Nuclear Power in the United Kingdom

- The UK generates about 15% of its electricity from about 5.9 GWe of nuclear capacity.

- Most existing capacity is to be retired by the end of the decade, but the first of a new generation of nuclear plants is under construction, and final investment decision has been confirmed for a second plant.

- Government plans call for up to 24 GWe of new nuclear capacity by 2050 to provide about 25% of electricity.

- The UK has implemented a thorough assessment process for new reactor designs and their siting.

- The UK has privatized power generation and liberalized its electricity market, which together make major capital investments problematic.

Reactors

Construction

Shutdown

Operable nuclear power capacity

Electricity sector

Total generation (in 2024): 285 TWh

Generation mix: natural gas 86.3 TWh (30%); wind 84.1 TWh (29%); biofuels & waste 45.4 TWh (16%); nuclear 40.6 TWh (14%); solar 14.8 TWh (5%); hydro 7.8 TWh (3%); coal 2.7 TWh (1%); oil 1.5 TWh.

Import/export balance: 33.4 TWh net export (43.7 TWh imports, 10.3 TWh exports)

Total consumption: 273 TWh

Per capita consumption: c. 4000 kWh in 2024

Source: International Energy Agency and The World Bank. Data for year 2024

End 2024 installed electricity generating capacity was 105 GWe: 35.0 GWe natural gas; 32.8 GWe wind; 18.3 GWe solar; 7.4 GWe biofuels & waste; 5.9 GWe nuclear; 4.8 GWe hydro (including 2.9 GWe pumped storage); and 1.3 GWe oil.

In the late 1990s, nuclear power plants contributed around 25% of total annual electricity generation in the UK, but this has gradually declined as old plants have been shut down and ageing-related problems affect plant availability.

Energy policy

UK energy policy since the 2008 Energy Act has largely been built around reducing carbon dioxide emissions rather than security of supply or cost. The 2008 Climate Change Act (CCA) set a goal to reduce greenhouse gas emissions by at least 80% by 2050 from 1990s levels. The CCA requires the UK government to set legally-binding five-year ‘carbon budgets’ to ensure progress towards the 2050 target. In June 2019, following the Intergovernmental Panel on Climate Change's (IPCC's) Special Report on Global Warming of 1.5°C, the CCA was amended to commit the UK to achieving a 100% reduction in emissions – 'net zero' – by 2050.

The CCA required a report setting out proposals for meeting the carbon budgets. The government's Clean Growth Strategy was published in October 2017.

In November 2020 the government published The Ten Point Plan for a Green Industrial Revolution, which announced funding and support for the following areas:

- Advancing offshore wind.

- Driving the growth of low-carbon hydrogen.

- Delivering new and advanced nuclear power.

- Accelerating the shift to zero emissions vehicles.

- Green public transport, cycling and walking.

- 'Jet zero' and green ships.

- Greener buildings.

- Investing in carbon capture, usage and storage.

- Protecting the natural environment.

- Green finance and innovation.

Following on from the Ten Point Plan, in December 2020 the government published a white paper, Powering our Net Zero Future, which sets out the changes needed to make the transition to clean energy by 2050.

In 2021, the Sixth Carbon Budget report (covering the period 2033-2037) – issued by the Climate Change Committee (CCC) that was established under the CCA – set a target of an 80% reduction in greenhouse gas emissions relative to 1990 levels by 2035.

In 2022, following Russia’s military offensive in Ukraine (see information page on Russian-Ukraine War and Nuclear energy), the UK government announced a “major acceleration of homegrown power” to “boost long-term energy independence, security and prosperity.” The energy security strategy is centred on a significant expansion of nuclear energy, with an ambition of up to 24 GWe of capacity by 2050 to provide about 25% of electricity. A new government body, Great British Nuclear, would be set up to “bring forward new projects" and a £120 million Future Nuclear Enabling Fund was launched to "support development of nuclear projects, stimulate competition in the industry and unlock investment."

The strategy also sets out new ambitions for offshore wind as well as a new licensing round for North Sea oil and gas projects. The UK used to be a large producer of oil and gas from the North Sea, but production declined significantly since its peak in 2000. In 2004 the country became a net importer of natural gas and in 2005 a net importer of crude oil. During the decade 2007-2017 natural gas and oil net imports more than doubled.

Due to a policy of coal to gas switching, gas is a key pillar of the UK energy mix and is particularly important for electricity generation. Domestic gas production peaked in 2000 before declining by about 65% in the following decade. Production levels have since remained broadly stable. In 2020, domestic production was sufficient to meet about 50% of demand. Most imports come via pipeline from Norway (55% of the total in 2020). In recent years, the proportion of gas imported as LNG has risen substantially (to 42% of the total in 2020). Of the gas imported as LNG in 2020, 48% was from Qatar, 27% from the USA, 12% from Russia, and 6% from Trinidad & Tobago.

In November 2015 the government articulated new policy priorities for UK energy, involving possibly phasing out coal-fired generation without carbon dioxide abatement in 2025, building new gas-fired plants, and much greater reliance on nuclear power and offshore wind to grapple with “a legacy of ageing, often unreliable plant” and undue reliance on coal. The energy secretary said: "Opponents of nuclear misread the science. It is safe and reliable. The challenge, as with other low carbon technologies, is to deliver nuclear power which is low cost as well. Green energy must be cheap energy.

“We are dealing with a legacy of under-investment and with Hinkley Point C planning to start generating in the mid-2020s, this is already changing. It is imperative we do not make the mistakes of the past and just build one nuclear power station." In the event, the final investment decision for Sizewell C was signed in July 2025, by the incoming Labour government.

In June 2021 the All-Party Parliamentary Group on Nuclear Energy called for urgent decisions to maintain at least 10 GWe of nuclear capacity. "The most critical step now is for government to begin legislating for a financing model for new nuclear in 2021,” it said. It outlined a 10-point roadmap free of EU constraints.

Electricity market reform and financing

In July 2011 the government issued a white paper on electricity market reform (EMR).35 Its four main proposals were: a carbon floor price; long-term contracts (involving feed-in tariffs with a 'contract for difference') to stabilize financial returns from low-carbon generation; a mechanism to ensure the provision of sufficient generating capacity nationwide; and an 'emissions performance standard' to prohibit the construction of high-carbon generation.

The Energy Bill introduced into parliament at the end of November 2012 was in line with the above principles and designed to attract investment to bring about a transformation of the electricity market, moving from predominantly a fossil-fuel to a diverse low-carbon generation mix. The Energy Act passed into law in December 2013, along with new provisions including the supplier obligation. It included:

- Contracts for difference (CfDs) to stabilize revenues for investors in low-carbon electricity generation projects – renewables, new nuclear or carbon capture and storage (CCS) – helping developers secure the large upfront capital costs for low-carbon infrastructure while protecting consumers from rising energy bills. The feed-in tariff with CfD means that if the market price is lower than the agreed ‘strike price’, the government pays that difference per kWh, passing that cost onto electricity consumers. If the market is above the strike price the generator pays the difference to electricity consumers by reducing average tariffs. CfDs are long-term contracts which can be capped regarding quantity of power. The idea is that the carbon floor price will drive the market towards any feed-in tariff or strike price level applied to clean sources. The CfD strike prices for Hinkley Point C nuclear plant are set out below. The Czech Republic, Hungary, Poland and Slovakia are considering the UK CfD model for their own nuclear projects.

- A new government-owned company to act as a single counterparty to the CfDs with eligible generators, and to be central to industry cash flow. A two-stage process means projects are able to apply to the company for a CfD contract once they have cleared meaningful hurdles such as planning permission and a grid connection agreement, and then a small number of hurdles post-CfD award in order to retain the contract.

- Introduction of a capacity market, allowing for capacity auctions, at the minister's discretion. The capacity market involves retainer payments for dispatchable capacity to be built and maintained to ensure that demand can be met regardless of short-term conditions affecting other generators. It is to provide an insurance policy against future supply shortages, helping to ensure reliable electricity supplies at affordable cost. See subsection below.

- A final investment decision (FID) process will enable investment in low-carbon projects to come forward for early projects, guarding against delays to investment in energy infrastructure.

- Transitional measures will allow renewables investors to choose between the new system and the renewables obligation, which was closed to new capacity in March 2017.

- The government had legislated to establish a carbon price floor (CPF) from April 2013, to underpin the move to a low-carbon energy future. The carbon price support (CPS) tax is the difference between the UK floor price and the ETS traded price. Per tonne of CO2, the CPS cap was set at £18 for FY 2021/22. (It was planned to rise to £30 by 2020, but it has been kept lower due to public pressure).

- The supplier obligation is a compulsory levy enforceable by the government-owned CfD counterparty company as if it were a licence condition. It is collected on a unit cost fixed rate (£/MWh). Each supplier collects it in line with its market share and pays it to the counterparty for passing onto the generators. The supplier obligation needs to be funded by the suppliers so that payments under CfDs can be made regardless of collections from customers, which started in December 2014.

As well as price per MWh, the question of guaranteed load factor arises so that output is sufficient to amortize the investment, in the face of renewables’ preferential grid access. For Hinkley Point C, the agreement provides protection from being curtailed without appropriate compensation.

The UK Guarantees Scheme (UKGS) was established in October 2012 to support infrastructure projects seeking finance and investment. In June 2021 the administration and responsibility for the UKGS moved to the UK Infrastructure Bank.

The offer of a £2 billion loan guarantee for Hinkley Point C was announced in September 2015, and a Treasury statement then said that the government guarantee "is also expected to open the door to unprecedented collaboration in the UK and China on the construction of new nuclear power stations." It added: "The agreement also boosts work being carried out under a memorandum of understanding on fuel cycle collaboration signed with China in 2014, which has the potential to leverage UK expertise in waste management and decommissioning as well as support UK growth."

In June 2017 a report from the government’s National Audit Office (NAO) said that other funding options for Hinkley Point C should be considered besides the CfD model. It also called for the government to look in more detail at alternative funding methods to the CfD, such as direct state funding or loans, for future new nuclear construction in the UK.

In 2018 the UK government announced that it was considering a regulated asset base (RAB) model for future nuclear power plant projects as an alternative to CfDs. Under a RAB model, the UK government would provide a plant owner with regulated rates that can be adjusted to guarantee its costs are covered. The RAB model allows the owner of a regulated operation to collect an authorized return on the asset's value that includes operating costs and profit. It protects the operator of a facility by ensuring that the operator has sufficient revenue to maintain its financial capability over a period. It is similar to the US rate base model but with greater flexibility on the part of the UK market regulator to determine what is 'reasonable'.

In July 2019 the UK government published its assessment of the RAB model, which concluded that it has the potential to reduce the cost of raising finance for new nuclear projects, thereby maximising value for money for consumers.

For more information, see information page on Financing Nuclear Energy.

Capacity market

In March 2014 the government announced the design of the capacity market to provide security of supply from 2018 by encouraging investment in reliable generating capacity.* The UK is the first country in Europe to establish a reserve capacity market to ensure supplies when intermittent renewables sources fail to produce. This is a pioneering concept and likely of great interest internationally. Agreements for new dispatchable capacity are for 15 years, and agreements for existing capacity are for one or three years. A provider of reserve capacity will receive a warning of at least four hours from the National Grid that the electricity system is under stress. Penalties for unreliable capacity will be capped at 200% of a provider’s monthly income and 100% of their annual income. The capacity market does not affect dispatch rules when the power is needed.

* A capacity market normally works by producers bidding in their capacity at cost of production, and the grid operator accepts the lowest bids up to the capacity it thinks will be required to meet demand, with a little reserve. The highest bids accepted represent the clearing price, set by the most expensive plant needed to meet demand, and this is what all accepted bidders are paid. The UK system is a variant of this, and with the uncertainties of forecasting demand and the four years lead time between auction and delivery, supplementary auctions are held one year ahead (especially for demand-side response) or private trading can adjust for contingencies. Successful bidders for new capacity are able to write up to 15-year contracts at the auction clearing price, those with existing capacity, rolling one-year contracts.

An auction for pre-qualified capacity is held every year, for delivery four years ahead. A demand curve for the year is published before the auctions and is based around a target capacity level together with an estimate of the reasonable cost of new capacity (referred to as the net cost of new entry, or ‘net-CONE’). The auction can include demand-side response, but excludes capacity receiving support under the renewables obligation (RO), feed-in tariff (FIT) or contract for difference (CfD). Capacity providers successful in the auction are paid by retail suppliers in the year of delivery. Payments are administered by Elexon, as settlement agent. They are included in the levy control framework (LCF) with renewables obligation, CfDs, and small-scale FITs paid for in energy bills.

The capacity auction is capped at £75/kW, which relates to the cost of building a new combined cycle gas turbine. In March 2021 the T-4 capacity market auction (for delivery FY 2024-25) cleared at £18/kW/year. The T-4 auction in February 2024 (for delivery FY 2027-28) cleared at a record £65/kW/year for about 42.8 GW, and the March 2025 auction (for delivery FY 2028-29) cleared at £60/kW/year for about 43.1 GW.

Nuclear power industry

Operable reactors in the United Kingdom

The history and development of the UK nuclear industry is covered in Appendix 1 to this paper, Nuclear Development in the United Kingdom.

The last operating Magnox reactor – Wylfa 1 – shut down in December 2015. All remaining reactors are owned and operated by a subsidiary of France's EDF called EDF Energy.

In November 2023 Costain signed a two-year contract worth £15 million per year to support eight EDF managed nuclear power stations, including the deployment of more than 150 specialists.

Most AGR units are running at significantly less than original or design capacity.

Reactor operating lifetime extensions

In the UK reactor operating lifetime extensions are decided on commercial grounds by the owners in the context of ten-year safety reviews of all reactors undertaken by the Office for Nuclear Regulation (ONR).

EDF Energy announced a seven-year lifetime extension for Hinkley Point B and Hunterston B in November 2012 and a five-year extension for Hartlepool in November 2013. It spent £150 million to prepare Dungeness for a 10-year licence extension, to 2028, and this was agreed by the ONR in mid-2014. In February 2016 it announced five-year lifetime extensions for Heysham I and Hartlepool, to 2024, and seven-year lifetime extensions for Heysham II and Torness, to 2030. However, in January 2022 EDF Energy announced that it planned to close Heysham II and Torness 1&2 in 2028, though in December 2024 the closure dates were pushed back to March 2030 following years of studying graphite crack progression. In September 2022 EDF Energy announced it was considering lifetime extensions beyond 2024 for Hartlepool and Heysham I. In March 2023 the utility confirmed the four reactors would operate for a further two years to March 2026. In December 2024 EDF Energy extended Hartlepool and Heysham I to March 2027, and in September 2025 announced a further 12-month extension to March 2028.

Age-related cracking of graphite bricks comprising the moderator was carefully monitored at Hinkley Point B and Hunterston B (now shutdown). Other reactors are checked less frequently. In April 2021, the ONR gave permission for the units at Hunterston B to be switched back on, but said continued operation would be up to a total of 16.7 terawatt days for unit 1 and 16.52 terawatt days for unit 2 – about a further six months operation for each reactor. Unit 1 returned to service on 23 April, followed by unit 2 on 5 June. Hunterston B1 was permanently shut down in November 2021, followed by unit 2 in January 2022.

The company expects a 20-year lifetime extension for Sizewell B, taking it to 60 years as for similar US PWRs. In January 2015 the ONR approved its ten-year periodic safety review (PSR), allowing operation until the next PSR in 2025. In 2025 the ONR said that EDF Energy’s application for a subsequent ten years of operation had shortfalls and agreed a scope of work to address these by 2028, granting EDF Energy permission to operate Sizewell B during the interim. EDF is seeking a 20-year extension to operate Sizewell B to 2055, for which it estimates an investment of around £800 million is needed. It is in negotiations with the UK government over a long-term power price to enable this.

Nuclear policy and procedure from 2006

It was originally intended that the Sizewell B reactor would be the first of a fleet of PWRs but these plans were abandoned in the 1990s. The question of new nuclear build was then effectively ruled out until 2006, when a review of energy policy reversed the government's opposition to building new nuclear capacitya. Government policy in England and Walesb has since been supportive of new nuclear plants, which should be financed and built by the private sector – with internalized waste and decommissioning costs as per the industry norm internationally. To facilitate new nuclear build, from 2006 the Labour government implemented several measures, in particular:

- Streamlining the planning process.

- Carrying out strategic siting assessment and strategic environmental assessment processes to identify and assess suitable sites for new nuclear plants.

- Ensuring that the regulators are equipped to pre-license designs for new build proposals (the Generic Design Assessment process).

- Electricity market reform to provide long-term sales contracts for power, and a capacity market.

- Legislating to ensure decommissioning and waste management liabilities will be met from operational revenue.

- Strengthening or supplementing the EU Emissions Trading Scheme to build investor confidence in long-term carbon pricing.

The Conservative and Liberal Democrat coalition government elected in May 2010, followed by the Conservative government elected in May 2015, continued to support nuclear power as a high priority and followed through with these initiatives, with minor exceptions noted below.

Following the referendum vote in mid-2016 to leave the EU, the Department of Energy and Climate Change (DECC) was abolished and UK energy policy was transferred to the new Department for Business, Energy, & Industrial Strategy (BEIS), with the priority of building new nuclear capacity affirmed.

Soon after this and in connection with final government approval for the Hinkley Point C project, the government introduced a legal requirement that it holds a controlling ‘special share’ in all major infrastructure projects, including nuclear power, “in line with other major economies”. This was welcomed by proponents of other new nuclear projects.

In its November 2020 Ten Point Plan, the government set out "delivering new and advanced nuclear power" as a policy priority (see above). The final investment decision for Sizewell C was signed in July 2025 (see below).

In February 2023 the Prime Minister’s office announced that BEIS would be split into three new departments, including a Department for Energy Security and Net Zero (DESNZ). DESNZ will be charged with developing the UK’s long-term energy strategy and helping to expand nuclear power generation. In light of department changes, the Chancellor Jeremy Hunt tasked the National Infrastructure Commission to make recommendations on nationally significant infrastructure projects – including major power capacity – in order to overhaul planning requirements and streamline approval processes.

In March 2023 the Chancellor announced that nuclear energy would be classified as environmentally sustainable in the UK’s green taxonomy, giving it access to the same investment incentives as renewable energy*. He also announced the launch of ‘Great British Nuclear’, aimed at providing up to one quarter of UK electricity generation by 2050 and launched the first stage of a competition for SMR developers to secure government funding. There were initially six companies shortlisted, with four shortlisted companies – GE Hitachi, Holtec, Rolls-Royce SMR and Westinghouse – entering negotiations in September 2024. In February 2025, the four SMR vendors were issued with an invitation to submit final tenders, three of which were submitted in April, with Westinghouse withdrawing. In June 2025 Rolls-Royce SMR was selected as the preferred bidder to construct the UK’s first SMRs.

* In July 2025 the UK government scrapped plans for a UK green taxonomy.

Support for nuclear continued following the July 2024 general election. In December 2024 the Labour government published its Clean Power 2030 Action Plan, which includes nuclear as a source of “firm low carbon power”. The Great British Energy Act 2025 received Royal Assent in May 2025, establishing a publicly owned clean energy company with nuclear in scope. In June 2025, Great British Nuclear was renamed Great British Energy – Nuclear (GBE-N).

In November 2025 the government announced Wylfa, Anglesey as the site for the first deployment of Rolls-Royce SMRs, with three units initially and the site assessed as capable of hosting up to eight. The government committed over £2.5 billion, with onsite activity expected from 2026 and power to the grid by the mid-2030s.

In December 2025 the government designated EN-7, a new National Policy Statement for nuclear energy generation, which replaced EN-6 and uses a criteria-based approach rather than listing specific sites, enabling nuclear development at locations beyond those previously identified and supporting SMRs and AMRs. In November 2025 the government published its Nuclear Regulatory Review making 47 recommendations for reform, all accepted in principle, including streamlining planning and designating nuclear as a 'critical national priority'. In February 2026 it published the Advanced Nuclear Framework establishing pathways for privately funded advanced reactor projects.

Planning

A new planning regime was introduced to aid the installation of nuclear reactors as well as other significant new infrastructure projects such as railways, large wind farms, reservoirs, harbours, airports and sewage treatment works. Under the Planning Act 2008, the need for new infrastructure would be addressed through a national policy statement (NPS, see next section on Nuclear site licensing and authorization). Then, it was intended that the local impacts of a particular development would be handled by an independent Infrastructure Planning Commission (IPC) rather than by ministers or local planning authorities. The IPC was formed in October 2009, but the new coalition government that took office following the 2010 general election replaced the IPC with an advisory body and returned decision-making power to the responsible minister. Under the Localism Act 2011, the IPC was abolished and in April 2012 its staff and functions were transferred to a new national infrastructure directorate created within the Planning Inspectorate (PINS).

A development consent order issued by the UK Planning Inspectorate is required for nationally significant infrastructure projects, and represents permission granted by the UK government for such developments, including nuclear power plants.

Nuclear sites: selection, licensing and authorization

Between July and November 2008, a consultation was carried out on a proposed strategic siting assessment (SSA) process for identifying sites which are suitable for new nuclear power stations to be built by the end of 2025.11 Sites found to be strategically suitable for new nuclear plants through the SSA were listed in the Nuclear National Policy Statement (Nuclear NPS).

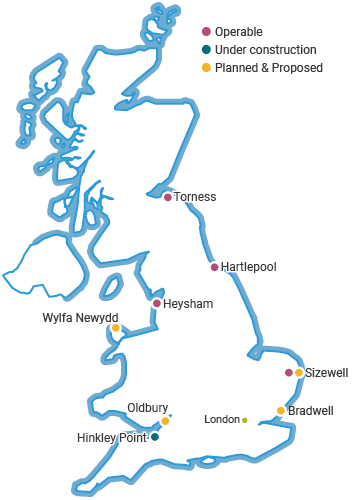

In its January 2009 response to the consultation12, the government invited nominations for sites to be assessed for their suitability for the deployment of new nuclear power stations by 2025. Eleven sites were nominated and, following assessment of these sites, the government formed the "preliminary conclusion" that all of the nominated sites, with the exception of Dungeness, were potentially suitabled. Three alternative sites – Druridge Bay in Northumberland, Kingsnorth in Kent and Owston Ferry in South Yorkshire – were not considered to be suitable for nuclear development before the end of 2025, although they were said to be worthy of further investigation. The ten sites included in the draft Nuclear NPS were: Hinkley Point, Oldbury, Sellafield, Sizewell and Wylfa, all of which were the subject of existing proposals (see below); as well as Bradwell, Braystones, Hartlepool, Heysham, and Kirksanton. In October 2010, the two greenfield sites near Sellafield – Braystones and Kirksanton – were removed from the list, and the other eight confirmed.

A consultation on six draft National Policy Statements for energy infrastructure, including the draft Nuclear NPS, ran from November 2009 to February 2010. Following the May 2010 general election, the new coalition government required all National Policy Statements to be ratified by parliament, confirming selection of the above eight sites in July 2011 and introducing planning reforms to allow plant construction to be expedited.

The minister also announced regulatory justification of the AP1000 and EPR reactor designs according to EU law, due to their potential for increasing energy security and decreasing CO2 emissions outweighing any detrimente. Hitachi-GE’s ABWR reactor design for Wylfa Newydd was justified in December 2014 and confirmed by Parliament in January 2015.

The ONR grants a nuclear site licence under the Nuclear Installations Act 1965 for the installation and operation of a nuclear reactor. This covers the full lifecycle from construction to operation and through to decommissioning. A standard set of 36 licence conditions is attached to each licence that requires site licence companies to implement adequate arrangements to ensure compliance. Prior to a nuclear site licence being granted, a site licence company has to demonstrate it is a suitable legal entity that is able to discharge its regulatory obligations.

A nuclear site licence was issued for Hinkley Point C in November 2012 after 16 months of consideration by the ONR. An application was made for Wylfa Newydd in April 2017, but in January 2019 Hitachi announced it was suspending work on the project. In September 2020 Hitachi announced its decision to withdraw from the UK nuclear business. An application was made for Sizewell C in June 2020 and approved in May 2024. The final investment decision for Sizewell C was made in July 2025 (see section on Sizewell C below).

In September 2025 the UK government advanced its phaseout of Russian uranium from 2030 to 2028 under the Technology Prosperity Deal with the USA, aiming for full independence from Russian nuclear fuel as part of broader efforts to cut funding for Russia’s war in Ukraine.

Generic design assessment

In June 2006, the UK's Health & Safety Executive (HSE), which licenses nuclear reactors through its Office for Nuclear Regulation (ONR), suggested a two-phase licensing process similar to that in the USAf. The first phase, developed in conjunction with the Environment Agency (EA), is the generic design assessment (GDA) processg. Considering third-generation reactors, a generic design authorization for each type would be followed by site- and operator-specific licences. Phase 1 would focus on design safety and take around three years to complete; phase 2 is site- and operator-specific and would take around 6-12 months.

Initial guidance on the GDA process was issued by the HSE and EA in January 2007, and in July of that year, applications for four reactor designs were made: UK EPR, submitted by Areva and EDF; Westinghouse's AP1000; GE Hitachi Nuclear Energy's ESBWR; and AECL's ACR-1000. Although the initial assessments of the four designs found no shortfalls, AECL withdrew its design from the GDA process in April 2008. Later, in September 2008, assessment of the ESBWR was halted after GE Hitachi requested a temporary suspension.

The HSE, through ONR, was on course to complete the initial GDA assessment for the two remaining designs by July 2011, although further processing was delayed pending an HSE evaluation of lessons from the March 2011 Fukushima accident and approval of the reactor vendors' responses to those.

Upon completion of the GDA, if the design is judged to be satisfactory, the ONR issues a design acceptance confirmation (DCA) and the Environmental Agency issues a statement of design acceptability (SoDA).

Small modular reactors (SMRs) are a further GDA task for the ONR. The National Nuclear Laboratory in 2014 undertook a feasibility study on SMR concepts, with its report on molten salt reactor development published by the government in July 2015. In March 2016 the Department of Energy & Climate Change (DECC) called for expressions of interest in a competition to identify the best value SMR for the UK. All proposals were required to proceed through the GDA process in the UK.

GDAs completed: Areva UK EPR (December 2012); Westinghouse AP1000 (March 2017); Hitachi-GE ABWR (December 2017); CGN HPR1000 (February 2022).

GDAs underway/submitted: Rolls-Royce SMR, GE Hitachi BWRX-300, Holtec International SMR-300.

In addition, Newcleo submitted a GDA for its LFR-AS-200 before subsequently suspending its UK development effort.

Westinghouse AP1000

The process of obtaining a full DAC and SoDA for the AP1000 resumed in January 2015 when Westinghouse became part of NuGen due to the Toshiba 60% stake in that project. It was completed in March 2017. Westinghouse said the milestone "expands the global regulatory pedigree of the AP1000 plant design and further confirms Westinghouse's innovative safety technology.” As the GDA proceeded, issues arose which were in common with new capacity being built elsewhere, particularly the EPR units in Finland and France. This led to international collaboration and a joint regulatory statement on the EPR instrumentation and control among the ONR, US NRC, France's ASN and Finland's STUK. For the AP1000, the ONR drew upon experience with the eight AP1000 units under construction in China and the USA. More broadly it relates to the Multinational Design Evaluation Programme and will help improve the harmonization of regulatory requirements internationally.

Hitachi-GE ABWR

Early in 2013 Hitachi-GE applied for GDA for its Advanced Boiling Water Reactor (ABWR), and in October 2014 the ONR and EA completed the third stage of this, and cleared it to proceed to the final stage. In 2015 the ONR and EA had raised an issue regarding reactor chemistry, and then another regarding safety analysis. The company completed the GDA process on schedule in December 2017. There are four operable ABWR units in Japan, while two more are under construction.

In January 2024 it was announced that Hitachi-GE had won £33.6 million UK Future Nuclear Enabling Fund grant from the UK government and it entered the GDA process for its 300 MWe BWRX-300 SMR. Step 1 of the GDA was completed in December 2024. Step 2 was completed in December 2025, making it the first vendor to complete the shortened two-step GDA process.

CGN Hualong One/HPR1000

In 2015, China General Nuclear Power Group (CGN) said it intended to apply for GDA for its version of the 1150 MWe Hualong One (HPR1000) reactor design, with a view to building it at Bradwell. Fangchenggang 3 is the reference plant. General Nuclear Systems (GNS), the joint venture of EDF Energy and CGN formed to progress the GDA, wrote to the government in October 2016 saying it was ready to start the GDA process, and in January 2017 the Department for Business, Enterprise and Industrial Strategy (BEIS) requested the ONR to commence it. The ONR had been advising EDF and CGN meanwhile. This GDA commenced in January 2017 and was completed in 2022.

Rosatom VVER-TOI

In 2012 Rosatom announced that it intended to apply for design certification for its VVER-TOI reactor design of 1200 MWe, with a view to Rusatom Overseas building them in the UK. In June 2013 an intergovernmental agreement set up a working group to explore possible Rosatom involvement in UK nuclear power projects. This led to a nuclear cooperation agreement in September 2013, immediately following which Rosatom, Rolls-Royce and Fortum agreed to prepare for submitting an application for GDA for the VVER-TOI reactor, possibly in 2015, though this did not proceed. There have been no further developments regarding VVER reactors.

Rolls-Royce SMR

In March 2022 Rolls-Royce Consortium applied for GDA of its 470 MWe design and the ONR began its three-stage assessment process in April 2022. The review moved to step 2 in April 2023, and to step 3 in July 2024.

Holtec International SMR-300

The ONR began its review in October 2023. Step 1 was completed in August 2024 and step 2 is ongoing.

GE Hitachi BWRX-300

The ONR began its review in January 2024.

Newcleo LFR-AS-200

Newcleo submitted an application to enter the GDA for its SMR design in December 2024 but in July 2025 suspended its UK development programme.

Funded decommissioning programme

The Energy Act 2008 stipulates that plant operators are required to submit a Funded Decommissioning Programme (FDP) before construction on a new nuclear power station is allowed to commenceh. The Funded Decommissioning Programme must contain detailed and costed plans for decommissioning, waste management and disposal. The government will set a fixed unit price for disposal of intermediate-level waste and used fuel, which will include a significant risk premium and escalate with inflation. During plant operation, operators will need to set aside funds progressively into a secure and independent fund. Ownership of wastes will transfer to the government according to a schedule to be agreed as part of the FDPi.

Relationship with the European Union and Euratom

Following a referendum and parliamentary vote, the UK left the European Union on 31 January 2020. As part of the Withdrawal Bill, the UK left the European Atomic Energy Community (Euratom) on 31 January 2020.

Euratom is a separate legal entity from the EU and governed by the 1957 Euratom Treaty, preceding the EU, but it is closely linked to its institutions. Nuclear power generates almost 30% of the EU’s electricity, and Euratom establishes a common market in nuclear goods, services, capital and people within Europe as well as arrangements for safeguards related to the Nuclear Non-Proliferation Treaty.

The UK government passed the Nuclear Safeguards Act 2018, which makes provisions for the government to pass regulations on and implement safeguards agreements, covering some of the 'gaps' created by leaving Euratom. The government signed new nuclear cooperation agreements with Australia, the USA, Canada, as well as two new safeguards agreements with the International Atomic Energy Agency (IAEA) to ensure the supply of nuclear material for electricity generation and medical use. In December 2020 the UK signed a nuclear cooperation agreement with the EU, which took effect from 1 January 2021.

Building new nuclear capacity

Hinkley Point C

EDF Energy is constructing two EPR nuclear reactors at Hinkley Point in Somerset.

The company applied for consent to construct and operate the two reactors (3260 MWe) at Hinkley Point in October 2011, though the GDA process on reactor design was not concluded until December 2012 (see section above on generic design assessment). At that time, EDF envisaged having the first new reactor online by 2018. By mid-September 2010 EDF Energy had let £50 million in contracts for site works at Hinkley Point, and by February 2013 pre-development costs there had reached almost £1 billion. In March 2013 environmental permits were granted for plant operation, and planning permission was received.

Earlier in late July 2011, NNB Generation (then EDF Energy 80%, Centrica 20%) submitted an application to ONR for a nuclear site licence for two Areva EPRs at Hinkley Point C. The ONR assessed the company's "suitability, capability and competence to install, operate and decommission a nuclear facility," and issued a site licence in November 2012. The local government had given permission to prepare the site.

EDF announced in October 2013 that while it would retain 45-50% of the Hinkley Point C project, two Chinese companies, CGN and CNNC, would take 30-40% of it between them, Areva would take 10%, and other interested parties might take up to 15%.* The French government held 85% of EDF and 80% of Areva, the Chinese companies are wholly government-owned. In September 2015, following Areva’s financial losses, EDF confirmed that Areva’s 10% share was “no longer on the agenda.”

* By the end of 2012 Centrica had expressed reservations about its investment in the new plant and EDF was discussing with China General Nuclear Power Holdings (CGNPC, now CGN) about buying out Centrica or in some other way taking equity in Hinkley Point. The two companies are partners in the Taishan nuclear plant in China, using EPR technology. Then in February 2013 Centrica said it would not proceed to invest in the new units, citing uncertainty re project costs and schedule. (It remains a 20% shareholder in EDF Energy's current nuclear generation capacity at eight plants.)

Through 2012 and most of 2013 EDF, parent company of EDF Energy, was locked into negotiations with the UK government to obtain "the correct market framework [to] allow an appropriate return on the massive investment required." A £1.2 billion civil engineering contract was deferred. In June 2013 the government announced that it would guarantee up to £10 billion in loans for the plant under the 2012 UK Guarantees Scheme (see above) for infrastructure (and that CfD rates for wind power would be at least £100 per MWh, and £155/MWh for offshore wind). In September 2015 the government announced a £2 billion loan guarantee offer for the project, and said more would be available if EDF met certain conditions. EDF said that this would “pave the way for a final investment decision by energy company EDF, supported by China General Nuclear (CGN) and China National Nuclear Corporation (CNNC), later this year."

In October 2013 the government announced that initial agreement had been reached with EDF Group on the key terms of a proposed £16 billion* investment contract for the Hinkley Point C nuclear power station. These include a 35-year CfD**, the 'strike price' of £89.50/MWh being fully indexed to the Consumer Price Index and conditional upon the Sizewell C project proceeding. If it does not for any reason, and the developer cannot share first-of-a-kind costs across both, the strike price is to be £92.50/MWh. The terms include compensation if output is curtailed by the National Grid. EDF said that the agreement in principle was not legally binding, and depended on a positive decision from the European Commission in relation to state aid, following which it would make a final investment decision on the project. It said that following EC approval, first concrete would be 30 months on, with construction time 75+ months.

* This is the overnight capital cost in 2012 £, including some owner’s costs. A £24.5 billion figure has been mentioned on the basis of including financing (interest charges during construction) and inflation.

** The 35 years run from start-up during 2025-2029. After 2029 the CfD is shortened by one year of delay up to 2033, after which it would be cancelled. EdF Energy would be able to get revenues from the market, but not top-up revenues from the CfD.

In October 2014 the EC decided that revised UK plans to support the construction and operation of the project were in line with EU state aid rules. The price support for electricity from the plant over 35 years was found to address a genuine market failure. In the process of the investigation the UK agreed to modify significantly the terms of the project financing, by raising the guarantee fee paid by the developer to the UK Treasury. Also as soon as the operator's overall return on equity exceeds the rate estimated at the time of the decision, any gain will be shared with the public entity supporting the long-term wholesale electricity price through the CfD. This gain-share mechanism will be in place not only for the 35-year support duration as initially envisaged, but for the entire 60-year lifetime of the project. Moreover, if the construction costs turn out to be lower than expected, the gains will also be shared.

In October 2015 a strategic investment agreement was signed committing CGN to take 33.5% of the project, and EDF initially being responsible for 66.5%, with a view to selling this down to near 50%. CGN’s holding would be through its new company, General Nuclear International. In December 2016 the Chinese coal mining company Wintime Energy agreed to take about 2% of the project, through CGN. The EDF-CGN joint venture is NNB Generation Company Limited, which holds the site licence issued in 2012.

After prolonged consultation with French unions, in July 2016 EDF made its decision to proceed with the project, with full construction then expected to begin in mid-2019. UK trade unions expressed “100% support”. However, the UK government unexpectedly said that it would take until September for the new leadership to make a final decision on the project. The Chinese ambassador then urged the government to decide as soon as possible, pointing out that the project "is the considered outcome of a mutually beneficial tripartite partnership between Britain, France and China," and that the UK "could not have a better partner" than CGN. After seven weeks of uncertainty the government gave approval, after reaching a new agreement in principle with EDF, which means that the government will be able to prevent the sale of EDF’s controlling stake prior to completion of construction. The agreement was signed at the end of September, as was a €5 billion contract between NNB and Areva for two EPR nuclear steam supply systems, from design and supply to commissioning, and two I&C systems. A long-term fuel supply agreement with Areva was also signed.

EDF expected the first reactor to be operational 115 months after the investment decision and government approval, hence early 2026. In May 2016 it put the cost at £18 billion including normal contingencies, of which £2.4 billion had already been spent. In July 2017 the cost estimate was raised to £19.6 billion. By November 2017 about £9 billion of supply chain contracts had been awarded. In September 2019 EDF again raised the estimated cost of construction by £1.9-2.9 billion, taking the cost estimate to £21.5-22.5 billion. In January 2021 EDF raised its cost estimate to £22-23 billion owing to delays due to coronavirus. It then expected unit 1 to start up in June 2026. In May 2022 EDF raised the cost estimate to £25-26 billion, and pushed back the in-service date for unit 1 to June 2027 at the earliest.

EDF is acting as architect-engineer. Contractors include Areva (now Framatome) for the reactor system, its fuel, and instrumentation and control, worth £1.7 billion; Bouyges and Laing O'Rourke for civil engineering, worth over £2 billion; GE and Alstom for the conventional islands with two 1770 MWe Arabelle turbines, worth $1.9 billion; and Costain for cooling water intake tunnels (seven metres in diameter with a total length of 11 km). Rolls-Royce will provide some manufacturing of nuclear components. The government and EDF said UK companies could take up to 57% of the construction work. The total number of workers on the project could reach as high as 25,000, with a peak of 5600 onsite at one time, and EDF estimating 900 permanent jobs when the units are operational. In September 2016 EDF said that the project would not use the offered government loan guarantee.

In March 2017 the ONR issued a licence for placement of the first structural concrete for the 'technical galleries' of the plant. These are a series of underground reinforced concrete structures located beneath the site, and some above-ground structures. In November the ONR approved construction of the 'common raft' reactor foundation, which was poured in four stages from December 2018 to mid-2019. First concrete for the nuclear island was poured on 11 December 2018, and construction of the basemat for the first unit was completed by June 2019. First concrete for unit 1 was poured in December 2018, and in December 2019 for unit 2.

National Grid will build 56 km of new 400 kV connections (8 km of which will be underground) and upgrade an existing 132 kV network. About 67 km of overhead lines will be replaced, with 10 km underground.

In China, EDF in joint venture has built two EPR units at Taishan, the components are from Japan and China, and the project is close to schedule and budget. For Hinkley Point C, all construction risks will remain with EDF and its partners. As noted above, the Chinese investment is seen as a foothold in the UK, with a view to Chinese reactors being built in future. In connection with the Hinkley Point agreement, EDF and CGN have also signed heads of agreement for a wider partnership in developing new power plants at Sizewell and Bradwell.

In December 2022 EDF, CGN and the UK government agreed a three-year extension to the standing CfD, amending the ‘long-stop date’ to 2036. Project completion costs were then estimated in the range of £25 to £26 billion. The same month, construction of the reactor pressure vessel for the first two EPR units was completed in France, ready for delivery to Hinkley Point C.

In January 2024 following the completion of an exhaustive cost and schedule re-evaluation, EDF announced a two-year delay to the completion of Hinkley Point C, meaning the first reactor would not be connected to the grid before 2030. The estimated completion cost of the plant was also raised to a range of £31 billion to £34 billion in 2015 values.

See also EDF Energy webpage on Hinkley Point C.

Power reactors under construction

| Reactor | Type | MWe gross | Construction start | Grid connection |

| Hinkley Point C1 | EPR | 1720 | December 2018 | 2029 |

|---|---|---|---|---|

| Hinkley Point C2 | EPR | 1720 | December 2019 | 2030 |

Sizewell C

EDF Energy plans to build two further EPR units at Sizewell, in Suffolk. EDF Energy and CGN agreed in October 2015 to develop the Sizewell C project to the point where a final investment decision could be made. The Sizewell C project was initially jointly owned by EDF (80% share) and CGN, but in November 2022 the UK government bought out CGN’s 20% stake in the project. Further UK government investment (see below) has reduced EDF Energy’s stake. In November 2022 EDF Energy said that it planned to "retain only a minority stake in the final investment decision – a maximum of 20%".

The RAB financing model (see Electricity Market Reform section above, and information page on Financing Nuclear Energy) is being used for Sizewell C. In June 2019, EDF indicated that its own provisional forecasts suggested that the associated upfront cost would be about £6 annually per household. EDF submitted a development consent order (a planning application) for the plant in May 2020. In November 2020 a government spokesman said that planning approval was unlikely to be before the second half of 2021.

In January 2022 the UK government allocated £100 million to support the Sizewell C project, with the aim of attracting finance from private investors. In September 2022 prime minister Boris Johnson announced that the UK planned to invest an additional £700 million to help advance the project and to acquire a 50% stake.

In January 2024 the UK government announced an additional £1.3 billion of funding allowing pre-construction work to continue pending a final investment decision. In May 2024 the ONR granted a nuclear site licence for the Sizewell C site. In June 2025 the UK government committed a further £14.2 billion to the project, and in July it signed the final investment decision. EDF Energy in July 2025 estimated the capital cost of the project at £38 billion (in 2024 prices). It said this represented a 20% saving compared with Hinkley Point C. In November 2025 the project reached financial close, with £5 billion in debt raised through a Bpifrance export credit facility alongside a term loan from the National Wealth Fund.

The government will take an initial 44.9% stake in the project. Canadian investment fund La Caisse will have a 20% stake, British multinational energy and services company Centrica 15%, and international infrastructure asset manager Amber Infrastructure will have an initial 7.6% (with an option to acquire a further 2.4% from the government exercisable within 24 months of revenue commencement). France's EDF would have a 12.5% stake in the project.

France's export credit agency, Bpifrance Assurance Export earlier proposed a £5 billion debt guarantee to back EDF's commercial bank loans. Alongside this investment, the UK's National Wealth Fund – the government's principal investor and policy bank – is making its first investment in nuclear energy. It will provide the majority of the project's debt finance, working alongside Bpifrance Assurance Export, to help support the building of the power plant. The government said it is providing the National Wealth Fund with additional capital to facilitate this lending to Sizewell C. In July 2025 the government made a final investment decision to go ahead with Sizewell C. Announcements stated an estimated cost of £38 billion in 2024 prices. The British government would be the largest shareholder with 44.9%, followed by La Caisse (20%), Centrica (15%), EDF (12.5%) and Amber Infrastructure (with an initial 7.6% and an option to take a further 2.4% from the government).

Small reactors

Cottam

In September 2025, Plans were announced by EDF Energy to redevelop its shutdown Cottam coal power plant in partnership with Holtec using SMR-300 units. The companies were working with Tritax Management to supply power directly to a ‘1 GW’ data centre also to be built at the site before 2030, while the nuclear units would come online in the 2030s. Holtec SMR-300s have a net capacity of 320 MWe and are designed to be built in pairs, covering about 30 acres (12 hectares). Holtec noted that the Cottam site covers 900 acres and therefore has ample potential for more units.

Cottam is in Nottinghamshire, near Retford, alongside the river Trent. A coal plant with four 500 MWe boilers operated there from 1968 until 2019. It is now under decommissioning with main buildings, cooling towers and chimney all removed as of mid-2025.

Cottam would be Britain’s first nuclear power plant sited on a river, and only the second to be inland.

In March 2024 Hyundai Engineering & Construction and Holtec International – referred to as Team Holtec – signed an agreement with Balfour Beatty and Mott McDonald to cooperate on Holtec’s bid to construct SMRs in the UK.

Hartlepool

In September 2025, Centrica, and X-energy announced a joint development agreement to build a plant comprising 12 Xe-100 units adjacent to EDF Energy’s existing Hartlepool nuclear power plant. The companies said they intend to find industrial and investor partners to create a development company for this and other projects. Meanwhile, Centrica would provide initial project capital. The companies said they aim for first power in the mid-2030s.

Power reactors planned and proposed

| Proponent | Reactor/site | Locality | Type | Capacity (MWe gross) |

Construction start |

| EDF Energyn | Sizewell C1 | Suffolk | EPR | 1670 | |

| Sizewell C2 | Suffolk | EPR | 1670 | ||

| Rolls-Royce SMR | Wylfa SMR-1 | Anglesey, Wales | Rolls-Royce SMR | 490 (est.) | |

| Total planned | 3 units | 3830 MWe | |||

| EDF Energy | Cottam | Nottinghamshire | SMR-300 | 2 x 360 | |

| Centrica | Hartlepool | County Durham | Xe-100 | 12 x 90 | |

| Rolls-Royce SMR | Wylfa SMR-2&3 | Anglesey, Wales | Rolls-Royce SMR | 2 x 490 (est.) | |

| Total proposed | 16 units | 2780 MWe | |||

| China General Nuclear | Bradwell B1&B2 | Essex | Hualong One | 2 x 1150 | Cancelled |

| Horizon | Wylfa Newydd 1&2 | Anglesey, Wales | ABWR | 2760 | Cancelled |

| Horizon | Oldbury B1&B2 | Gloucestershire | ABWR | 2760 | Cancelled |

| GE Hitachi | Sellafield | Cumbria | 2 x PRISM | 2 x 311 | Cancelled |

| Candu Energy | Sellafield | Cumbria | 2 x Candu EC6 | 2 x 740 | Cancelled |

| NuGeneration | Moorside 1-3 | Cumbria | 3x AP1000 | 3 x 1135 | Cancelled |

The PRISM and EC6 options for Sellafield were alternatives for plutonium disposition.

Building new nuclear capacity: other proposals

Since the government reversed its unfavourable policy towards nuclear in 2006, several utilities have begun planning to build new nuclear plants. The initial concern was that the most promising sites were owned by only two organizations: British Energy – which had recently completed restructuring following its financial collapse in 2002 (see section on British Energy in Appendix 1, Nuclear Development in the United Kingdom); and the government-owned Nuclear Decommissioning Authority (NDA) – which had recently taken ownership of BNFL's and the UKAEA's nuclear sites in order to decommission theml. Utilities wishing to build new nuclear plants in the UK therefore had to either acquire British Energy, or its sites; or acquire land from the NDA.

France’s EDF, 85% owned by the French government, successfully bid for British Energy, completing the £12.5 billion acquisition in January 2009. Later in 2009, Centrica bought a 20% stake in British Energy for £2.3 billion. Conditions attached to the acquisition of British Energy included the sale of land at Wylfa, Bradwell and either Dungeness or Heysham, as well as to relinquish one of the three grid connection agreements it held for Hinkley Point. British Energy became part of EDF Energy.

There has been substantial international interest in the UK's 21st century nuclear programme, as described below. Also Rosatom, owned by the Russian government, had proposed taking equity in Horizon before it was bought by Hitachi.

Notably, several Chinese government-owned companies, principally CGN, have discussed taking equity in each of the proposed nuclear developments. It was reported that CGN would only proceed with taking a share of Hinkley Point if it had significant operational control of any further nuclear plants, notably Sizewell C. The UK government has shown concern about Chinese government control through CGN, compared with French government control through EDF. When CGN showed interest in buying Horizon, for example, the government said it could only have a minority interest.

In October 2013, following the signing of a memorandum of understanding on nuclear power cooperation by the two countries, the Chancellor announced that the government approved Chinese companies taking equity – including potential future majority stakes – in the development of UK’s nuclear power projects. UK companies would have access to business opportunities in China’s nuclear programme. Immediately after this, EDF Group announced that it had agreement in principle with both CGN and CNNC to take substantial equity in the Hinkley Point C project.

In January 2014 CGN said that it would be a minority shareholder in Hinkley Point C “to lay the foundation for further development in CGN-led projects in the UK.” It then planned to acquire a site, and along with local and Chinese partners, to build and operate nuclear power plants in the UK. No particular reactor technology was mentioned, but the UK government confirmed that Chinese companies could own and operate Chinese-designed nuclear plants subject to normal approvals. However, in July 2020 the UK government announced a review of the national security impact of all Chinese investments in UK infrastructure, including Bradwell B. This followed its decision to block telecommunications company Huawei from participating in the development of the country's 5G mobile network. See section on Bradwell B, below.

NuGeneration – Moorside

NuGeneration* was set up early in 2009, and then comprised a 50:50 joint venture of Iberdrola (which owns Scottish Power) with GDF Suez (now Engie). NuGeneration in October 2009 bought the 190 ha Moorside site on the north side of Sellafield from the NDA for £70 million. In December 2013 Iberdrola agreed to sell its 50% share to Toshiba for £85 million, after having been in discussion since early in the year regarding building its Westinghouse AP1000 reactors and taking equity in the project. Toshiba then bought one-fifth of GDF Suez’s stake at the same price, to give it majority (60%) ownership for about £102 million, from June 2014. Following Westinghouse’s Chapter 11 bankruptcy petition, in April 2017 Engie announced that it required Toshiba to buy its 40% share in NuGen, and this transaction was completed in July 2017 for £109 million. Engie said it "remains willing to put its know-how and expertise at the service of NuGen and help any restructuring with new potential partners for the development, construction and operation of the project."

* Originally this was owned 37.5% each by Iberdrola and GDF Suez, and 25% by Scottish & Southern Energy, though SSE decided to sell out of it in 2011, giving the other partners 50% each. Before the Toshiba acquisition, China’s State Nuclear Power Technology Corporation (SNPTC) was reported to be interested in a share in NuGen.

In December 2017, it was announced that Korea Electric Power Corporation (Kepco) had been named as the preferred bidder to acquire 100% of the shares in NuGen. Subject to completion of the acquisition and UK government approval, two of Kepco's APR1400 reactors would be used at the site, replacing earlier plans for three AP1000 units. However in July 2018, it was announced that Kepco had lost its status as preferred bidder. In September 2018, NuGen announced it was reducing its staff by 60% due to the "prolonged time" it had taken to agree a sale. In November 2018, Toshiba announced that it had decided that NuGen would be wound up from January 2019 after failing to find a buyer.

Earlier, in November 2016 and prior to Westinghouse's filing for bankruptcy, NuGen announced that it expected the cost of the project to be £13-15 billion. The UK government said that it expected the CfD strike price would be significantly lower than that for Hinkley Point.

National Grid would need to build 400 kV lines both north and south, and there are grid connection agreements for 1600 MWe by October 2023 and another 1600 MWe by October 2025. In October 2016 it announced plans to invest £2.8 billion in these new transmission links over 164 km and upgrading old ones. More than a quarter of the new links could be underground, including 23.4 km through the Lake District National Park, which also involves placing existing transmission lines underground and removing obtrusive pylons. Putting cables through a 22 km tunnel under Morecambe Bay to avoid the south part of the national park would cost £1.2 billion, the major part of £1.9 billion to put transmission lines out of sight. The timing of work on the transmission links would be aligned with that for the plant itself.

In July 2020, Moorside Clean Energy Hub – a consortium of 15 companies, unions and individuals, including EDF – called for a “package of nuclear projects at Moorside, including a 3.2 GW UK EPR power station, small modular reactors and advanced modular reactors.”

Horizon – Wylfa Newydd and Oldbury

Early in 2009, a 50:50 new-build joint venture of RWE npower with E.ON UK was established: Horizon Nuclear Power. Horizon bid for NDA land alongside old Magnox plants at Oldbury, Wylfa and Bradwell. Other bidders included EDF Energy and Vattenfall. The winning bids for Oldbury and Wylfa were from Horizon. Including bids from EDF and NuGeneration, the auction raised £387 million for the NDA28.

By 2025, Horizon planned to have around 6000 MWe of new nuclear capacity in operationm. For its site at Wylfa in Wales, Horizon was proposing constructing up to four AP1000 reactors or three EPR units. For its Oldbury site, it was considering either three AP1000 reactors or two EPRs. The planning application for Wylfa was envisaged in 2012, that for Oldbury in 2014. But early in 2012 German-based RWE and E.ON announced that they wanted to withdraw from Horizon.

Following this there were several expressions of interest in buying Horizon: first was Rosatom directly with a view to using VVER-1200 reactors, then China's SNPTC with Toshiba, which became a Westinghouse-SNPTC bid with Exelon. An Areva-CGNPC bid was announced, using the EPR, but then withdrawn, and finally Hitachi Ltd bid with a view to building the GE-Hitachi ABWR. Rosatom subsequently said that it was prepared to build western-design reactors in UK initially, pending design certification of VVER types. Meanwhile some work continued on the two sites.

In October 2012 the £696 million Hitachi bid was accepted, making Horizon a 100% subsidiary of Hitachi. It planned to build two or three of the 1380 MWe (gross) ABWR units at each site, and in April 2013 applied to the ONR for GDA. In December 2017 the regulator cleared the design for use in the UK. As with the EPR design, the ONR worked with overseas regulators on the assessment of the UK ABWR. (Several ABWR units have been operating in Japan.)

Earlier in May 2013 Horizon signed an engineering and design contract with Hitachi-GE Nuclear Energy Ltd (HGNE, 80% owned by Hitachi), which was progressing the GDA for Wylfa Newydd with the ONR. In 2015 Hitachi incorporated in UK a new company Hitachi Nuclear Energy Europe Ltd (HNEE) which was to represent the parent company in the Menter Newydd joint venture with Bechtel Management Co and JGC Corporation (based in Japan) which was set up for the engineering, procurement and construction (EPC) of the project. HGNE was to operate under contract to the Menter Newydd joint venture.

In December 2013 the government signed a cooperation agreement with Hitachi and Horizon “to promote external financing” for the Wylfa Newydd project under the 2012 UK Guarantees scheme for infrastructure, with a view to a guarantee by the end of 2016 similar to that for Hinkley Point. Horizon said in November 2016 that Hitachi had spent £1.5 billion already on “on engineering and preliminary site work to date at Wylfa Newydd” and expected a final investment decision in 2019. In March 2017 Hitachi said that it would focus on controlling construction costs and accordingly planned to involve Bechtel, to help attract investors.

In July 2016 Horizon and Hitachi signed a technical services contract with Japan Atomic Power Co (JAPC) to support Horizon in construction, costing, licensing and commissioning the ABWR units. In February 2017 Horizon announced an operating partnership with the major US utility Exelon, which has 19,460 MWe of nuclear capacity from 21 units, including 14 BWRs. In April 2017 Exelon and JAPC formed a 50:50 joint venture, JExel Nuclear, "to leverage Exelon's expertise in operational excellence and safety among international operators using Japanese reactor technologies."

In April 2017 Horizon Nuclear Power Wylfa Ltd applied to the ONR for a site licence for Wylfa Newydd. This was expected to take 19 months to process.

In June 2017 Hitachi said that a decision to proceed with the project was contingent on finding an investment partner, without which it would suspend the project. Both the government and the company had said that they expect the CfD strike price to be significantly lower than that for Hinkley Point.

In June 2018, Hitachi and the UK government commenced negotiations on the project. The UK's Business and Energy Secretary stated that the discussions focused on achieving lower cost electricity for consumers. He also told parliament on 4 June 2018, that a "long-term pipeline" of support would be provided for new nuclear projects in the UK.

Later in June, it was announced that Hitachi was also in discussions with Japanese banks and utilities regarding investment in Horizon.

However, in January 2019 Hitachi announced that it was suspending work at Wylfa Newydd and Oldbury, having failed to agree terms on funding with the UK government.The site licence had not been granted by the time work was suspended in January 2019.

The site licence had not been granted by the time work was suspended in January 2019. The Business and Energy Secretary told parliament that the government was willing to consider a one-third equity stake in the Wylfa project, alongside investment from Hitachi and Japan government agencies and other strategic partners. It was also willing to consider providing all the required debt financing to complete construction, and it would consider a contract for difference agreement to the project with a strike price of no more than £75/MWh – somewhat less than for EDF's Hinkley Point C now under construction.

In September 2020 Hitachi withdrew from the project announcing that it would "end business operations on the nuclear power plant construction project in the United Kingdom."

In November 2020 it was reported that a US consortium, led by Bechtel, was considering investment in the project.

In January 2021 Horizon withdrew its planning application for its proposed plant and confirmed that it would close its UK operations on 31 March. In February 2021 it was reported that the Welsh government was considering acquiring the Wylfa Newydd site and its staff, to take on a 'caretaker' role for the project until a developer is found.

Horizon had earlier submitted an application for a development consent order (DCO) to the Planning Inspectorate and a decision was initially expected before the end of September 2020. However, following Hitachi’s withdrawal from the project, the deadline for the decision was extended to the end of the year, and then again by a further four months to April 2021, to allow time to consider options for the project’s future.

In March 2024 it was announced that the government had agred to buy the Wylfa and Oldbury sites from Hitachi for £160 million.

Bradwell Power Generation – Bradwell B

Bradwell in Essex, close to London, is the site of a Magnox plant, with both reactors shut down in 2002. Under the strategic siting assessment process it was approved in 2011 as a site for new build. The Bradwell B project is jointly owned by CGN (66.5%) and EDF (33.5%) through Bradwell B Power Generation Company Limited. Bradwell B, as planned, would consist of two Hualong One units (1150 MWe each).

In connection with the Hinkley Point agreement in October 2015, EDF and CGN agreed to advance plans for a new plant at Bradwell and seek regulatory approval – through the GDA process – for a UK version of the Chinese-designed Hualong One reactor, the UK HPR1000. General Nuclear System Limited (GNS), a joint venture created to carry out the GDA process for the UK HPR1000, wrote to the government in October 2016 applying to start the process. The GDA commenced in January 2017, and was completed in February 2022.

The design of the EU HPR1000 has been assessed according to the European Utility Requirements (EUR) and the certificate of compliance was awarded in October 2020.

While the Bradwell project was expected to follow others, with the withdrawal of Toshiba from NuGen and Moorside, CGN said it was ready to bring forward its plans for Bradwell to have the first unit in commercial operation there from 2030.

In July 2020 the UK government announced a review of the national security impact of all Chinese investments in UK infrastructure, including Bradwell B. This followed its decision to block telecommunications company Huawei from participating in the development of the country's 5G mobile network.

In December 2020 Bradwell B Power Generation Company was awarded an electricity generation licence from the UK's gas and electricity markets regulator.

SMR vendor engagement

From 2015 to 2020 the UK government made a number of attempts to encourage and prioritize proposals from SMR vendors and developers.

In June 2021 the Dalton Nuclear Institute at Manchester University published a position paper that set out eight actions required to assess the role of nuclear power in achieving the government’s aim of net zero carbon dioxide emissions by 2050. These focused on early commissioning of a demonstration high-temperature gas-cooled reactor, with major consideration also paid to demonstrating hydrogen generation using nuclear heat. Then an ongoing review of SMRs should be maintained and led by a body that is not conflicted by claims and lobbying by any particular proposer. R&D into closed fuel cycles should continue.

In October 2023 the government announced that six SMR suppliers – EDF, GE Hitachi Nuclear Energy International, Holtec Britain, NuScale Power, Rolls-Royce SMR and Westinghouse – had been invited to bid for UK government contracts in the next stage of the selection process. A final investment decision is planned to take place in 2029.

Below are details of other SMR engagements.

In 2016 the UK government launched a small modular reactor (SMR) competition to “gauge market interest among technology developers, utilities, potential investors, funders and other interested parties in developing, commercializing and financing SMRs in the UK.” Expressions of interest were received from 33 eligible participants.

In July 2020 the UK government awarded £40 million in funding to support advanced nuclear development. Three-quarters of the funding will go towards three 'advanced modular reactor’ projects – Westinghouse's lead-cooled fast reactor, Urenco’s U-battery, and Tokamak Energy, which is working with Oxford University to develop fusion reactors – with each receiving £10 million.

Since October 2015 NuScale, a 55% Fluor subsidiary, had aimed to deploy its 50 MWe SMR in the UK before 2030, and sought partners for this in addition to Sheffield Forgemasters. In January 2016 National Nuclear Laboratory (NNL) confirmed that the NuScale reactor could run on MOX fuel, and said that a 12-module NuScale plant with full MOX cores could consume 100 tonnes of reactor-grade plutonium in about 40 years, generating 200 TWh from it. This comment addressed a UK agenda for plutonium disposal – see section below. NuScale announced in March 2016 that it would put its SMR forward as part of the UK government's competition to identify the best value design for the UK. In September 2017, following acceptance of the company's design certification application by the US Nuclear Regulatory Commission (NRC) earlier in the year, NuScale released a five-point UK SMR action plan. On release the company re-stated its hope that it would build an SMR in the UK within a decade.

Also in October 2015 Westinghouse submitted an unsolicited proposal to partner with the UK government to license and deploy its 225 MW light water reactor, an integral PWR. The Westinghouse proposal involved a “shared design and development model” under which the company would contribute its SMR conceptual design and then partner with the UK government and industry to complete, license and deploy it. This would engage UK companies in the reactor supply chain such as Sheffield Forgemasters. In April 2016 Westinghouse confirmed that the UK had the manufacturing capability to build its SMRs, and reiterated its “commitment to developing SMR technology in the UK.”

Early in 2016 Rolls-Royce submitted a detailed design to the government for a 220 MWe SMR unit, a PWR of fairly conventional design. It then submitted a paper to the Department of Business, Energy and Industrial Strategy, outlining its plan to develop a fleet of 7 GWe of SMRs with a new consortium. In January 2017 Rolls-Royce identified Amec Foster Wheeler, Nuvia and Arup, together with the Nuclear Advanced Manufacturing Research Centre, as partners. In July 2017 Laing O’Rourke joined the consortium. By mid-2021, the capacity of what was then referred to as the UK SMR had been increased to 470 MWe. In November 2021 the UK government announced that it had provided £210 million in funding to the consortium to develop its design for deployment in the UK by the early 2030s. In December 2021 it was announced that Qatar Investment Authority would invest £85 million for a 10% stake in Rolls-Royce's UK SMR project. In April 2022 the GDA process for the Rolls-Royce SMR began.

In November 2022, Rolls-Royce announced that it had identified four priority locations to build SMR-based power stations in the UK, including Trawsfynydd, Wylfa, and Oldbury. The locations are all on land owned by the UK Nuclear Decommissioning Authority (NDA). Before the NDA commits to SMR development, approval must first be granted by the Department of Business, Energy, and Industrial Strategy. The following month, Rolls-Royce also shortlisted three sites to host its first factory for producing SMR components, including: Sunderland, South Tyneside in northeast England; Teesworks, Redcar, in Teesside also in northeast England; and Gateway, Deeside, in North Wales. However, in April 2024 Rolls-Royce abandoned plans for the dedicated pressure vessel factory, citing delays to the SMR competition, and would instead source reactor pressure vessels from the existing supply chain.

In June 2016 GE Hitachi said it would be entering its PRISM fast reactor in the competition. See also mention of PRISM under Civil plutonium disposition below.

Early in 2019 the Japan Atomic Energy Agency (JAEA) formed a joint venture with Penultimate Power UK to build a 10 MWe SMR in northeast England, the EH HTGR, for power and process heat in industrial clusters. It is based on JAEA’s HTTR which has been operating since 1998 and has achieved 950°C on a sustained basis. Plans include scaling up the design to 100 MWe and building a factory in the UK for multiple plants. Penultimate Power claimed the first reactor would cost about £100 million ($142 million), with reductions for future units. Subject to UK government approval, it had expected the first reactor to be operating by 2029.

Moltex proposed its stable salt reactor, which could have been a possibility for the UK to use its civil plutonium instead of disposing of it. The fast version of the deisgn is fuelled by plutonium-239 chloride with minor actinides and lanthanides, which could be recovered from LWR fuel or fuel used by its 'global workhorse reactor'. A 300 MWe demonstration plant – the SSR-W300 wasteburner – was envisaged with conventional fuel tubes running on plutonium and uranium chlorides. Moltex submitted this and another 40 MWe thermal version of its design – the 'global workhorse' – in the SMR competition.

Other expressions of interest in the UK's SMR competition were received from EDF Energy and its Chinese partner CNNC. In 2016 CNNC subsidiary China Nuclear Engineering & Construction Corp (CNECC) submitted an expression of interest based on its ACP100+ design.

Fusion demonstrations