V-392B reactors similar to those already on the site. Under the intergovernmental agreement, some 85% of the estimated UAH 40 billion (€3.7 billion) project would be financed through a Russian loan, with 15% funding coming from Ukraine. The loan would be repaid within five years after the reactors went into service. In July 2012 the government confirmed the feasibility, costings and timing of the project – then $4.9 billion total. The loan agreement was expected to be finalized by the end of 2012. At the end of 2013 the energy minister said that construction might resume in 2015.

After the annexation of Crimea by Russia in March 2014, the cabinet in July reviewed the political situation with Russia, affirmed the priority of nuclear power, and said that a Western-design reactor might be built at South Ukraine, which had access from the sea for large equipment delivery.

In December 2014 the prime minister reaffirmed the priority of completing the Khmelnitski 3&4 units by 2018 to meet anticipated demand, although Energoatom said that the government was in the process of revoking the intergovernmental agreement with Russia and amending the corresponding domestic legislation for Khmelnitski 3&4 construction by Atomstroyexport (now NIAEP-ASE). The energy ministry was reported to want Skoda JS to take over the contract from Atomstroyexport. However the foreign ministry initially opposed this due to Skoda JS being owned by Russia’s OMZ, and Energoatom appealed to the president to resolve the matter. The cost for completing the two units had been put at €3.7 billion including the first fuel load at €296 million. A Polish investor offered finance of €1.48 billion in return for electricity supply to Poland.

In September 2015 parliament voted to repeal the 2012 law on construction of the two units on the basis of non-performance by Atomstroyexport. The government wanted Skoda JS to take over the project, and Skoda was keen to do so. Energoatom has signed an agreement with Barclays bank to finance completion of the Khmelnitski 3&4 units, and stresses that Skoda JS “operates by European laws in spite of the fact that the Russian company is its shareholder.” Energoatom has dismissed Chinese expressions of interest. In August 2016 Energoatom signed an agreement with KHNP, one objective of which is to cooperate on the completion of Khmelnitski 3&4. An associated objective is to cooperate on the Ukraine-EU 'energy bridge' project, exporting power from Khmelnitski 2 to Poland. In July 2017 Energoatom said that Skoda JS had modified the design and would supply both engineering services as well as many of the components for the two units, with overall 70% Ukrainian content.

In September 2020 KHNP said that it was in discussions with Energoatom regarding its participation in a new-build project at the country’s Rovno nuclear power station site using its APR1400 reactor design.

In September 2021 Energoatom and Westinghouse signed an agreement to build four AP1000 reactors at established sites in the country. But before that, a pilot project would be the joint completion of Khmelnitsky 4, which would now have some AP1000 components sourced from those in storage from the aborted VC Summer 2&3 project in the USA. The agreement covering the five reactors is valued at about $30 billion. Financing will be from US Eximbank. In November 2021 a contract was signed for two AP1000 units at Khmelnitski, costing $5 billion each and with 60% Ukraine content*. Energoatom intends to build further AP1000 units at Zaporozhe, Rivne and South Ukraine. Beyond that it planned four at Chyhyryn in the Cherkasy region and four at a new site in western Ukraine. The goal is 24 GWe of nuclear capacity by 2040.

* It is not clear if this agreement relates to units 3&4 or 4&5.

In June 2022 Westinghouse and Energoatom signed an agreement increasing the number of planned AP1000 reactors from five to nine. In January 2023 the Cabinet of Ministers gave the go-ahead to begin work on project documentation for the construction of Khmelnitsky 5&6. The target date to complete construction and start-up of the two units is 2030-2032, with an estimated cost of $5 billion. In December 2023 Ukraine's energy minister, Energoatom and Westinghouse signed an agreement on the purchase of equipment for what would become Khmelntisky 5.

The two oldest units in Ukraine, Rivne 1&2, were to be replaced as part of the 2006 nuclear power strategy. In 2018, however, Energoatom signed an agreement with Holtec International to replace them by 2030 with six SMR-160 units. It is intended that this will be a pilot project and that a manufacturing hub for these reactors will result. In June 2019 Holtec, Energoatom and the State Scientific and Technology Centre (SSTC) set up the Ukrainian Module Consortium to progress plans for SMR-160 units.

A 500 kV, 477 km high-voltage transmission line connecting the Rostov nuclear power plant in Russia to Crimea was completed in 2018.

Ukraine power reactors under construction

In the World Nuclear Asssociation reactor table, K3&4 are listed as 'under construction', but construction is currently suspended. Ukraine approved purchase of VVER-1000 equipment from Bulgaria’s cancelled Belene project in February 2025 for K3&4, though Bulgaria reversed its decision in April 2025. A further seven AP1000 units are listed as 'proposed' on the basis of the June 2022 agreement (see above).

Ukraine power reactors planned and proposed

| Location | Reactor | Gross capacity (MWe) | Start construction | Commercial operation |

| Khmelnitski 5&6 | AP1000 | 2 x 1250 | ||

|---|---|---|---|---|

| Total planned: 2 | 2500 | |||

| Current sites, plus new at Chyhyryn* and in western Ukraine | AP1000 | 7 x 1250 | ||

| Total proposed | 8750 |

* Chigirin/Chyhyryn/Chehyrn on the Tyasmyn River in the Cherkasy oblast in the centre of the country is proposed as one site for a new nuclear plant. A VVER-1000 unit was under construction there until about 1989, the first of four planned.

Small modular reactors

In June 2019 the Ukrainian Module Consortium was set up between US company Holtec, Energoatom, and the State Scientific and Technical Center for Nuclear and Radiation Safety (SSTC NRS). It announced that it was considering building six SMR-160s at the country's Rivne nuclear power station site from 2030. . In July 2024 Holtec and Energoatom signed an agreement for up to 20 SMR-160 units, with the first targeted to supply power by March 2029.

In February 2020 the SSTC NRS signed a memorandum of understanding (MoU) with NuScale Power regarding collaboration on the regulatory and design gaps between the US and Ukrainian processes for the licensing, construction, and operation of a NuScale power plant in Ukraine. In September 2021 Energoatom signed an MoU with NuScale to explore the deployment of NuScale units in Ukraine. It said: “We are considering the possibility of building SMRs in Ukraine to replace carbon-emitting thermal power plants and to increase the load-following capacities of the Ukrainian energy system.” In September 2023, Energoatom and Westinghouse signed an MoU for AP300 SMR deployment.

Nuclear supply chain

Atomenergomash’s Energomashspetsstal (EMSS), a castings and forgings manufacturer, is at Kramatorsk in the Donetsk region. Major upgrading of EMSS was completed in 2012, enabling it to make the forged components of large reactor pressure vessels such as those for VVER-TOI units. As well as power engineering, it has metallurgy, mechanical engineering and shipbuilding divisions, and earlier (to 1989) provided steam generators and reactor pressure vessels for Atommash at Volgodonsk in Russia. It is part of Rosatom's AEM-Technology and provides forgings to be finished at AEM's Petrozavodskmash and Atommash plants in Russia.

JSC Turboatom at Kharkov in the northeast, established in 1934 and now 75.2% government-owned (but with this share being reduced), is among the leading world turbine-building companies. It specializes in steam turbines for thermal and nuclear power plants, and has the capacity to produce 8000 MWe of such per year, with individual units up to 1100 MWe. It has supplied 110 turbines totalling 50 GWe for 24 nuclear power plants, and in 2015 supplied its 20th 1000 MWe unit. Ukrainian power plants employ 47 Turboatom-made turbines and 43 Russian ones, for which Turboatom is now making spare parts. It also completed a contract to modernize the turbines at Hungary’s Paks nuclear power plant. In March 2016 it signed an agreement with Westinghouse to uprate the capacity of VVER-1000 turbine generator sets by up to 10%.

Turboatom is also building Holtec’s Hi-Storm 190 casks for Ukraine’s Central Spent Fuel Storage Facility (CSFSF) for VVER fuel, celebrated as “the dawn of a new chapter in US-Ukraine cooperation.” As noted above, Westinghouse is working with Turboatom to uprate the capacity of 13 VVER-1000 turbine generator sets by up to 10%. The company is developing export markets in Europe, to replace Russia.

Earlier in February 2010 Energoatom signed a cooperation agreement with China Guangdong Nuclear Power Co (CGN) relating to nuclear power plant design, construction, operation and maintenance.

Uranium resources and mining

Ukraine has modest recoverable resources of uranium – 185,400 tU according to the 2022 edition of the IAEA 'Red Book', 71,800 tU of these recoverable at under $80/kgU. Reasonably assured resources are 120,600 tU, nearly all in metasomatite deposits in the Kirovograd block in the Dniprovski Basin of the Ukrainian Shield and requiring underground mining in the basement rock. Ore grade is 0.1-0.2%U. A few shallower sandstone deposits at lower grade are amenable to ISL and have potential byproduct elements. Reasonably assured resources for ISL are 3700 tU at <$80/kg.

Uranium mining began in 1946 underground at Pervomayskoye and Zheltorechenskoye, and in 1951 the government set up the Vostochny Gorno-Obogatitel’niy Kombinat (VostGOK), Eastern Mining and Processing Enterprise or Skhidniy Gorno-Zdobychuval’nyi Kombinat (SkhidGZK in Ukrainian, or Skhidniy HZK) at Zheltiye Vody or Zhovti Vody (Ukr) in the Dnepropetrovsk oblast, close to the border of Kirovograd, to process the ore. In 1959 a second plant was built here. A total of about 130,000 tU has been produced to date.

Uranium mine production, tonnes U

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Zheltye Vody mill | 850 | 890 | 960 | 922 | 926 | 1200 | 808 | 707 | 790 | 800 | 744 | 455 | 100 |

Novokonstantinovskoye is not separately reported.

Three underground uranium mines are operating today through the state-owned VostGOK company: Ingulskaya, Smolinskaya and Novokonstantinovskoye.

In January 2022 Ukraine’s energy minister announced the country’s aim to become self-sufficient in uranium by 2027. Production had been about 800 tonnes annually – around 30% of the country's requirements.

The plan launched in 2022 ensured the operation of the Smolinskaya mine until the end of 2023, and the Ingulskaya mine until 2028. The development of new production facilities at Novokonstantinovskoye and Aprelskoye will be prioritized, with commissioning aimed for in 2026. Pilot production at Novokonstantinovskoye took place in 2011 but the mine was never brought to full operation.

VostGOK had been producing up to 830 tonnes of uranium per year – around 30% of the country's requirements. The central mill is at Zheltye Vody, close to the border of Kirovograd. Mine production is from several sources – notably Ingulskaya and Smolinskaya mines in the Kirovograd region, with about 66,000 tU and 5000 tU resources respectively. At Ingulskaya block leaching in the Centralniy and Michurinskoye deposits is undertaken, and at Smolinskaya, mining the Vatutinskoye deposit, beneficiated ore from radiometric sorting at site is railed to the central mill. VostGOK had plans to start mining the Severinskiy deposit in 2020, but this did not proceed. The mineralization occurs in metasomatite deposits up to 1300 metres deep, with typical grade of 0.1%U.

The Novokonstantinovskoye uranium project in the Kirovograd region (40 km west of Kirovograd) is claimed to be the largest uranium deposit in Europe, and about 80,000 tU resources at 0.14% are quoted in the 2022 Red Book. It is also a metasomatite deposit. Ceremonial first production was in August 2008, but development then languished. Three underground levels have been opened up at 680 to 1090 metres depth. Russia's Rosatom had said it was keen to invest in developing the project, but agreement on equity was not reached. The government was seeking partners to help fund the $820 million development cost, but after becoming impatient with disputes, it legislated to put the project under VostGOK from December 2009.*

* This edict was cancelled in February 2010, and the regional Public Utility Company Nedra Kirovogradshchiny was then to take over responsibility. However, this was reversed in September, and the project reverted to VostGOK. Earlier, the project was being developed independently of VostGOK by the Novokonstantinov uranium development company, to produce up to 1500 t/yr by 2013, and 2500 t/yr eventually.

In October 2010 VostGOK announced that production would commence in 2011, ramping up towards 1050 tU/yr. Russian overtures were again rejected. First production was in June 2011, with 99 tU projected to end of year. Production in 2012 was expected to be 180-190 tU, and then 424 tU in 2013, 760 tU in 2014, and 1270 tU in 2015, which proved to be unrealistic. VostGOK was aiming to invest over UAH 6 billion to develop the Novokonstantinovskoye mine, but lack of financing prevented this. In March 2019 the energy ministry said it aimed to increase production at the mine from 285 tU in 2018 to 594 tU in 2021.

Heap leaching occurs at Smolinskaya, and also Novokonstantinovskoye to treat one-third of its ore. Higher-grade ore is railed 100 km east from the Ingulskiy mine, 150 km east from Smolinskaya and 130 km east from Novokonstantinovskoye to the central mill and hydrometallurgical plant at Zheltye Vody in Dnipropetrovsk oblast, southeast of Kiev. After crushing and radiometric sorting there, the ore is acid leached in autoclaves at high temperature and pressure.

In 2013 VostGOK finished re-treatment of about 3 million tonnes of tailings at Smolinskaya mine, and a mobile ore-sorting complex was commissioned at Ingulskaya mine in 2011 to enable the same there, both for uranium recovery and to enable proper rehabilitation of the sites.

In November 2015 China Nuclear Energy Industry Corporation (CNEIC) expressed some interest in development of Novokonstantinovskoye. VostGOK commented on the possibility of uranium exports to China.

In situ leach (ISL) mining of uranium began in 1961 and in Devladovske and Bratske deposits it occurred from 1966 to 1983 using acid to recover 3925 tU but mining was discontinued for environmental reasons. In June 2009 VostGOK announced that it planned to develop the Safonovskiy/Safonovka deposit using in situ leaching (ISL) to produce 100-150 tU/yr in a sandstone deposit 80 m deep. From about 2020 a private company, Nuclear Energy Systems of Ukraine LLC (NES), has mined palaeochannels 30-100 metres deep in the Safonovka deposit by acid ISL, expecting to recover 2250 tU.

There are legacy issues with former uranium mining and processing, particularly at the Pridniprovsky Chemical Plant (PHZ) at Dniprodzerzhinsk, not far from the Dnipro River. Nine tailings dams containing 42 million tonnes of mine tailings and 4 PBq of activity and derelict production facilities from operations over 1948-91 are the subject of a large-scale remediation program. PHZ processed ores from the Michurinskoye deposit (near Kirovograd), phosphate ores of the Melovoye deposit (near Shevchenko, now Aktau, Kazakhstan) and raw concentrate from GDR, Hungary and Bulgaria.

In 2016 Kazatomprom agreed with Ukraine’s minister for coal and energy to establish a uranium mining joint venture, presumably for ISL mining.

Ukraine also has zirconium resources, and supplies zirconium to Russia.

Fuel cycle

Ukrainian uranium concentrate and zirconium alloy are sent to Russia for fuel fabrication. The nuclear fuel produced from these Ukrainian components by TVEL in Russia is then sent to Ukrainian nuclear power plants. Fuel for Ukrainian nuclear plants is also supplied by Westinghouse under Ukraine's Nuclar Fuel Diversification Programme (see below).

The country depends primarily on Russia to provide other nuclear fuel cycle services also, notably enrichment. In June 2007 Ukraine agreed to investigate joining the new International Uranium Enrichment Centre (IUEC) at Angarsk, in Siberia, and to explore other areas of cooperation in the nuclear fuel cycle and building power reactors in other countries. Late in 2008 it signed an agreement for Ukraine's State Concern Nuclear Fuel to take a 10% stake in the IUEC based at Angarsk, and in October 2010 this came into effect. Ukraine’s State Concern Nuclear Fuel apparently sells natural uranium to IUEC, which enriches it at Russian plants. Then IUEC sells the enriched uranium to the Fuel Company TVEL, which fabricates fuel assemblies and supplies them to NAEC Energoatom. The first commercial supply from IUEC was in November 2012. The contracted volume is 60,000 SWU/yr, proportional to the Ukrainian shareholding. Ukraine requires about 2 million SWU/yr overall.

In July 2015 State Concern Nuclear Fuel signed an agreement with Converdyn in USA to investigate building a conversion plant to supply Ukraine’s needs.

In April 2015 Energoatom signed an agreement with Areva (now Orano) for the supply of enriched uranium, as “a real step towards diversifying the supply of nuclear materials to Ukrainian nuclear power plants.” Deliveries would begin in 2015 or when Ukraine’s new fuel fabrication plant being built by TVEL at Smolino was operational. This is now aborted, and it is uncertain where fuel fabrication from Areva sources might occur.

In January 2022 the government approved a plan that aims to increase domestic production of uranium concentrate to 1265 tU in 2026, up from the 995 tU targeted in 2022.

In February 2023 Energoatom and Canada's Cameco agreed that Cameco would supply Energoatom's uranium hexafluoride requirements for the nine nuclear reactors at the Rivne, Khmelnitsky and South Ukraine nuclear power plants from 2024 to 2035, with an option for Cameco to supply the Zaporizhzhia nuclear power plant under Russian control, should it return to Energoatom's operation. A related agreement "for weighing, sampling, storage, analysis and transportation of uranium oxide concentrate" – covering the entire quantity of uranium mined by Ukraine's SkhidGZK to be supplied to Canada – was signed in April.

Fabricated fuel imports

In order to diversify nuclear fuel supplies, Energoatom started implementation of the Ukraine Nuclear Fuel Qualification Project (UNFQP) for VVER-1000 fuel. The Project assumed the use of Western-manufactured fuel in the VVER-1000 following the selection of Westinghouse as a vendor on a tender basis. In 2005, South Ukraine's third unit was the country's first to use the six lead test assemblies supplied by Westinghouse, which were placed into the reactor core together with Russian fuel for a period of pilot operation. A reload batch of 42 fuel assemblies was provided by Westinghouse in mid-2009 for a three-year period of commercial operation at the unit with regular monitoring and reporting. In addition to the initial supply of fuel from Westinghouse, other aims of the project included the transfer of technology for the design of nuclear fuel.

Under a 2008 contract, Westinghouse supplied a total of 630 fuel assemblies for South Ukraine 2&3. However, these trials to 2011 were contentious, with Energoatom claiming manufacturing defects in the fuel and Westinghouse asserting errors in fuel loading. Each reactor has 163 fuel assemblies.

In June 2010, Energoatom signed a long-term fuel supply contract with Russia's TVEL for all 15 reactors. Earlier, Rosatom had offered a substantial discount to Ukraine if it signed up with TVEL for 20 years. In 2010, TVEL sold Ukraine nuclear fuel for $608 million (€449 million). In 2013 all fuel came from TVEL, valued at $601 million. In 2014 Ukraine bought $588 million of fuel services from TVEL and $39 million from Westinghouse Sweden.

Following the annexation of Crimea by Russia, in April 2014 Ukraine extended its 2008 contract with Westinghouse for fuel supply through to 2020. In 2015 Energoatom ordered Westinghouse fuel for unit 5 of the Zaporozhe plant, as well as for South Ukraine. The Westinghouse fuel is fabricated at its plant at Vasteras in Sweden. Westinghouse commented: "This new agreement for Westinghouse VVER fuel design testifies to the quality of our fuel design and demonstrates that it has, in fact, operated without issue at the South Ukraine nuclear power plant, as confirmed by extensive and recent joint Energoatom and Westinghouse inspections. This contract extension .... will allow Energoatom to continue diversification of its fuel supply. We expect that ... Westinghouse will grow its share of the Ukrainian nuclear fuel market.” Russian sources have since suggested that the Westinghouse VVER fuel is unlicensed and dangerous. In 2015 Energoatom bought 5% of its fuel from Westinghouse, worth $32 million, out of a total of $644 million. In 2016 Energoatom imported $549 million of fuel, with $387 million (70.5%) of this from TVEL and $162 million (29.5%) from Westinghouse – less than the expected 40%. In 2017 Energoatom bought $368.9 million worth of nuclear fuel from TVEL and $164.4 million of Westinghouse fuel from Sweden (31% by value). As of July 2021, six of Ukraine's 15 reactors were operating using Westinghouse fuel: South Ukraine 2&3 and four units at Zaporozhye.

Earlier in January 2018 Energoatom extended its contract with Westinghouse to 2025. Energoatom stated that seven of the country's 15 nuclear reactors will use Westinghouse fuel by 2025. In July 2018, Westinghouse announced that South Ukraine 3 was loaded with a full core of its VVER-1000 fuel – the first unit in Ukraine to operate with Westinghouse VVER-1000 fuel as the sole source. In December 2019, Zaporozhe 5 was loaded exclusively with Westinghouse fuel.

In December 2018 Energoatom confirmed that an agreement with TVEL had been signed for the continued supply of fuel for eight of the 15 Ukranian nuclear reactors between 2021 and 2025. Westinghouse will supply fuel to six.

While Ukraine is not imminently a part of the EU, the European Commission said in May 2014 that as a condition of investment, any non-EU reactor design built in the EU must have more than one source of fuel.

Ukraine fuel fabrication plans

About 2009 TVEL and Westinghouse both bid to build a fuel fabrication plant in Ukraine, and in September 2010 the Ministry of Fuels & Energy selected TVEL. The State Concern Nuclear Fuel signed an agreement with TVEL for a 50-50 joint venture to build a plant to manufacture VVER-1000 fuel assemblies. Preparatory work was undertaken for the US$ 460 million (€355 million) plant at Smolino, Kirovograd region, 300 km southeast of Kiev, to produce about 400 fuel assemblies (200 tU) per year, but with eventual capacity of 800 per year. The site is near Smolinskaya uranium mine.

One condition was that Ukraine held a controlling stake in the joint venture company that was to be established to manage the plant, despite relying on TVEL to provide 70% of the loan funds to construct it. Another condition was that TVEL transfer the technology for the manufacture of fuel assemblies under a non-exclusive licence by 2020, for reactors both in Ukraine and abroad. Russia agreed to transfer fuel fabrication technology by 2020. Ukraine’s prime minister called it “the most substantial project towards energy independence in the history of independent Ukraine." In December 2011 the private joint-stock company Nuclear Fuel Production Plant (NFPP) was set up to run it.

Site works started in 2012 and full construction was due to start in mid-2014, with the first phase to 2015 setting up capacity for fabrication of fuel rods and assemblies (using pellets from Ulba in Kazakhstan, 34% TVEL-owned), the second phase to 2020 involving production of fuel pellets. It was expected to start supplying fuel in 2016, and that it would cater all nuclear fuel needs of Ukraine’s nuclear power plants, while surplus products could be exported under separate arrangements with TVEL, mainly to Eastern Europe. In July 2014 construction was delayed due to disagreement on terms and conditions of the contract, and the Ukraine deputy minister said that Westinghouse or Areva might be called upon. In August 2014 TVEL said it was ready to supply the equipment for the plant as soon as contract disagreements and financing were resolved, and Novosibirsk Chemical Concentrates Plant (NCCP) said it had manufactured the process lines and was putting them into storage. In October 2015 the energy minister said that the government planned to terminate the agreement with TVEL.

In 2016 the government was talking with Kazatomprom about joint venture fuel fabrication for Ukraine being undertaken in Kazakhstan, previous plans for a plant in Ukraine having failed.

In 2018 TVEL and China Nuclear Energy Industry Corporation (CNEIC) were reported to be considering the joint construction of a VVER fuel fabrication plant in Ukraine. TVEL has helped CNEIC and Jiangsu Nuclear Power Corporation set up VVER fuel production at Yibin for China’s first four VVER reactors.

In August 2021 a US-Ukraine cooperation agreement included mention of a nuclear fuel fabrication plant at the Skhidniy mining and processing plant in Ukraine, evidently by Westinghouse.

In June 2022 Westinghouse and Energoatom signed an agreement that would see Westinghouse's Västerås plant in Sweden fabricate all fuel for Ukraine’s reactors.

Earlier, in the 1990s, an attempt had been made to set up a complete suite of fuel cycle facilities other than enrichment, but this failed for political and financial reasons. The December 2006 decision to form Ukratomprom revived intentions to build a fuel fabrication plant (see Appendix).

In May 2008 Ukraine's Ministry of Fuels and Energy signed an agreement with Atomic Energy of Canada Ltd (AECL) to develop CANDU technology. This could provide synergies with the existing Ukrainian VVER reactors by burning uranium recovered from the VVERs' used fuel. However, no developments have eventuated in Ukraine.

Decommissioning & waste management

There is no intention to close the fuel cycle in Ukraine, though the possibility remains under consideration. In 2008 the National Target Environmental Program of Radioactive Waste Management was approved. Storage of used fuel for at least 50 years before disposal remains the policy. The new program meets the requirements of European legislation and recommendations of the International Atomic Energy Agency (IAEA) and the European Atomic Energy Community (Euratom). Its implementation will create an integrated system of radioactive waste of all types and categories for 50 years. In 2014 Energoatom commenced a study on having used fuel of both TVEL and Westinghouse origin reprocessed by Areva at La Hague in France.

Used fuel is mostly stored on site though some VVER-440 fuel continued to be sent to Russia for reprocessing under a 1993 arrangement. At Zaporozhe a long-term dry storage facility for spent fuel has operated since 2001, but other VVER-1000 spent fuel has been sent to Russia for storage, at a cost to Ukraine of about $200 million per year. A centralised dry storage facility for spent fuel (CSFSF) was proposed for construction in the government's 2006 energy strategy (see below).

Preliminary investigations have shortlisted sites for a deep geological repository for high- and intermediate-level wastes including all those arising from Chernobyl decommissioning and clean-up.

A new facility for treatment solid radioactive waste is at the site of Zaporozhe nuclear power plant, commissioned in 2015. It will be fitted with a state-of-the-art incinerator of Danish design.

In 2013, a four-year Ukraine-NATO project began to clean up low-level radioactive waste at nine military facilities in the country. €25 million was budgeted. The waste will be buried in the Chernobyl exclusion zone.

CSFSF near Chernobyl for VVER fuel

In December 2005, Energoatom signed a US$ 150 million agreement with the US-based Holtec International to implement the Central Spent Fuel Storage Facility (CSFSF) project for Ukraine's VVER reactors. Holtec's work involves design, licensing, construction, commissioning of the facility, and the supply of transport and vertical ventilated dry storage systems for used VVER nuclear fuel, initially 2500 VVER-1000 and 1100 VVER-440 assemblies. This was projected for completion in 2008, but was held up pending legislation. Then in October 2011 parliament passed a bill on management of spent nuclear fuel, and this was approved in the upper house in February 2012. It provides for construction of the dry storage facility within the Chernobyl exclusion area, between the resettled villages Staraya Krasnitsa, Buryakovka, Chistogalovka and Stechanka in Kiev Region, southeast of Chernobyl. Ukraine requires all spent fuel to be stored in double wall multi-purpose canisters (DWC).

The new storage facility will become a part of the common spent nuclear fuel management complex of the state-owned company Chernobyl NPP, though it will not take any Chernobyl fuel. In April 2014 the government approved the 45 hectare site for the facility, to take fuel from Rovno, South Ukraine and Khmelnitski. The total storage capacity of the facility will be 16,530 used fuel assemblies, including 12,010 VVER-1000 assemblies and 4520 VVER-440 assemblies. Some of these have high-burnup fuel and are hot, with up to 38 kW heat load. It was expected to cost $460 million, including 'start-up complex' $160 million. Holtec quoted three years for construction from mid-2014, when the project was reactivated under a new government with a new contract. The contract was amended in January 2015 so that the civil design and construction of CSFSF will be the responsibility of NNEGC Energoatom (Ukraine).

At the same time, Holtec International (USA) is responsible for the supply of specific dry spent nuclear fuel storage and transport canisters and casks which will be used at the three nuclear power plant sites, and during the used nuclear fuel transport from them to the CSFSF, as well as at the facility itself. Holtec HI-STAR 190 transport casks will be used for transporting canisters to the site where they will be loaded into Holtec’s HI-STORM 190 ventilated vertical storage system, to provide physical protection, radiation shielding and allow passive heat removal. The double-wall canisters (DWC) were approved by the State Nuclear Inspectorate (SNRIU) early in 2015. In October 2015 Holtec agreed with Turboatom in Ukraine to manufacture the HI-STORM 190 casks, initially 94 of them.

The cost of the project is equivalent to a few years of payments to Russia for storing Ukraine's fuel from the three plants (about $200 million per year). Construction of the CSFSF commenced in August 2014, with Holtec acting as the general contractor of the project, while two Ukrainian companies, YUTEM Engineering Ltd and Ukrtransbud Inc, started to build it. In August 2015 Holtec said that site construction was 57% complete and due to be finished in July 2016. Then in October 2016 Energoatom subsidiary AtomProjectEngineering said that the active phase of construction was due to start in March 2017. In July 2017 the SNRIU issued a licence for the project. The CSFSF was commissioned in December 2023, becoming the world first consolidated interim dry storage facility for VVER used fuel.

Holtec earlier said that hostilities in the east had set back the schedule.

Vitrified high-level waste from reprocessing Ukrainian fuel will be returned from Russia and go to the CSFSF.

Chernobyl ISF-2 for RBMK fuel

Used fuel from decommissioned RBMK reactors at Chernobyl nuclear power plant will be stored in a new dry storage facility being built a few kilometres from the plant, and not far from CSFSF. In September 2007 Holtec International and the Ukrainian government signed a contract to complete the placement of Chernobyl's used nuclear fuel in dry storage systems at the Chernobyl Interim Spent Nuclear Fuel Storage Facility (ISF-2). Removing the radioactive fuel from the three undamaged Chernobyl reactors is essential to the start of demolishing them. Holtec completed the dry storage project, begun in 1999 by the French company Framatome (subsequently Areva and then Orano), and was able to utilise much of the previous structures and components from Areva, substantially supplemented. Areva’s €80 million contract was suspended in October 2005, after donor countries rejected its proposal to correct problems with its endeavours. "The prior contractor's technology was shown to be inadequate to meet the facility's functional and regulatory requirements," according to Holtec, which took over the project in 2011. Areva was required to pay €45 million to Ukraine in compensation for the botched project.

Transfer of most used fuel to the site from Chernobyl units 1-3 was completed in 2013, with the last damaged fuel removed in June 2016. Initially this is stored in ISF-1, a wet storage facility which was commissioned in 1986. The Chernobyl Dry Storage (ISF-2) project requires dividing over 21,000 fuel assemblies into 42,000 fuel bundles in a custom-engineered hot cell, and drying them – a step overlooked in the Areva era. The bundles will be put into double-walled shielded steel canisters which are then filled with inert gas and welded shut. Each metal canister, containing 93 used fuel assemblies, is placed horizontally in a NUHOMS concrete storage module where it will be enclosed for up to 100 years. Once all the used fuel has been transferred by about 2030, ISF-1 would be decommissioned. The first Holtec canisters for the Areva-designed NUHOMS dry storage system were delivered from the USA in November 2015, and about 85 of these will be involved in stage 1. The balance of 231 were delivered over 2017-19. They will store the fuel long-term in an inert gas environment.

ISF-2 has a fixed price of $411 million and was completed in 2019, though hostilities in the east set back the schedule. In August 2017 the SNRIU approved an integrated systems test of the facility, and system-wide trials commenced in May 2019. Hot testing was completed in December 2020. A full operating licence from the SNRIU was issued in April 2021. Fuel transfers to ISF-2 began in June 2021. There is full endorsement from the Assembly of Donors, which provides funding for Chernobyl remediation and decommissioning through the EBRD’s Nuclear Safety Account. The works were being carried out by Ukrainian companies UTEM-Engineering (principal contractor) and Ukrtransbud.

Chernobyl: other waste

Also at Chernobyl, Nukem has constructed an Industrial Complex for Solid Radwaste Management (ICSRM) which was handed over in April 2009. In this, solid low- and intermediate-level wastes accumulated from the power plant operations and the decommissioning of reactor blocks 1 to 3 is conditioned by incineration, high-force compaction, and cementation, as required and then packaged for disposal. In addition, highly radioactive and long-lived solid waste is sorted out for temporary separate storage. A low-level waste repository has also been built at the Vektor complex 17 km away.

The Liquid Radioactive Waste Treatment Plant (LRTP) at Chernobyl retrieves some 35,000 cubic metres of low- and intermediate-level liquid wastes at the site from their current tanks, processes them into a solid state and moves them to containers for long-term storage. The plant began treating waste in July 2019. LRTP is also funded through EBRD’s Nuclear Safety Account.

Reactor decommissioning: Chernobyl

Four Chernobyl RBMK-1000 reactors, plus two almost-completed ones, are being decommissioned. Unit 4, which was destroyed in the 1986 accident, is enclosed in a large shelter and a new, more durable containment structure was completed in 2016. The last of the other three shut down in December 2000. In mid-2001 a new enterprise, SSE ChNPP was set up to take over management of the site and decommissioning from Energoatom. Its remit includes eventual decommissioning of all Ukraine nuclear plants.

This New Safe Confinement (NSC) project cost about €1.5 billion. In September 2007 a €430 million contract was signed with a French-led consortium Novarka to build this new shelter, to enclose both the destroyed Chernobyl 4 reactor and the hastily-built 1986 structure over it. It is a metal arch 110 metres high and spanning 257 m, which was built adjacent and then moved into place at the end of 2016. The arch frame is equipped with internal cranes to undertake demolition of the old structure and the remains of unit 4. It would enable the eventual removal of the fuel-containing materials in the bottom of the reactor building and accommodate their characterisation, compaction, and packing for disposal. The NSC is the largest moveable land-based structure ever built. The NSC was damaged by a drone strike in February 2025; international partners have pledged €42.5 million for repairs.

The International Chernobyl Shelter Fund facilitated by the EBRD was set up in 1997. In May 2005, international donors made pledges worth approximately €150 million towards the new safe confinement. The largest contribution came from the G8 and the EU. Russia contributed to the fund for the first time and other fund members, which include the USA, increased their contributions, with the Ukrainian government pledging some €15 million. The European Commission has committed €239.5 million since 1997, making it the main donor.

Units 1-3 are undergoing decommissioning conventionally – the first RBMK units to do so – and work will accelerate when the new ISF-2 dry storage facility for fuel is fully commissioned (see above).

Research & development

Ukraine has had two research reactors, including a 10 MW tank type one – VVR-M – which was commissioned in 1960 at the Institute for Nuclear Research in Kiev. This was converted to LEU fuel in 2008 under the US Global Threat Reduction Program. Plans for a $250 million replacement were announced in 2008.

In 2012 the government approved construction of KIPT Experimental Neutron Source at the Kharkov Institute of Physics and Technology, using LEU. It is basically an accelerator system, subcritical. The USA is providing technical assistance and $25 million towards it, the total contribution being $73 million. There is cooperation with Oak Ridge and Idaho National Laboratory in the USA. It is intended for research in nuclear physics as well as isotope production, particularly for nuclear medicine.

There is also a very small IR-100 training reactor (200 kW) at the Naval Engineering school in the Sevastopol National University of Nuclear Energy and Industry in Crimea. This was taken over in the Russian annexation of Crimea, and Ukraine has raised with IAEA the safeguards implication. Russia's national radioactive waste management company, NO RAO, will receive data for the accounting and control of radioactive materials and waste from Crimea.

Organization

In 1996 the former nuclear operating entity Goskomatom set up a new corporate nuclear utility, National Nuclear Energy Generating Company (NNEGC) Energoatom. NNEGC Energoatom is responsible for the safety of all Ukrainian nuclear power plants under the law on Nuclear Power Use and Radiation Safety. Its main task is construction of new power capacities and lifetime extension for the existing plants, procurement of new fuel and transportation of used fuel, establishment of the national infrastructure for management of irradiated fuel, ensuring physical security of nuclear power facilities, and professional training and development of personnel.

Goskomatom was replaced by two departments within the Fuel & Energy Ministry: the Department for Nuclear Energy, responsible for civil nuclear power plants operation, and the Department for Atomic Industry, responsible for the development of the nuclear fuel cycle.

The regulator is the State Nuclear Regulatory Inspectorate of Ukraine (SNRIU), now an independent authority (it was until 2001 under the Ministry of Environment Protection & Nuclear Safety as the SNR Committee). In March 2015 the SNRIU was accepted as a full member of the Western European Nuclear Regulators' Association (WENRA).

The State Scientific and Technical Centre for Nuclear and Radiation Safety (SSTC NRS) provides technical advice and support for the SNRIU.

The 1995 law on Nuclear Energy Use and Radiation Safety establishes the legal basis of the industry and included a provision for the operating plant to have full legal responsibility for the consequences of any accident. The 1995 law on Radioactive Waste Management complements this, and the consequent state program was approved in 2002.

Safety, security and non-proliferation

After the break-up of the Soviet Union, Ukraine negotiated to repatriate nuclear warheads and missiles to Russia in return for nuclear fuel supplies. Ukraine then joined the Nuclear Non-Proliferation Treaty (NPT) as a non-nuclear weapons state. Its safeguards agreement under the NPT came into force in 1998, and in 2005 the Additional Protocol to this agreement was ratified.

Notes & references

References

Judith Perera, Nuclear Power in the Former USSR, McCloskey, UK, 2003

Ukrainian Ministry of Fuel & Energy

State Nuclear Regulatory Inspectorate of Ukraine

National Nuclear Energy Generating Company Energoatom

Shelter Implementation Plan, Chernobyl Shelter Fund, European Bank for Reconstruction and Development, February 2000

Holtec delivers first 'dry' storage canisters to Chernobyl site, World Nuclear News, 27 November 2015

Areva’s Incredible Fiasco in Chernobyl, le Journal de l’Energie, 17 February 2016

Karel Beckman, Energy Post, Ukrainian crisis can be solved – with an Energiewende, 22 August 2016

OECD Nuclear Energy Agency and International Atomic Energy Agency, Uranium 2020: Resources, Production and Demand ('Red Book')

Notes

a. Zaporozhe is the Russian name for the site; Zaporizhzhia is preferred by Ukraine. [Back]

Appendices:

The K2R4 saga

In the 1990s both the government and Energoatom were determined to bring two new reactors – Khmelnitski 2 and Rovno 4 (K2R4) – into operation as soon as possible. Both reactors were 80% complete when a halt was imposed in 1990.

In 1995 a Memorandum of Understanding was signed between the Governments of the G7 countries, the EC and the Ukrainian government which required closure of the operating Chernobyl reactors. Thus, Chernobyl reactors were shut down – the last in December 2000.

The Memorandum stipulated the agreement on international financial aid to Ukraine to support Chernobyl decommissioning, power sector restructuring, completion of K2R4 nuclear reactors, thermal and hydro plant rehabilitation, construction of a pumped storage plant, and to support energy efficiency projects in accordance with Ukraine's energy sector strategy.

In 2000 the European Bank for Reconstruction & Development (EBRD) approved (by an 89% vote apart from abstentions) a US$ 215 million loan towards completion of K2R4. This EBRD funding, though a modest part of the US$ 1480 million estimated to be required, was a key factor in plans for their completion to western safety standards. Conditions on the loan included safety enhancement of all 13 Ukraine nuclear power reactors, independence for the country's nuclear regulator, and electricity market reform.

Following approval of the EBRD loan, the European Commission (EC) approved a US$ 585 million loan to Energoatom. The EC said that approval of this Euratom funding "a few days before the permanent closure of Chernobyl gives a clear sign of the Commission's commitment to nuclear safety ... as well as to the deepening of [EU] relations with Ukraine." It "will finance the completion, modernisation and commissioning of two third-generation nuclear units". The EC pointed out that it and the EBRD had concluded that the project met all safety, environmental, economic and financial criteria.

Russia earlier provided US$ 225 million credit for K2R4 equipment and fuel, then in 2002 a Russian loan of US$ 44 million for completion of the units was approved. The arrangement covered goods and services from Russia. It followed signing of a US$ 144 million agreement in June, including about US$ 100 million of fuel.

However the promised loans of US$ 215 million and the Euratom's US$ 585 million were deferred late in 2001 because the government had baulked at doubling the wholesale price of power to USD 2.5 cent/kWh as required by EBRD. Ukraine also rejected almost all approved Russian loans. The Ukrainian government then approved estimates for the completion, site works and upgrades for the K2R4 nuclear power reactors, at US$ 621 million and US$ 642 million respectively. With local finance and a bond issue, Energoatom proceeded with work on both units.

In July 2004, prior to start-up of the two units, the EBRD finally approved a scaled-down loan of US$ 42 million. This sum was matched by US$ 83 million from Euratom, approved by the EC. The project finances the post-start-up component of a safety and modernisation programme developed for K2R4.

The loan was approved on condition that revised tariffs are implemented in order to fund upgrading of all 13 operating power reactors in Ukraine to K2R4 standards, that a decommissioning fund is set up and "an internationally agreed level of nuclear liability insurance" is reached.

The programme on modernisation and safety improvement of K2R4 was established taking into account IAEA's recommendations. It consists of 147 "pre-commissioning", as well as "post-commissioning" and "before and after commissioning" measures. In 2003-2004, Framatome ANP, an independent expert of the EBRD, together with the local Riskaudit Company, reviewed the implementation status and sufficiency of the programme. They assessed positively the result of this programme's implementation to date. The post-commissioning modernization measures were completed in November 2010, under the US$ 125 million budget from EBRD and Euratom.

In August 2004 the Ukrainian President said that Western governments had failed to honour their 1995 undertakings to assist his country in exchange for closing the Chernobyl plant, particularly in relation to the Khmelnitski 2 and Rovno 4 completion, grid infrastructure and a pumped storage hydro plant.

Nuclear industry structure and the Russian connection

Late in 2006 the government moved to set up a new national nuclear industry entity – Ukratomprom, as a vertically-integrated nuclear holding company reporting to Energy Ministry and cabinet. Ukratomprom was to consist of six state-owned enterprises including Energoatom, the VostGOK uranium mining company, and the Novokonstantinov uranium development company, with assets of some $10 billion, including $6.35 billion for Energoatom. Three major projects were to be launched in 2007, including a $1875 million uranium production venture comprising refurbishment of VostGOK's hydrometallurgical plant and construction of a uranium mill at Novokonstantinov. Then it was announced that Energoatom would not be included in Ukratomprom, and soon afterwards plans were abandoned.

Russia has made strenuous efforts to regain its influence in Ukraine, and early in 2010 various proposals for civil nuclear joint ventures were put forward. In April the Russian president suggested "full-scale cooperation of our nuclear industries," and that the two countries establish a large holding company that would include power generation, heavy engineering and fuel cycle facilities. As a first stage, he suggested a merger involving Ukrainian uranium mining with Russia's Novosibirsk Chemical Concentrates Plant in Siberia, which produces VVER fuel. Also he noted that Ukraine's Turboatom was producing large steam turbines solely for Russia. Furthermore, all Ukrainian reactors need modernization which, he said, could be most effective with close cooperation of Russian enterprises, at the same time as opening access for Ukrainian partners to the Russian market as it greatly expands nuclear capacity. In addition, Russia and Ukraine could collaborate in foreign markets on the basis of financing provided by the Russian government and leading financial institutions. Ukraine's president agreed in principle that some of these particular suggestions might have merit.

Rosatom followed up with the suggestion that if Ukraine signed long-term (25-year) fuel supply contracts with Russia it would enjoy a discount of more than $1 billion. Furthermore, Rosatom was ready to transfer up to 50% of the shares in the Novosibirsk Chemical Concentrates Plant to Ukrainian partners and establish domestic fuel production, either “either [as] a branch of the combine where we can be shareholders together, or a new plant in the Ukrainian territory." Rosatom reiterated its long-standing desire to take a share of Ukraine's Novokonstantinov uranium project, and also proposed a joint venture bringing together the heavy engineering assets of Russia's Atomenergomash and Ukraine's Turboatom at Kharkov.

Energoatom has set up Atomproektengineering to handle new nuclear power projects, including investment, design, and construction. It has already been involved with Khmelnitski 3&4 (see section on Building further nuclear power capacity). In October 2010 Atomenergomash announced that it and NAEC Energoatom would set up a strategic consortium to localize nuclear equipment manufacture in Ukraine, particularly in relation to Khmelnitski 3&4.

Ukraine's plans for fuel cycle developments are to develop uranium mining and fuel fabrication, but not conversion, enrichment or reprocessing – these being done in Russia, albeit with some Ukraine equity in IUEC (see section on Fuel cycle).

Related information

Chernobyl AccidentUkraine: Russia-Ukraine War and Nuclear Energy